Smarter Lending: Expanding Credit Access and Improving Risk Decisioning at Scale

- Por

- Episodio

- 163

- Publicado

- 24 jul 2025

- Editorial

- 0 Calificaciones

- 0

- Episodio

- 163 of 184

- Duración

- 49min

- Idioma

- Inglés

- Formato

- Categoría

- No ficción

In This Episode

This week on Breaking Banks, join us as we explore how real-time data is helping lenders understand financial behaviors beyond traditional credit scores, as Plaid, the largest financial data network, and Experian, a leading data technology company join forces via their new partnership.

Listen as Michelle Young, Credit Product Lead at Plaid and Ashley Knight, SVP of Product Management at Experian connect with host Brett King to discuss how this new partnership is providing proven risk insights and real-time cash flow data to banks, credit unions and consumer lenders, and the potential it brings for a major change in lending. Datos Insights' Stewart Watterson also joins to offer insights on two critical industry challenges that the availability of real-time cash flow data addresses: creating pathways to credit for underserved consumers, and for financial institutions, expanding the consumer lending addressable market while improving the ability to manage credit risk. It's a win-win!

This episode is not to be missed! Lend smarter and get ahead of the curve to learn how cashflow and credit data can fuel business performance and competitive advantages now!

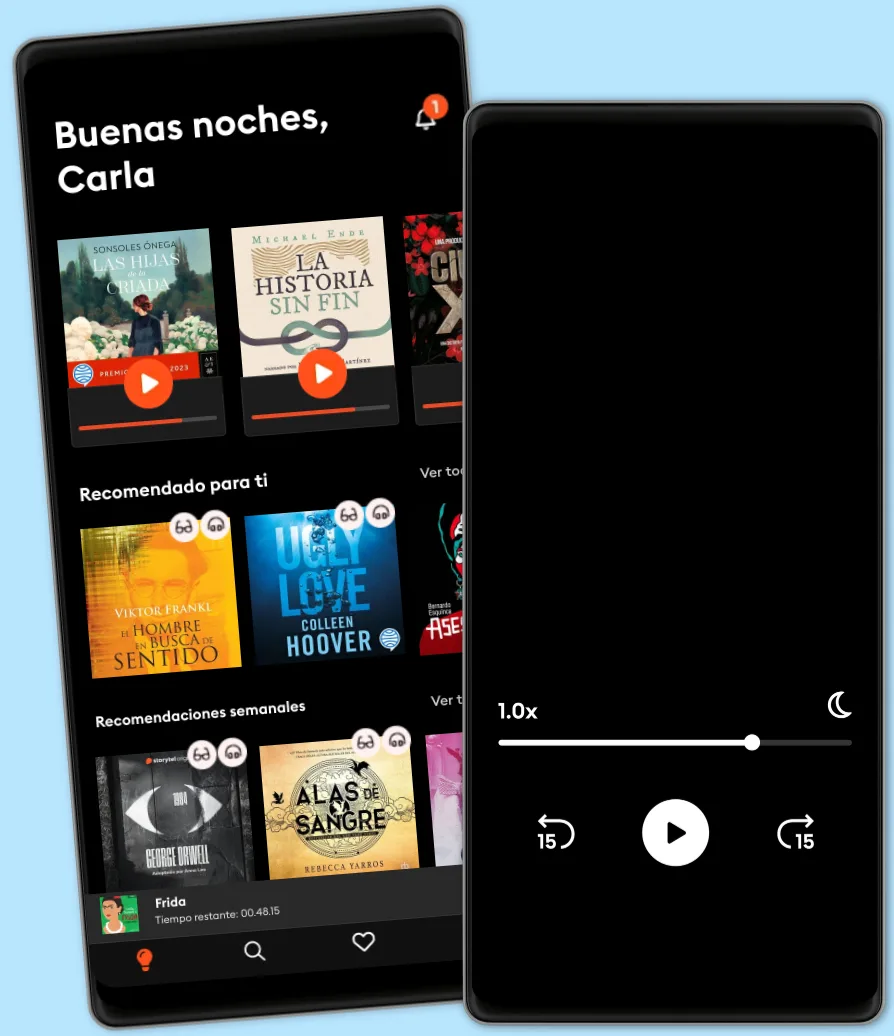

Escucha y lee

Descubre un mundo infinito de historias

- Lee y escucha todo lo que quieras

- Más de 1 millón de títulos

- Títulos exclusivos + Storytel Originals

- Precio regular: CLP 7,990 al mes

- Cancela cuando quieras

Otros podcasts que te pueden gustar...

- Intelligence SquaredIntelligence Squared

- SerendipiasSER Podcast

- La Hora ExtraSER Podcast

- Hoy por HoySER Podcast

- Un Libro Una HoraSER Podcast

- Still Online - La nostra eredità digitaleBeatrice Petrella

- The DailyThe New York Times

- This American LifeThis American Life

- The Witch Trials of J.K. RowlingThe Free Press

- The Book ReviewThe New York Times

- Intelligence SquaredIntelligence Squared

- SerendipiasSER Podcast

- La Hora ExtraSER Podcast

- Hoy por HoySER Podcast

- Un Libro Una HoraSER Podcast

- Still Online - La nostra eredità digitaleBeatrice Petrella

- The DailyThe New York Times

- This American LifeThis American Life

- The Witch Trials of J.K. RowlingThe Free Press

- The Book ReviewThe New York Times

Español

Chile