Global Data Pod Research Rap: Inflation Monitor

- By

- Episode

- 182

- Published

- Apr 30, 2025

- Publisher

- 0 Ratings

- 0

- Episode

- 182 of 183

- Duration

- 29min

- Language

- English

- Format

- Category

- Economy & Business

Nora Szentivanyi and Michael Hanson discuss key takeaways from the latest Global Inflation monitor and the impact of tariffs on inflation in the US and the rest of the world. After a broad-based upside surprise in January, core inflation has shown a similar widespread moderation. The US CPI data show limited impact from tariffs through March, but we look for core inflation to jump to a 6%ar this quarter and next. At the same time, inflationary impulses in the rest of the world appear tilted to the downside; a pullback in US front-loading demand along with a decoupling of US-China trade should put downward pressure on goods prices as excess supply is redirected elsewhere. Absent a meaningful retaliation, we see core inflation outside the US moderating to 2.5-3%ar over 2H25.

This podcast was recorded on April 30, 2025.

This communication is provided for information purposes only. Institutional clients can view the related reports at

https://www.jpmm.com/research/content/GPS-4966015-0

https://www.jpmm.com/research/content/GPS-4956489-0

https://www.jpmm.com/research/content/GPS-4960640-0

for more information; please visit www.jpmm.com/research/disclosures for important disclosures.

© 2025 JPMorgan Chase & Co. All rights reserved. This material or any portion hereof may not be reprinted, sold or redistributed without the written consent of J.P. Morgan. It is strictly prohibited to use or share without prior written consent from J.P. Morgan any research material received from J.P. Morgan or an authorized third-party (“J.P. Morgan Data”) in any third-party artificial intelligence (“AI”) systems or models when such J.P. Morgan Data is accessible by a third-party. It is permissible to use J.P. Morgan Data for internal business purposes only in an AI system or model that protects the confidentiality of J.P. Morgan Data so as to prevent any and all access to or use of such J.P. Morgan Data by any third-party.

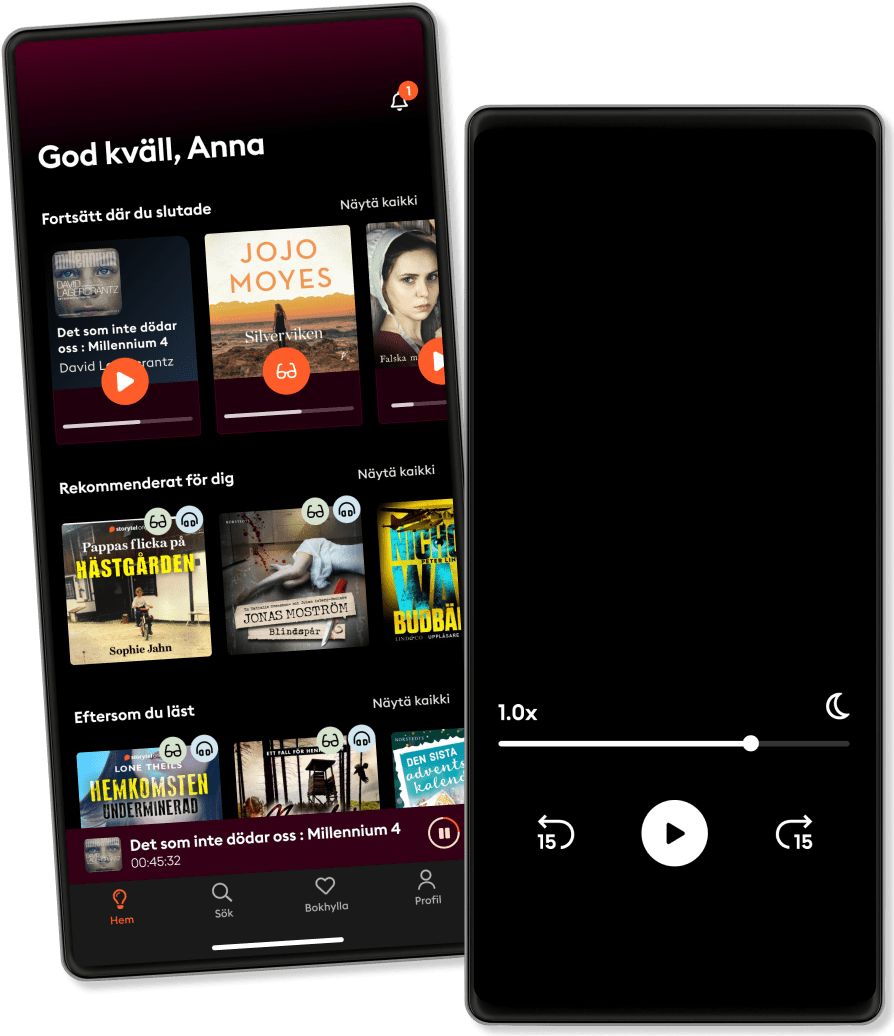

Listen and read

Step into an infinite world of stories

- Read and listen as much as you want

- Over 1 million titles

- Exclusive titles + Storytel Originals

- 14 days free trial, then €9.99/month

- Easy to cancel anytime

Other podcasts you might like ...

- Business WarsWondery

- The Journal.The Wall Street Journal & Gimlet

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- “Очи в очи” с Жасмин МаджидPhD Жасмин Маджид

- Inspiring Stories of Successful Brands (Motivational Podcast)Audio Pitara by Channel176 Productions

- Online Paise Kaise Kamaye (Hindi Podcast with Nijo Jonson)Audio Pitara by Channel176 Productions

- Chedilal Ghar Jode (Smart Savings) New Hindi PodcastAudio Pitara by Channel176 Productions

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- Business WarsWondery

- The Journal.The Wall Street Journal & Gimlet

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- “Очи в очи” с Жасмин МаджидPhD Жасмин Маджид

- Inspiring Stories of Successful Brands (Motivational Podcast)Audio Pitara by Channel176 Productions

- Online Paise Kaise Kamaye (Hindi Podcast with Nijo Jonson)Audio Pitara by Channel176 Productions

- Chedilal Ghar Jode (Smart Savings) New Hindi PodcastAudio Pitara by Channel176 Productions

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

English

International