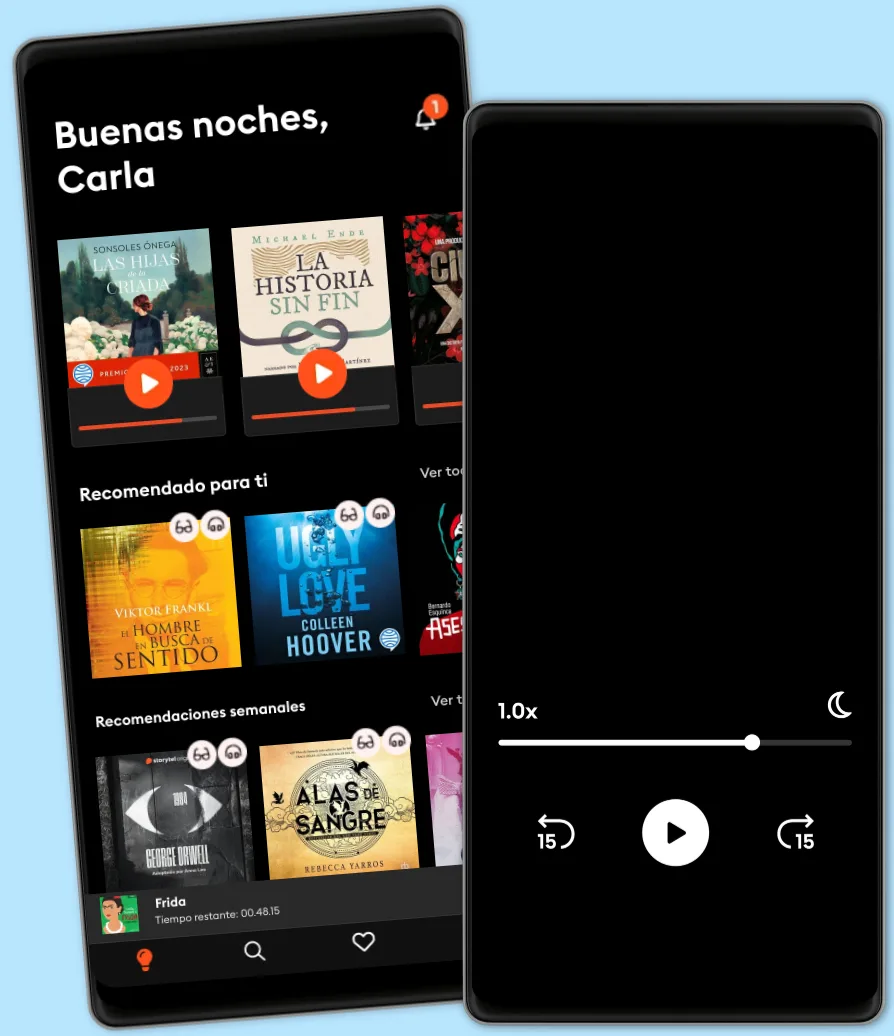

Escucha y lee

Descubre un mundo infinito de historias

- Lee y escucha todo lo que quieras

- Más de 900 000 títulos

- Títulos exclusivos + Storytel Originals

- 7 días de prueba gratis, luego $7.99 /mes

- Cancela cuando quieras

401(k)s & IRAs For Dummies

- Por

- Con

- Editorial

- Duración

- 11H 57min

- Idioma

- Inglés

- Format

- Categoría

Desarrollo personal

When you're ready to start setting aside (or withdrawing) money for your retirement—whenever that might be—401(k)s & IRAs For Dummies is here for you! It covers both types of retirement plans because they each have valuable tax benefits, and you may be able to contribute to both at the same time. With the practical advice in this book, you learn how to manage your accounts, minimize your investment risk, and maximize your returns.

Written by a well-known expert and "father of the 401(k)," Ted Benna, 401(k)s & IRAs For Dummies helps you keep up with the ever-changing rules surrounding both retirement plans—including the rules from the SECURE and CARES Acts—and avoid the mistakes that can lead to higher taxes and penalties. Additional topics include:

● Tax strategies before and after retirement

● Required distributions and how much you need to take

● Penalties for taking money out early and how to avoid them

Whether you're just starting to think about a retirement plan, planning when to retire, or you're facing retirement, you'll find useful and practical guidance in 401(k)s & IRAs For Dummies.

© 2021 Tantor Media (Audiolibro): 9781666174205

Fecha de lanzamiento

Audiolibro: 21 de diciembre de 2021

Otros también disfrutaron...

