Ordfronten podcastWalter Kalmaru

2020 Year end tax planning and tax saving strategies for 2021 & beyond

- Door

- Episode

- 21

- Published

- 8 dec 2020

- Uitgever

- 0 beoordelingen

- 0

- Episode

- 21 of 71

- Lengte

- 55min

- Taal

- Engels

- Format

- Categorie

- Economie & Zakelijk

•Year end tax planning and tax saving strategies for 2021 & beyond •Saving for education – credits, deductions and Qualified Tuition Plan •State tax implications of working remotely •PPP Loan Forgiveness •CARES Act – Economic Impact Payments what to expect when you file your 2020 tax returns. •International Taxation •Foreign Capital Gains •Foreign earned income exclusion •Foreign tax credit •FATCA (Form 8938)FBAR (Form Fincen 114) disclaimer: •Information shared in this webinar are for educational purposes. Individual situations may vary and needs to be considered on a case to case basis. Users discretion advised to consult their tax advisers

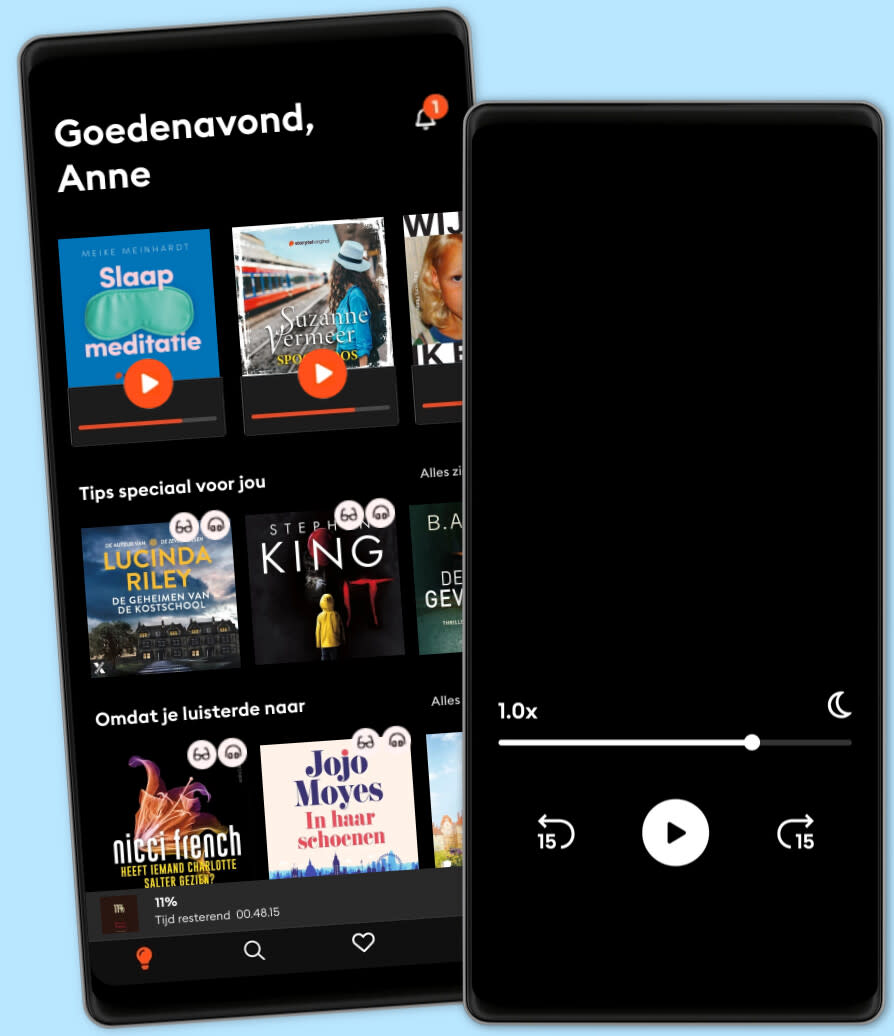

Luisteren én lezen

Onbeperkte toegang tot een oneindige bibliotheek vol verhalen - allemaal in 1 app.

- Meer dan 1 miljoen luisterboeken en ebooks

- Elke week honderden nieuwe verhalen

- Opzeggen wanneer je maar wilt

- Voor ieder een passend abonnement

Other podcasts you might like ...

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Meditations for Leaders - Sustainable High PerformJoakim Eriksson

- Play to Potential Podcast

- SerafpoddenSeraf förlag

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- Ordfronten podcastWalter Kalmaru

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Meditations for Leaders - Sustainable High PerformJoakim Eriksson

- Play to Potential Podcast

- SerafpoddenSeraf förlag

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

Taal en regio

Nederlands

België