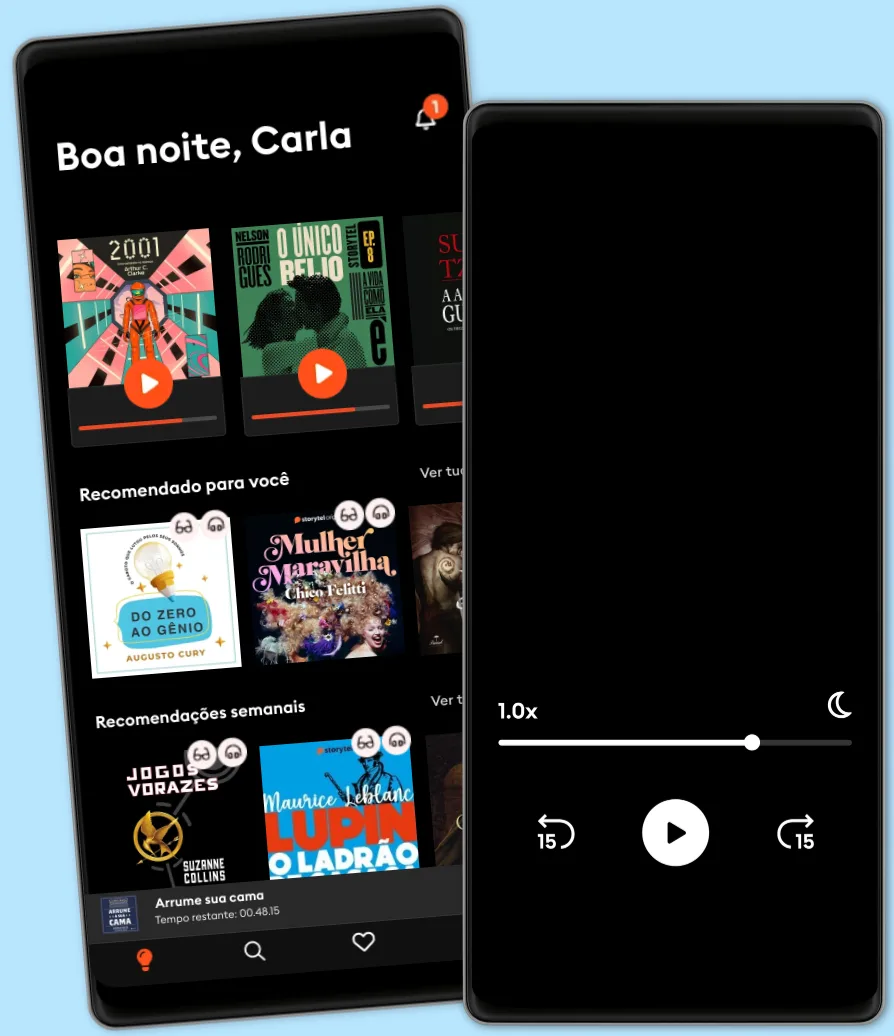

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

Spillover Effects Of The Recent Financial Crisis: A Comparative Analysis Of Selected Emerging Markets And Developed Eu Markets

- Por

- Com:

- Editor

- Duração

- 1H 45min

- Idioma

- Inglês

- Formato

- Categoria

Economia & Negócios

The global financial crisis, which started as the result of the subprime mortgage crisis in the summer of 2007 and triggered by the collapse of Lehman Brothers in 2008, quickly spread globally and thus energized researchers, decision makers to debate on the policy implications, severity across countries, and possible solutions. A central and important question remains regarding who should be blamed for originating and triggering the crisis, although most tend to agree that this was due to the absence of sound regulations to protect savers and lenders, agreement on the part of the corporate banking elite to loot lump sums from the financial markets through fraud, and the outright untruthfulness of credit agencies concerning the inherent risk to the public.Indeed, the global financial crisis (GFC) cost the USA trillions of dollars and, understanding the need for intervention, the US government responded with hash fiscal and monetary expansionary policies in order to stabilise both the economy and the financial market. Additionally, it came up with the biggest ever stimulation programme, which was worth more than one trillion to bring about the recovery by bailing out any banks exposed to bankruptcy and at risk of collapsing.

© 2023 Ryan Rowley (Audiobook): 9798368975702

Data de lançamento

Audiobook: 20 de agosto de 2023

Outros também usufruíram...

- Sports Byline: Terry Porter Ron Barr

- COVID Curveball: An Inside View of the 2020 Los Angeles Dodgers World Championship Season Tim Neverett

- Me? Buy An Electric Car? Hah! NEVER!: But if you're gonna Buy One, here are some things you need to know Philip Pallette

- Early Christian Martyr Stories: An Evangelical Introduction with New Translations Bryan M. Litfin

- Serving Herself: The Life and Times of Althea Gibson Ashley Brown

- Playing Through the Pain: Ken Caminiti and the Steroids Confession That Changed Baseball Forever Dan Good

- 12 Life Lessons Every Graduate Should Know Sean Kouplen

- Exploring Creation with Health and Nutrition, 2nd edition Laura Chase

- Union with the Resurrected Christ: Eschatological New Creation and New Testament Biblical Theology G. K. Beale

- Walter Johnson: Baseball’s Big Train Henry W. Thomas

- Jim Kaat: Good As Gold: My Eight Decades in Baseball Jim Kaat

- The Black Dwarf Walter Scott

- On Second Thought... Maybe I Can: A transformational story of overcoming obstacles and living out your wildest dreams. Debbie Weiss

- The Truth of How Owners and Employees Cheat Their Companies: If you own a Business, Plan to own a business or work for someone who owns a Business, who and how they can cheat it. Alex Kwechansky

- 9 Athletes to Watch in the 2018 Winter Olympics Kit Ramgopal

- Why Church?: Christianity as It Was Meant to Be Scott Cowdell, PhD

- The Reverend Father Gaucher's Elixir Alphonse Daudet

- The Great Bank Forgery: The Story of Macdonnell and the Bidwells Sir Basil Thomson

- The Graft: How a Pioneering Operation Sparked the Modern Age of Organ Transplants Edmund O. Lawler

- Golf’s Greatest Collapses Andrew Podnieks

- From the Bench to the Boardroom: My Journey from Underdog Athlete to Turnaround CEO Michael C. MacDonald

- Spontaneous Order: How Norms, Institutions, and Innovations Emerge from the Bottom Up H. Peyton Young

- Pratique o poder do "Eu posso" Bruno Gimenes

4.5

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- O sonho de um homem ridículo Fiódor Dostoiévski

4.7

- Gerencie suas emoções Augusto Cury

4.5

- 10 Maneiras de manter o foco James Fries

3.8

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- Os "nãos" que você não disse Patrícia Cândido

4.2

- A gente mira no amor e acerta na solidão Ana Suy

4.5

- A metamorfose Franz Kafka

4.4

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- Jogos vorazes Suzanne Collins

4.8

- A arte da guerra Sun Tzu

4.6

- Primeiro eu tive que morrer Lorena Portela

4.3

- Pare de Procrastinar: Supere a preguiça e conquiste seus objetivos Giovanni Rigters

4.3

- talvez a sua jornada agora seja só sobre você: crônicas Iandê Albuquerque

4.5

Português

Brasil