335: Global Macro Advisor To World’s Largest Hedge Funds Adam Robinson, The Princeton Review

- By

- Episode

- 311

- Published

- Jul 4, 2020

- Publisher

- 0 Ratings

- 0

- Episode

- 311 of 436

- Duration

- 38min

- Language

- English

- Format

- Category

- Economy & Business

Adam Robinson is on the show today to dive deep into the collapse of a global market. It’s not just about inflation and deflation; it’s about understanding the collapse of the velocity of money. Now, the majority is trying to understand negative interest rates. Adam Robinson returns to the show to further his discussion with Jason about macroeconomics. A system based on radical consumption is a losing battle. How has this shaped us, and how has the coronavirus changed how we eat, dress, consume, and even view real estate? Key Takeaways: [1:00] Millennials, Gen Z, or people in the prime of their life can afford Manhattan and are looking to migrate away from high-density areas. [3:00] Are we looking at a collapse in the global economy? [9:15] What would the economy look like if everyone got a check for $100k? [13:10] Inflation and deflation aside, what we care about, is the velocity of money, which has collapsed. [15:45] With negative interest rates, we are paid to own gold. [22:10] A system based on radical consumption is a losing battle. [25:45] Let’s break away for a Google/Psychology session. [31:00] Our home life has changed so much. How we eat, dress, and purchase, things have shifted because of the Stay-At-Home orders. Websites: IAmAdamRobinson.com JasonHartman.com/Webinar www.JasonHartman.com www.JasonHartman.com/properties Jason Hartman Quick Start Jason Hartman PropertyCast (Libsyn) Jason Hartman PropertyCast (iTunes)

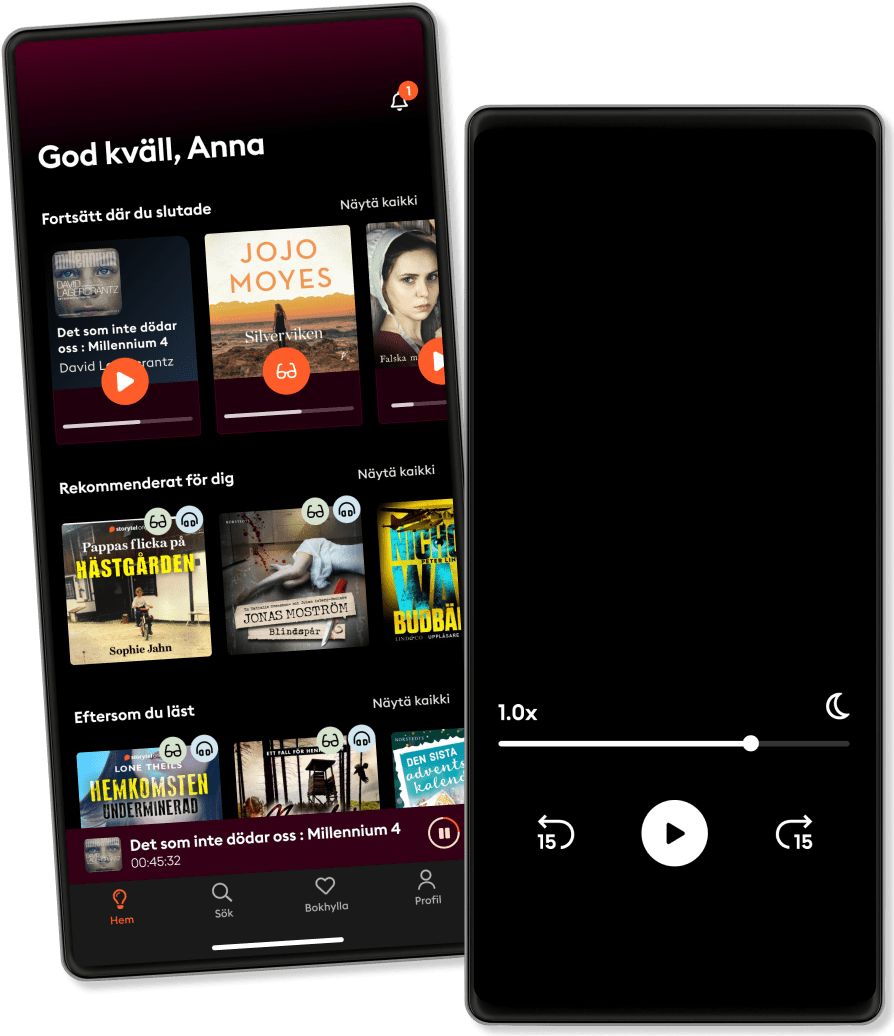

Listen and read

Step into an infinite world of stories

- Read and listen as much as you want

- Over 1 million titles

- Exclusive titles + Storytel Originals

- 14 days free trial, then €9.99/month

- Easy to cancel anytime

Other podcasts you might like ...

- Business WarsWondery

- The Journal.The Wall Street Journal & Gimlet

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- Inspiring Stories of Successful Brands (Motivational Podcast)Audio Pitara by Channel176 Productions

- Online Paise Kaise Kamaye (Hindi Podcast with Nijo Jonson)Audio Pitara by Channel176 Productions

- Chedilal Ghar Jode (Smart Savings) New Hindi PodcastAudio Pitara by Channel176 Productions

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- Sabse Pehle Family, Sabse Pehle InsuranceBIG FM

- Business WarsWondery

- The Journal.The Wall Street Journal & Gimlet

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- Inspiring Stories of Successful Brands (Motivational Podcast)Audio Pitara by Channel176 Productions

- Online Paise Kaise Kamaye (Hindi Podcast with Nijo Jonson)Audio Pitara by Channel176 Productions

- Chedilal Ghar Jode (Smart Savings) New Hindi PodcastAudio Pitara by Channel176 Productions

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- Sabse Pehle Family, Sabse Pehle InsuranceBIG FM

English

International