Q&A: Can You Open an IRA for Someone Else's Kid? (And Should You?)

- Por

- Episodio

- 683

- Publicado

- 26 ago 2025

- Editorial

- 0 Calificaciones

- 0

- Episodio

- 683 of 705

- Duración

- 54min

- Idioma

- Inglés

- Formato

- Categoría

- Economía y negocios

#637: Nick wants to set up an investment account for his nephew to contribute annually, creating a nest egg for college since the parents are already opening a 529. He's unsure whether a standard brokerage account, IRA or other options work best when you're not the parent.

Diana asks whether she needs TIPS in her portfolio to protect against inflation. Or can she just rely on other investments that outpace inflation?

She's also wondering about the tax implications of TIPS ETFs. This matters during her peak earning years.

Prethive asks whether he should switch from Roth to Traditional 401(k) contributions. When he retires, he wants to move to a tax-free state. Or maybe move abroad.

He wonders if moving to avoid state taxes in retirement would save more money long-term.

Former financial planner Joe Saul-Sehy and I tackle these three questions in today’s episode.

Enjoy!

P.S. Got a question? Leave it here.

For more information, visit the show notes at https://affordanything.com/episode637https://affordanything.com/episode637 Learn more about your ad choices. Visit podcastchoices.com/adchoices

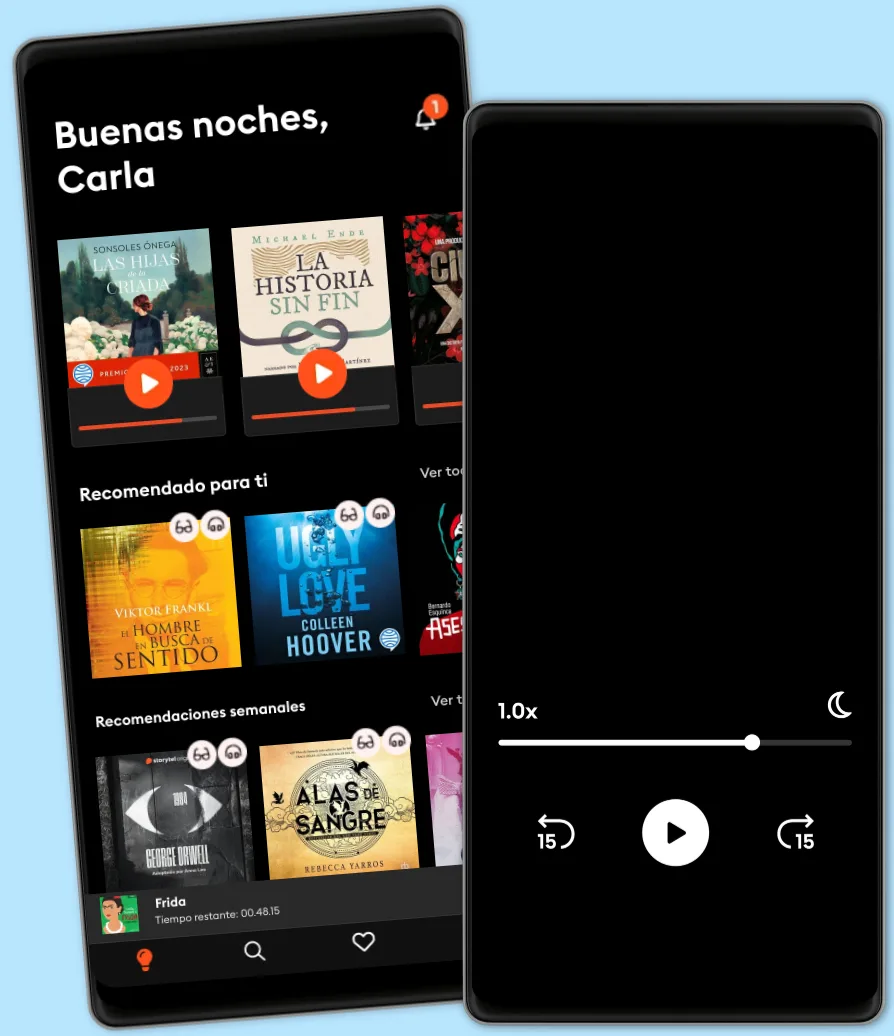

Escucha y lee

Descubre un mundo infinito de historias

- Lee y escucha todo lo que quieras

- Más de 1 millón de títulos

- Títulos exclusivos + Storytel Originals

- Precio regular: CLP 7,990 al mes

- Cancela cuando quieras

Otros podcasts que te pueden gustar...

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

Español

Chile