Brookfield CEO: Private vs. public markets, investment style and value creation

- Höfundur

- Episode

- 50

- Published

- 13 dec. 2023

- Útgefandi

- 0 Umsagnir

- 0

- Episode

- 50 of 194

- Lengd

- 48Mín.

- Tungumál

- enska

- Gerð

- Flokkur

- Viðskiptabækur

Bruce Flatt became the CEO of Brookfield in 2002 when the company was primarily a Canadian-based real estate firm with a market value of $5 billion. Under his leadership, it transformed into a global alternative asset manager, managing over $850 billion in assets across various sectors: real estate, infrastructure, renewable energy, private equity, and credit. In light of such diverse investments, what are the benefits of investing in private markets? What are the major global megatrends shaping these investments? And what qualities define a good investor?

The production team on this episode were PLAN-B's Nikolai Ovenberg and Niklas Figenschau Johansen. Background research was done by Sigurd Brekke with input from portfolio manager Erlend Kvendseth.

Links:

• Watch the episode on YouTube: Norges Bank Investment Management - YouTube • Want to learn more about the fund? The fund | Norges Bank Investment Management (nbim.no) • Follow Nicolai Tangen on LinkedIn: Nicolai Tangen | LinkedIn • Follow NBIM on LinkedIn: Norges Bank Investment Management: Administrator for bedriftsside | LinkedIn • Follow NBIM on Instagram: Explore Norges Bank Investment Management on Instagram

Hosted on Acast. See acast.com/privacy for more information.

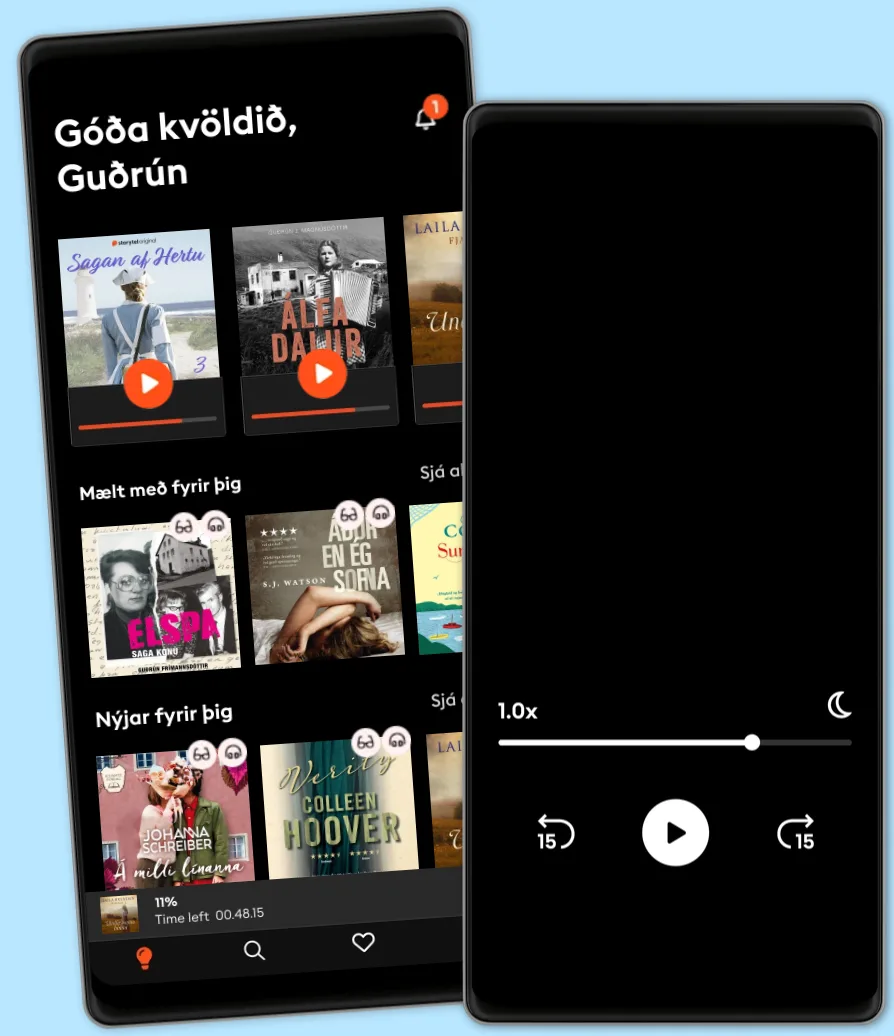

Hlustaðu og lestu

Stígðu inn í heim af óteljandi sögum

- Lestu og hlustaðu eins mikið og þú vilt

- Þúsundir titla

- Getur sagt upp hvenær sem er

- Engin skuldbinding

Other podcasts you might like ...

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- PBD PodcastPBD Podcast

- BrainStuffiHeartPodcasts

- Money Clinic with Claer BarrettFinancial Times

- The Diary Of A CEO with Steven BartlettDOAC

- The School of GreatnessLewis Howes

- HW News Editorial with Sujit NairHW News Network

- Boost Your Career PodcastAudio Pitara by Channel176 Productions

- Tools of Titans: The Tactics, Routines, and Habits of World-Class PerformersTim Ferriss

- The Creative Penn Podcast For WritersJoanna Penn

- The AI in Business PodcastDaniel Faggella

- PBD PodcastPBD Podcast

- BrainStuffiHeartPodcasts

- Money Clinic with Claer BarrettFinancial Times

- The Diary Of A CEO with Steven BartlettDOAC

- The School of GreatnessLewis Howes

Íslenska

Ísland