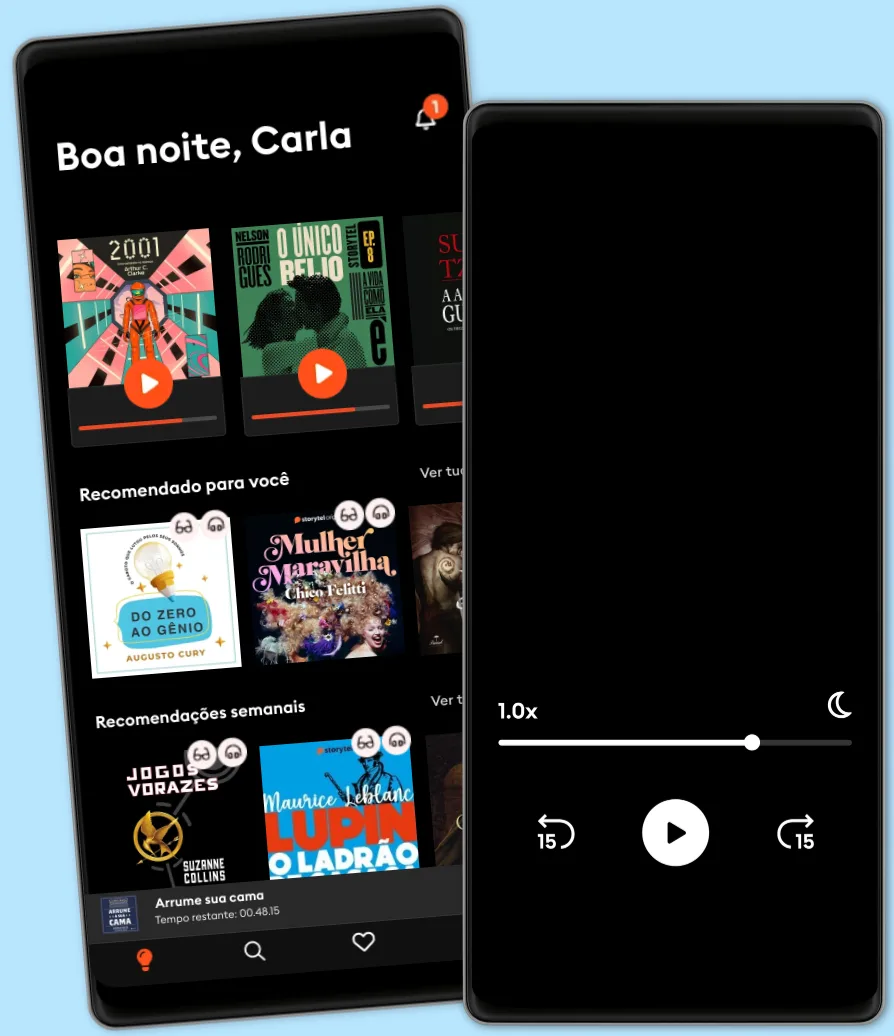

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

- Idiomas

- Inglês

- Format

- Categoria

História

Please note: This is a companion version & not the original book.

Book Preview:

#1 Income taxes are a cost that reduces the amount of money suppliers receive for selling a product. This necessarily makes supply go down. A tax lowers a buyer’s interest in buying, and the squeeze on profit margins from a tax makes producers sour on their own enterprises.

#2 The US income tax is an effective wealth tax that reduces supply and makes people lose interest in their own companies. It is a cost that reduces the amount of money suppliers receive for selling a product, and this necessarily makes supply go down.

#3 The focus on the top rate of the income tax and those subject to it, the richest people, is because these people are especially determined to avoid paying that top rate.

#4 The Sixteenth Amendment to the Constitution ratified in 1913, with its provision that Congress shall have power to lay and collect taxes on incomes, from whatever source derived, established the modern US income tax.

© 2022 IRB Media (Ebook): 9798350039337

Data de lançamento

Ebook: 7 de outubro de 2022

Outros também usufruíram...

- Maksymizing Life: turn self-doubt into self-confidence Valerie Maksym

- Powerful Affirmations for Black Men: Master Confidence, Boost Resilience and Cultivate Success in Life and Love Uplifting Truths for African American Men to Lead with Strength and Grit Elijah Jackson

- Bullying and Cyberbullying: How Parents and Teachers can Detect, Prevent and Stop Bullying, Implementing The Right Strategies Anna Maria Di Marzo

- Easily Cope with Stress: Relieve Stress Effectively and Feel More Centered with Meditation Elizabeth Snow

- Summary of W. Phillip Keller's A Shepherd Looks at Psalm 23 IRB Media

- Eating Right for Life: End Unhealthy Eating Patterns and Start Living a Healthy Lifestyle with Affirmations and Hypnosis Elizabeth Snow

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- Pratique o poder do "Eu posso" Bruno Gimenes

4.6

- O sonho de um homem ridículo Fiódor Dostoiévski

4.7

- Gerencie suas emoções Augusto Cury

4.5

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- 10 Maneiras de manter o foco James Fries

3.8

- Jogos vorazes Suzanne Collins

4.8

- A metamorfose Franz Kafka

4.4

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- Poder e Manipulação Jacob Petry

4.6

- A arte da guerra Sun Tzu

4.6

- A gente mira no amor e acerta na solidão Ana Suy

4.4

- Os "nãos" que você não disse Patrícia Cândido

4.9

- A cantiga dos pássaros e das serpentes Suzanne Collins

4.5

- Pare de Procrastinar: Supere a preguiça e conquiste seus objetivos Giovanni Rigters

4.3

Português

Brasil