Oaktree Sees Companies in Trouble as Rates Stay High

- By

- Episode

- 97

- Published

- Nov 21, 2024

- Publisher

- 0 Ratings

- 0

- Episode

- 97 of 125

- Duration

- 46min

- Language

- English

- Format

- Category

- Economy & Business

Private credit to risky borrowers that need a lifeline is poised to boom as rates stay high, according to Oaktree Capital Management. “You’re going to see a lot of what they call rescue financing,” said David Rosenberg, head of liquid performing credit at Oaktree. “That’s going to be one of the greatest opportunities we’ve seen in a decade.” Loans to troubled companies will focus on sectors that have seen most leveraged buyout activity, like technology and health care, Rosenberg tells Bloomberg News’ James Crombie and Bloomberg Intelligence senior credit analyst Jean-Yves Coupin in the latest Credit Edge podcast. Rosenberg and Coupin also discuss liability management, creditor-on-creditor violence, private debt stress, the M&A outlook, European investment opportunities and geopolitical risks.

See omnystudio.com/listener for privacy information.

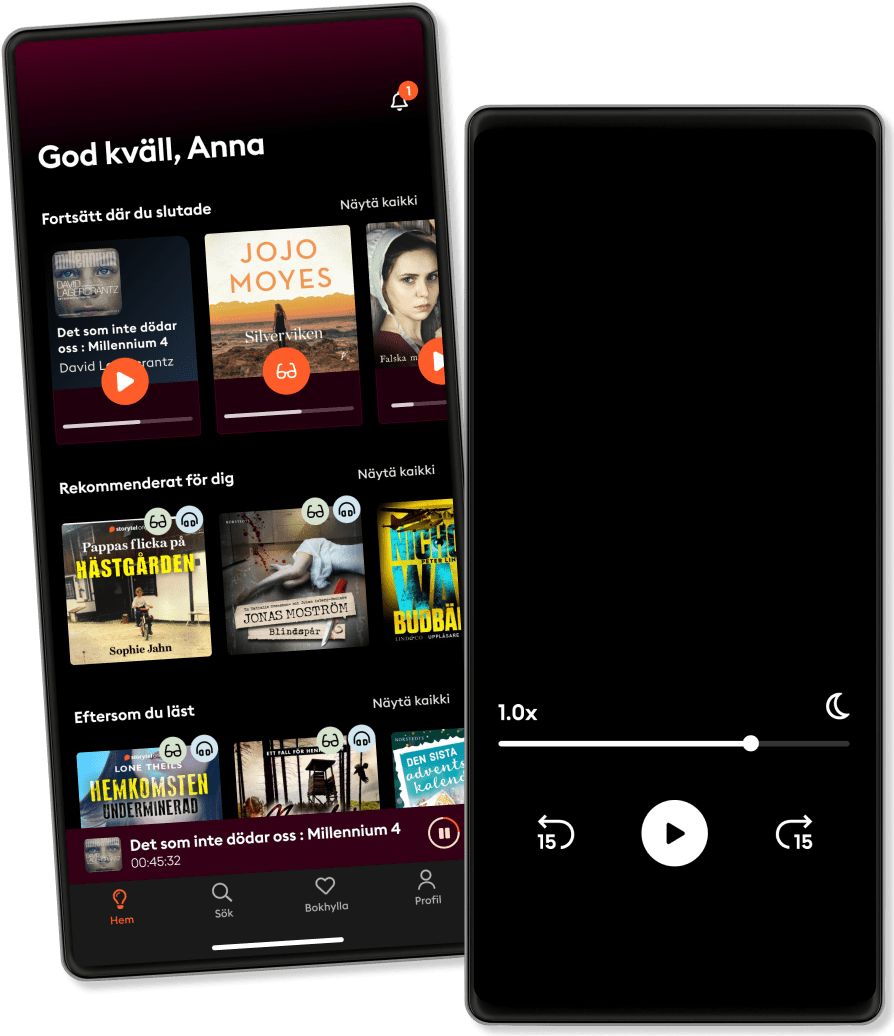

Listen and read

Step into an infinite world of stories

- Read and listen as much as you want

- Over 1 million titles

- Exclusive titles + Storytel Originals

- 14 days free trial, then €9.99/month

- Easy to cancel anytime

Other podcasts you might like ...

- Business WarsWondery

- The Journal.The Wall Street Journal & Gimlet

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- Inspiring Stories of Successful Brands (Motivational Podcast)Audio Pitara by Channel176 Productions

- Online Paise Kaise Kamaye (Hindi Podcast with Nijo Jonson)Audio Pitara by Channel176 Productions

- Chedilal Ghar Jode (Smart Savings) New Hindi PodcastAudio Pitara by Channel176 Productions

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- Sabse Pehle Family, Sabse Pehle InsuranceBIG FM

- Business WarsWondery

- The Journal.The Wall Street Journal & Gimlet

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- Inspiring Stories of Successful Brands (Motivational Podcast)Audio Pitara by Channel176 Productions

- Online Paise Kaise Kamaye (Hindi Podcast with Nijo Jonson)Audio Pitara by Channel176 Productions

- Chedilal Ghar Jode (Smart Savings) New Hindi PodcastAudio Pitara by Channel176 Productions

- Chiedi chi era GardiniPiano P

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- Sabse Pehle Family, Sabse Pehle InsuranceBIG FM

English

International