Structured Products Are Back. Why the Boom and What’s the Catch?

- Höfundur

- Episode

- 778

- Published

- 18 sep. 2025

- Útgefandi

- 0 Umsagnir

- 0

- Episode

- 778 of 824

- Lengd

- 23Mín.

- Tungumál

- enska

- Gerð

- Flokkur

- Óskáldað efni

When he announced the Fed’s decision to lower interest rates by 25 basis points, Fed Chair Jerome Powell made clear there’s still a bumpy road ahead for the US economy. Inflation is elevated and the labor market is showing signs of weakness. No wonder investors remain on edge. All this market uncertainty has helped fuel the rise of a particular type of investment offering: structured products. They’re supposed to lower investors’ downside risks. But they’re not risk-free. On today’s Big Take podcast, Bloomberg equities reporter Yiqin Shen and markets editor Sam Potter break down how these complex investment vehicles work — and what their resurgence reveals about the US economy. Read more: Rich Americans Are Driving a $200 Billion Boom in Complex Bets

See omnystudio.com/listener for privacy information.

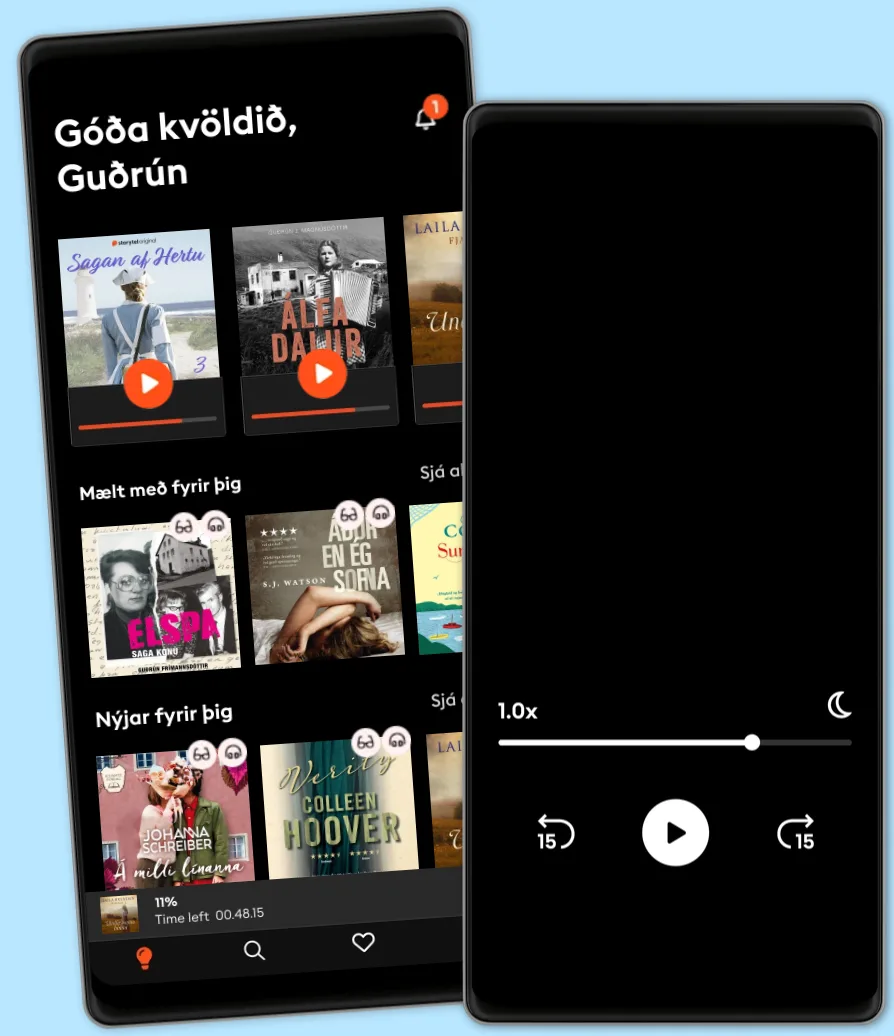

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Other podcasts you might like ...

- Stærke portrætterALT for damerne

- ALT for damerne podcastALT for damerne

- Anupama Chopra ReviewsFilm Companion

- Interviews with Anupama ChopraFilm Companion

- FC PopCornFilm Companion

- Spill the Tea with SnehaFilm Companion

- BodenfalletGabriella Lahti

- Dirty JaneJohn Mork

- DiskoteksbrandenAntonio de la Cruz

- EgyptenaffärenJens Nielsen

- Stærke portrætterALT for damerne

- ALT for damerne podcastALT for damerne

- Anupama Chopra ReviewsFilm Companion

- Interviews with Anupama ChopraFilm Companion

- FC PopCornFilm Companion

- Spill the Tea with SnehaFilm Companion

- BodenfalletGabriella Lahti

- Dirty JaneJohn Mork

- DiskoteksbrandenAntonio de la Cruz

- EgyptenaffärenJens Nielsen

Íslenska

Ísland