AIPIS 116 – Why Income Property is the Most Tax-Favored Asset Class with Diane Kennedy, CPA

- By

- Episode

- 94

- Published

- Feb 3, 2016

- Publisher

- 0 Ratings

- 0

- Episode

- 94 of 436

- Duration

- 46min

- Language

- English

- Format

- Category

- Economy & Business

This episode is all about taxes, and how as a real estate investor you may be able to avoid paying them. Think of how much faster you can build your wealth if you use the 30% you would be giving to the IRS to re-invest in additional properties. The government wants us to do this. And, if you are a real estate professional who owns an investment property you should not be paying taxes. If you are paying taxes, you have the wrong CPA working for you.

Key Takeaways:

[2:48] Defining tax drag

[5:31] A stepped-up basis – aka no depreciation recapture for heirs

[7:10] CRT – Charitable Remainder Trust

[9:09] Life insurance policy as an investment or as asset protection

[11:31] The magic of the Real Estate Professional status

[18:50] Getting a retroactive Aggregation Election within the statute of limitations

[21:40] Effectively self-managing a distant property

[27:07] What if I have a real estate license?

[29:54] ‘Married filing jointly’ is required for US taxes

[31:24] Contact Diane for tax advice

[31:40] Pay attention to the business structure you have for your properties

[34:56] Investors need to be careful with LLCs and offshore corporations

[35:44] Depreciation is the Holy Grail to tax write-offs

[36:02] Qualifying for the IRS tax depreciation for owners of investment properties

Mentions:

Hartman Media

Jason Hartman - Properties

US Tax Aid

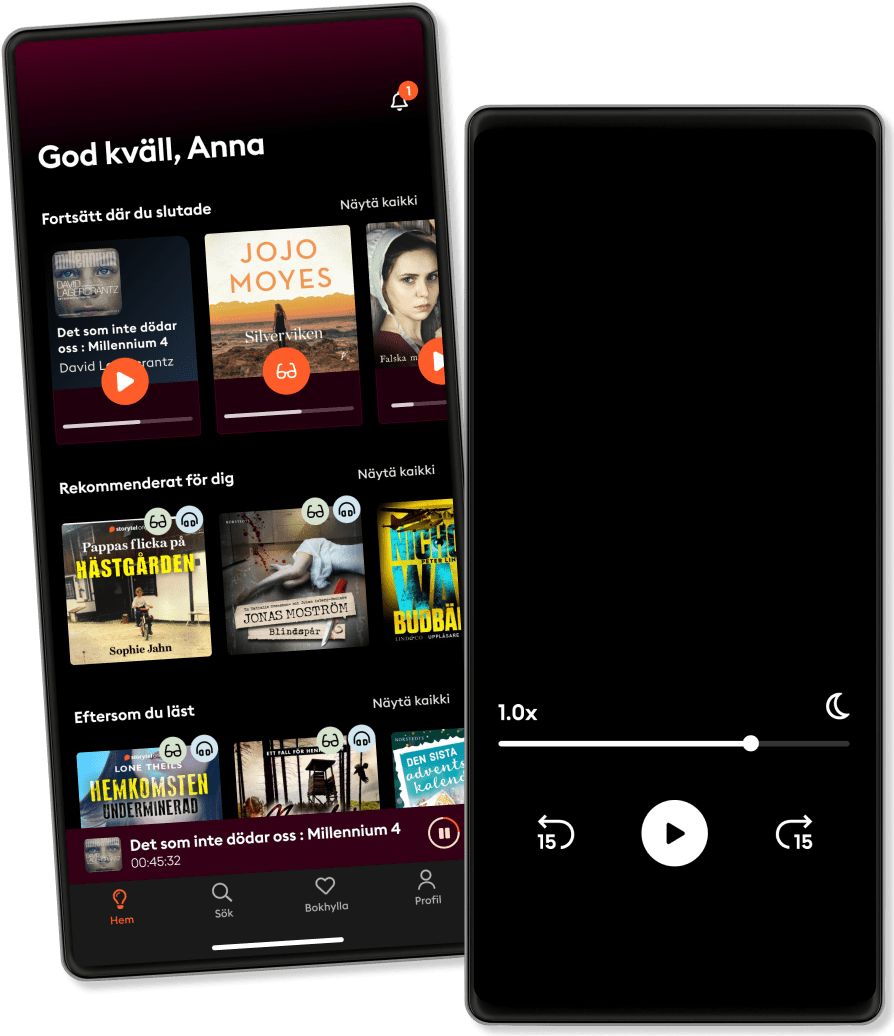

Listen and read

Step into an infinite world of stories

- Read and listen as much as you want

- Over 1 million titles

- Exclusive titles + Storytel Originals

- 14 days free trial, then €9.99/month

- Easy to cancel anytime

Other podcasts you might like ...

- Business WarsWondery

- The Journal.The Wall Street Journal & Gimlet

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- Inspiring Stories of Successful Brands (Motivational Podcast)Audio Pitara by Channel176 Productions

- Online Paise Kaise Kamaye (Hindi Podcast with Nijo Jonson)Audio Pitara by Channel176 Productions

- Chedilal Ghar Jode (Smart Savings) New Hindi PodcastAudio Pitara by Channel176 Productions

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- Sabse Pehle Family, Sabse Pehle InsuranceBIG FM

- Business WarsWondery

- The Journal.The Wall Street Journal & Gimlet

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- Inspiring Stories of Successful Brands (Motivational Podcast)Audio Pitara by Channel176 Productions

- Online Paise Kaise Kamaye (Hindi Podcast with Nijo Jonson)Audio Pitara by Channel176 Productions

- Chedilal Ghar Jode (Smart Savings) New Hindi PodcastAudio Pitara by Channel176 Productions

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- Sabse Pehle Family, Sabse Pehle InsuranceBIG FM

English

International