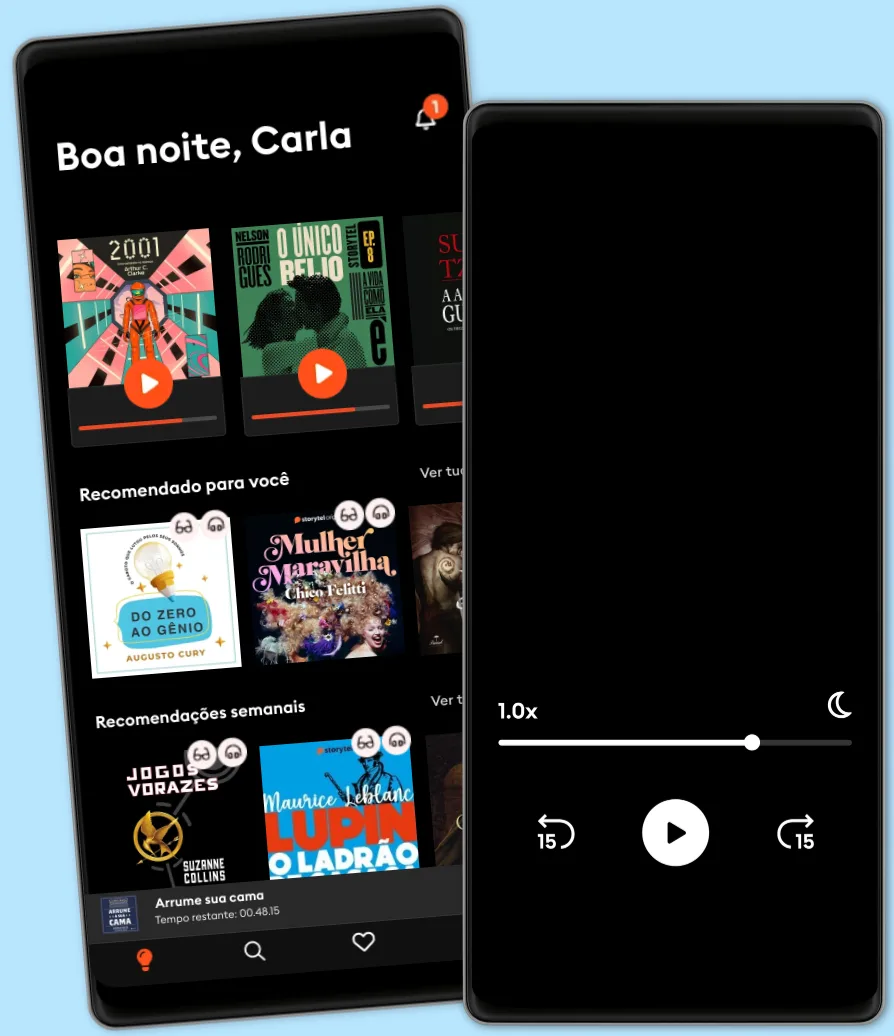

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

- Idioma

- Inglês

- Formato

- Categoria

Economia & Negócios

Please note: This is a companion version & not the original book. Book Preview:

#1 Investing is about forecasting returns. It is hard to call yourself an investor if you don’t think you have insights about expected returns. There are many ways to estimate expected returns, from fundamental to quantitative approaches and everything in between.

#2 The challenge of combining fundamental and quantitative approaches is how to marry them. I will make suggestions in this chapter.

#3 The capital asset pricing model is a basic way to estimate expected returns for investors. It links expected returns to an objective measure of risk and current interest rate levels. However, there are issues with the model.

#4 The Capital Asset Pricing Model is a theory that was developed to explain the relationship between risk and return, but it has been criticized for its flaws. It was developed by Nobel Prize winners William Sharpe and John Markowitz, but many academics have argued that it is flawed.

© 2022 IRB Media (Ebook): 9798822514874

Data de lançamento

Ebook: 12 de maio de 2022

Outros também usufruíram...

- Pratique o poder do "Eu posso" Bruno Gimenes

4.5

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- O sonho de um homem ridículo Fiódor Dostoiévski

4.7

- Gerencie suas emoções Augusto Cury

4.5

- 10 Maneiras de manter o foco James Fries

3.8

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- Os "nãos" que você não disse Patrícia Cândido

4.2

- A gente mira no amor e acerta na solidão Ana Suy

4.5

- A metamorfose Franz Kafka

4.4

- A arte da guerra Sun Tzu

4.6

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- Jogos vorazes Suzanne Collins

4.8

- Primeiro eu tive que morrer Lorena Portela

4.3

- Pare de Procrastinar: Supere a preguiça e conquiste seus objetivos Giovanni Rigters

4.3

- talvez a sua jornada agora seja só sobre você: crônicas Iandê Albuquerque

4.5

Português

Brasil