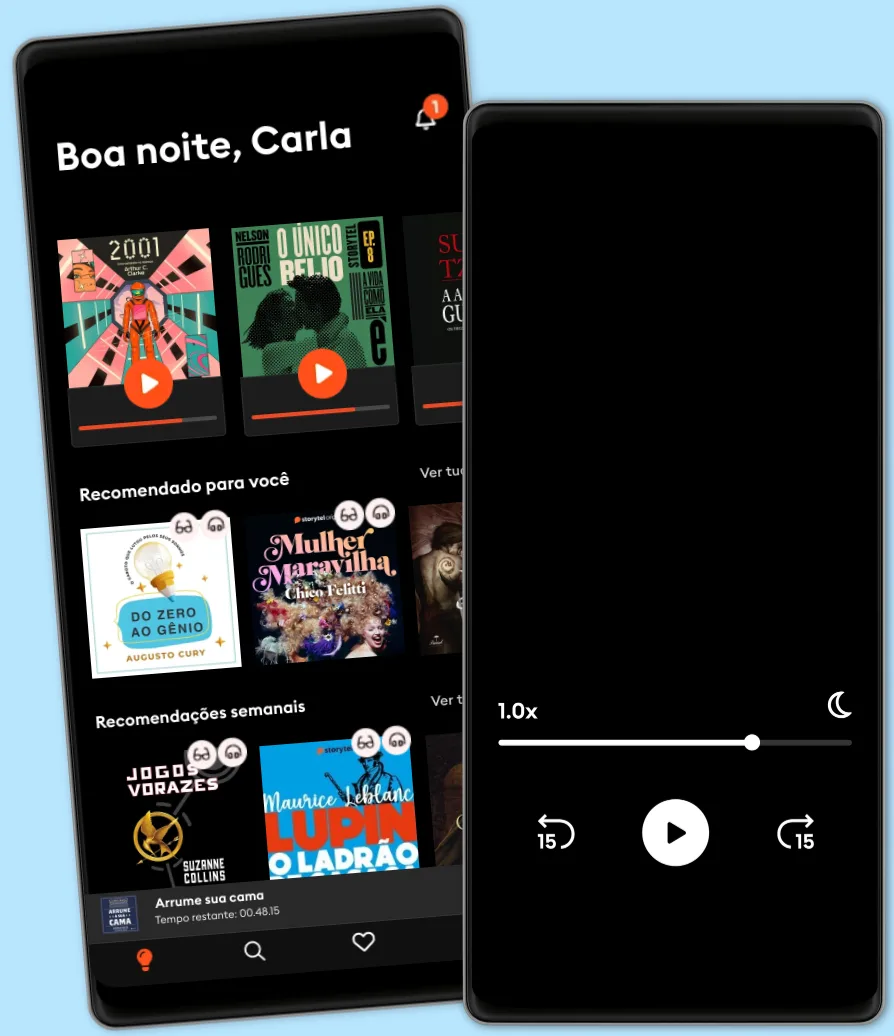

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

- Idioma

- Inglês

- Formato

- Categoria

Não-ficção

Please note: This is a companion version & not the original book. Book Preview:

#1 The Fed is not insolvent, but it is highly leveraged, and its balance sheet is not marked to market. This makes it vulnerable to large swings in market value.

#2 The Fed’s balance sheet lumps U. S. Treasury securities—Notes and Bonds, nominal into a single category and shows holdings of approximately $2. 3 trillion as of this writing. The Fed then breaks those holdings down by regional reserve bank.

#3 The Federal Reserve is so dominated by MIT-trained quants and PhDs that the policy makers get lost in the models and lose sight of the temperament of the American people. In early 2015, I had a private dinner with an official from the Federal Reserve who was categorical: We’re not insolvent, and never have been.

#4 The Gold Reserve Act of 1934 required the United States to issue gold certificates to the Federal Reserve, which it did. The certificates were last marked to market in 1971, at a price of $42. 22 per ounce. Using that price and the information on the Fed’s balance sheet, this translates into approximately 261. 4 million ounces of gold, or about eight thousand tons.

© 2022 IRB Media (Ebook): 9798822518322

Data de lançamento

Ebook: 16 de maio de 2022

Tags

Outros também usufruíram...

- Pratique o poder do "Eu posso" Bruno Gimenes

4.5

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- O sonho de um homem ridículo Fiódor Dostoiévski

4.7

- Gerencie suas emoções Augusto Cury

4.5

- 10 Maneiras de manter o foco James Fries

3.8

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- Os "nãos" que você não disse Patrícia Cândido

4.1

- A gente mira no amor e acerta na solidão Ana Suy

4.5

- A metamorfose Franz Kafka

4.4

- Jogos vorazes Suzanne Collins

4.8

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- A arte da guerra Sun Tzu

4.6

- Pare de Procrastinar: Supere a preguiça e conquiste seus objetivos Giovanni Rigters

4.3

- Primeiro eu tive que morrer Lorena Portela

4.3

- Poder e Manipulação Jacob Petry

4.6

Português

Brasil