- Hedge Funds for Dummies Ann C. Logue, MBA

- Options Trading For Dummies, 4th Edition Joe Duarte, MD

- Exchange-Traded Funds For Dummies Russell Wild

- Investing For Dummies 4th Edition Eric Tyson

- Accounting For Dummies, 7th Edition John A. Tracy

- Online Investing For Dummies: 10th Edition Matt Krantz

- Mutual Funds for Dummies Eric Tyson, MBA

- Bond Investing For Dummies: 2nd Edition Russell Wild

- Factor Investing For Dummies James Maendel, BFA

- Personal Finance For Dummies Eric Tyson

- Cryptocurrency Investing For Dummies Kiana Danial

- Soft Skills For Dummies Cindi Reiman

- Accounting for Dummies 3rd Ed. John A. Tracy

- Training & Development For Dummies, 2nd Edition Elaine Biech

- Penny Stocks For Dummies Peter Leeds

- Day Trading For Dummies: 4th Edition Ann C. Logue, MBA

- ChatGPT For Dummies Pam Baker

- Social Security for Dummies Jonathan Peterson

- Stock Investing For Dummies: 5th Edition Paul Mladjenovic

- Complete MBA For Dummies: 2nd Edition Kathleen Allen, PhD

- Navigating Your Later Years For Dummies AARP

- Trading for Dummies Michael Griffis

- Personal Finance After 50 For Dummies: 2nd Edition Robert C. Carlson

- Investing in Gold & Silver For Dummies Paul Mladjenovic, CFP

- Technical Writing For Dummies, 2nd Edition Sheryl Lindsell-Roberts

- Fundamental Analysis For Dummies, 3rd Edition Matthew Krantz

- Stock Investing for Dummies 2nd Ed. Paul Mladjenovic

- Commodities For Dummies, 3rd Edition Amine Bouchentouf

- Trading For Dummies, 5th Edition Lita Epstein, MBA

- Planning A Profitable Business For Dummies Veechi Curtis, MBA

- Real Estate Investing All-In-One For Dummies Ralph R. Roberts

- Technical Analysis For Dummies (3rd Edition): 3rd Edition Barbara Rockefeller

- Reading Financial Reports for Dummies Lita Epstein, MBA

- Foreclosure Investing For Dummies, 2nd Edition Ralph R. Roberts

- Anger Management for Dummies: 2nd Edition Charles H. Elliott, PhD

- Critical Thinking Skills For Dummies Martin Cohen

- Overcoming Anxiety For Dummies: 2nd Edition Laura L. Smith, PhD

- Business Valuation For Dummies Lisa Holton

- Resilience For Dummies Eva Selhub, MD

- Property Management Kit For Dummies Robert S. Griswold, MSBA

- Auditing for Dummies Marie Loughran

- Success Habits For Dummies Dirk Zeller, CEO

- Business Plans for Dummies 2nd Ed. Paul Tiffany

- Careers For Dummies Marty Nemko

- Victoria: Premio Planeta 2024 Paloma Sánchez-Garnica

4.6

- Mi recuerdo es más fuerte que tu olvido: Premio de Novela Fernando Lara 2016 Paloma Sánchez-Garnica

4.4

- Las que no duermen NASH Dolores Redondo

4.6

- Por si un día volvemos María Dueñas

4.6

- La brisa de oriente Paloma Sánchez-Garnica

4.5

- El alma de las piedras Paloma Sánchez-Garnica

4.3

- El libro de las hermanas Amélie Nothomb

4.2

- El lejano país de los estanques Lorenzo Silva

4.1

- La saga de los longevos 1. La Vieja Familia Eva García Sáenz de Urturi

4.2

- La mala costumbre Alana S. Portero

4.6

- La saga de los longevos 2. Los Hijos de Adán Eva García Sáenz de Urturi

4.5

- Pecados 1. Rey de la ira Ana Huang

3.9

- Las fuerzas contrarias Lorenzo Silva

4.4

- Pecados 2. Rey de la soberbia Ana Huang

3.9

- Pecados 3. Rey de la codicia Ana Huang

4

Siempre con Storytel:

Acceso ilimitado

Modo sin conexión

Modo Infantil

Cancela en cualquier momento

Ilimitado

Para los que quieren escuchar y leer sin límites.

1 cuenta

Acceso ilimitado

Escucha y lee los títulos que quieras

Modo sin conexión + Modo Infantil

Cancela en cualquier momento

Español

América Latina