Two ways frequent trading reverses profitability

- Por

- Episodio

- 105

- Publicado

- 29 nov 2017

- Editorial

- 0 Calificaciones

- 0

- Episodio

- 105 of 1247

- Duración

- 13min

- Idioma

- Inglés

- Formato

- Categoría

- Economía y negocios

Risk is an asset class. Keep in in your portfolio when it pays you to do so. That means overnight and over the weekend. When you day trade, you are churning your own account. In a recent interview with Chats With Traders, my friend Aaron Brown said that traders generally leave way too much money on the table. The real money is holding the best risks. You can define where you are going "risk off" by placing protective stop orders on your winners and Stop Loss orders on recent fills. Staying in good trades longer frees up time so that you can do more research, read, or go have fun doing whatever gives you pleasure. Exercise: Go to your best trades and enter them in a spreadsheet. Column A is your Entry. Column B is your exit. Column C is where it is now. Column D is what the worst price was between the prices in column B and C. Look at the percentage of those names where the price is Column C today is higher than Column B but also where the price is column D never went below Column A. This helps you understand the opportunity cost of short-term trading and how it works against you.

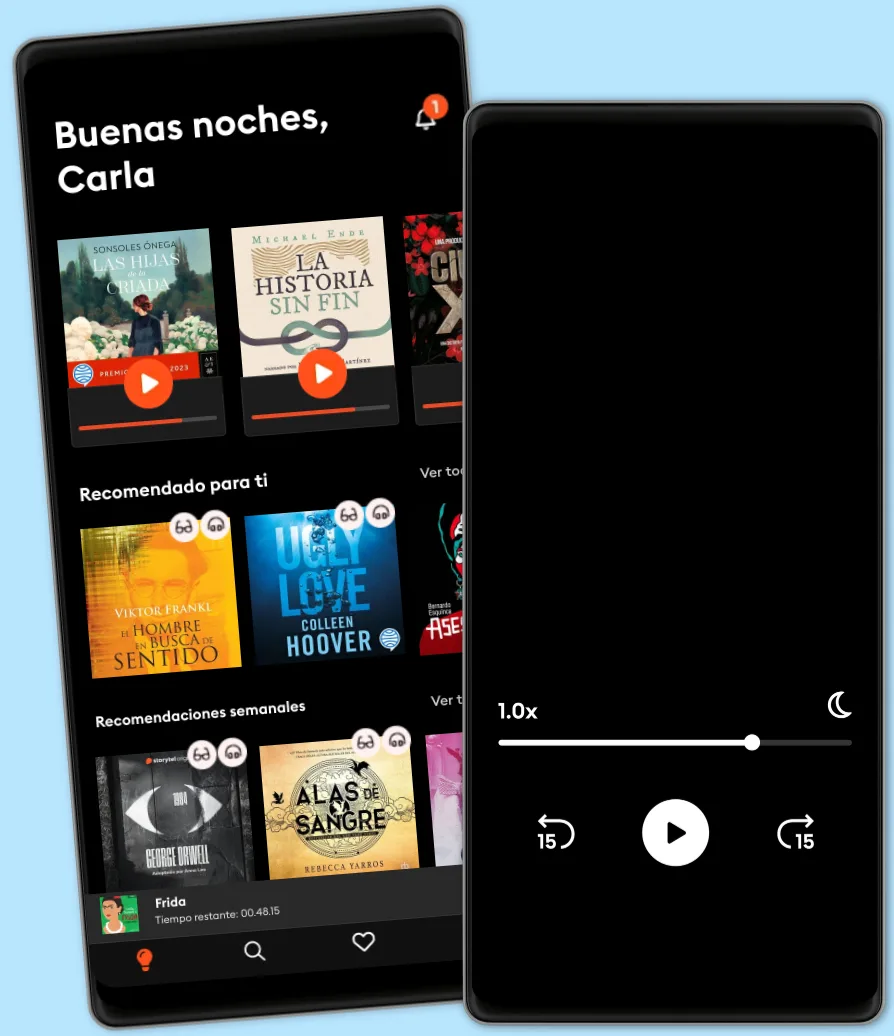

Escucha y lee

Descubre un mundo infinito de historias

- Lee y escucha todo lo que quieras

- Más de 1 millón de títulos

- Títulos exclusivos + Storytel Originals

- Precio regular: CLP 7,990 al mes

- Cancela cuando quieras

Otros podcasts que te pueden gustar...

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

Español

Chile