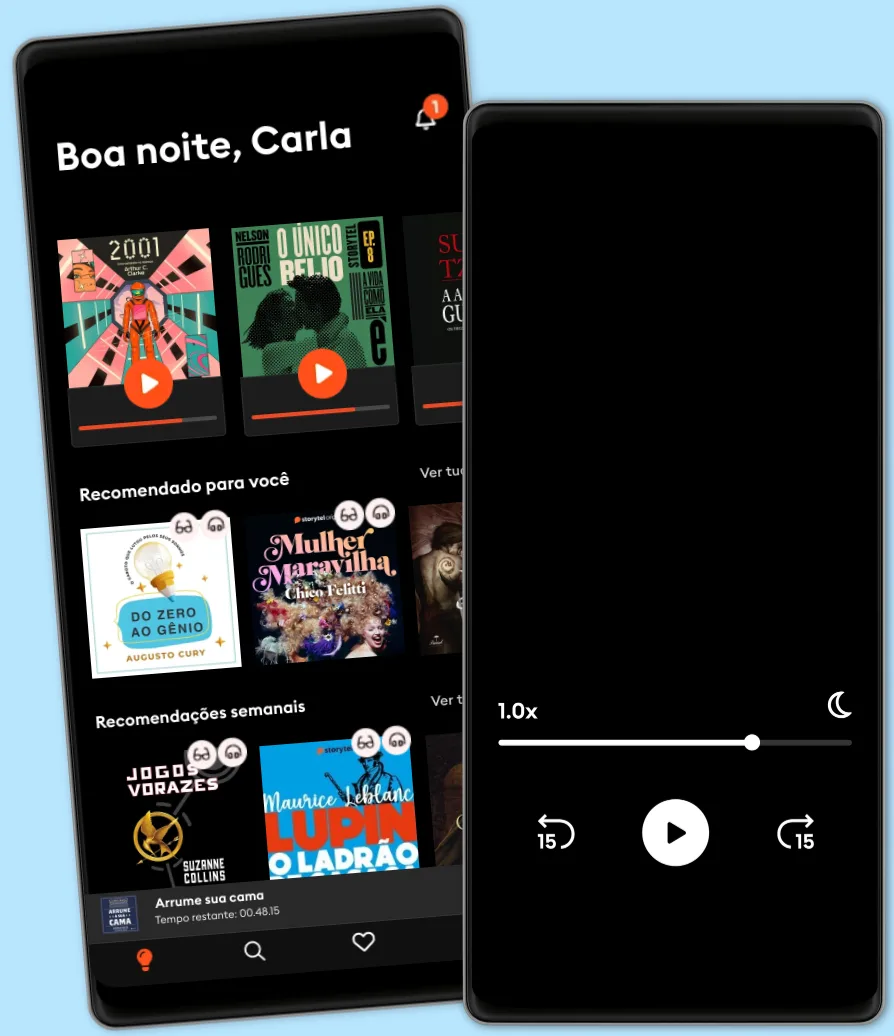

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working and Staying Tax Compliant Abroad

- por

- Com:

- Editora

- Duração

- 3H 11min

- Idiomas

- Inglês

- Format

- Categoria

Economia & Negócios

The Amazon Expat Tax Bestseller, Now Updated for 2018. Are you a citizen of the United States who lives abroad? You probably know America is one of only two countries that taxes its citizens on their worldwide income, regardless of where they live or work. If you’re thinking about becoming a digital nomad or expatriating to another country, do you know how to avoid paying unfair taxes on your income while abroad? There may be huge penalties and tax evasion charges if you don’t file correctly.

By combining the right strategies for citizenship, residency, banking, incorporation, and physical presence in other countries, most Americans abroad can legally lower their U.S. tax owing to $0. In U.S. Taxes for Worldly Americans, Certified Public Accountant, U.S. immigrant, expat, and perpetual traveler Olivier Wagner shows you how to use 100% legal strategies (beyond traditionally maligned “tax havens”) to keep your income and assets safe from the IRS.

Olivier covers a wealth of international tax information updated for 2018, including:

· Step-by-step instructions for the Forms and Schedules you will use to file your offshore tax, no matter where you are. · How to qualify for special deductions, credits, and exemptions on international taxation. · Why opening bank accounts and corporations in foreign countries is easier than you think. · How residency or citizenship in another country can legally lower your taxes. · How your spouse and children (whether American or of another nationality) affect your tax situation. · Practical advice for moving, living, and working with tax-free income in other parts of the world. · What to consider before renouncing your American citizenship and saying goodbye to the IRS for good.

As a non-resident American, there is no single easy answer to lower your taxes. If you don’t understand every possibility, you could end up paying too much. Embrace a worldly lifestyle with confidence as you master the U.S. tax system for Americans living overseas.

© 2020 Identity Publications (Audiolivros): 9781509492442

Data de lançamento

Audiolivros: 7 de março de 2020

Outros também usufruíram...

- Everyday Millionaires Chris Hogan

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More. Nicholas Regan

- Tax Accounting: A Guide for Small Business Owners Wanting to Understand Tax Deductions, and Taxes Related to Payroll, LLCs, Self-Employment, S Corps, and C Corporations Greg Shields

- US Corporate Tax System Introbooks Team

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties Martin J. Kallman

- Nudge: The Final Edition Richard H. Thaler

- CHATGPT BOOK FOR BEGINNERS: Getting Started with ChatGPT-4, Make Money Online with AI and Earn Passive Income Now Joseph Floyd

- The Uncertainty Solution: How to Invest with Confidence in the Face of the Unknown John M. Jennings

- Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can Too Dave Ramsey

- CPPB: Ready to Become a Certified Professional Public Buyer? Ace the CPB Exam in One Go! | Over 200 Expert Q&As | Realistic Practice Questions with Detailed Explanations Celeste Larkspur

- The Oxford Handbook of IPOs Douglas Cumming

- Climate Change: The Insights You Need from Harvard Business Review Harvard Business Review

- Yellen: The Trailblazing Economist Who Navigated an Era of Upheaval Jon Hilsenrath

- How to Keep Your Brain Young: Strategies for Staying Fit, Flexible, and Curious H. Norman Wright

- Broker, Trader, Lawyer, Spy: The Secret World of Corporate Espionage Eamon Javers

- Limited Liability Companies For Dummies: 3rd Edition Jennifer Reuting

- The Upside of Uncertainty: A Guide to Finding Possibility in the Unknown Nathan Furr

- FairTax:The Truth Boortz Media Group LLC

- The Legacy Journey: A Radical View of Biblical Wealth and Generosity Dave Ramsey

- All the Presidents' Bankers: The Hidden Alliances That Drive American Power Nomi Prins

- Crush It!: Why NOW Is the Time to Cash In on Your Passion Gary Vaynerchuk

- Basic Economics, Fifth Edition: A Common Sense Guide to the Economy Thomas Sowell

- The Everyday Hero Manifesto: Activate Your Positivity, Maximize Your Productivity, Serve The World Robin Sharma

- Influence, New and Expanded: The Psychology of Persuasion Robert B. Cialdini

- 13 Things Mentally Strong People Don't Do: Take Back Your Power, Embrace Change, Face Your Fears, and Train Your Brain for Happiness and Success Amy Morin

- The End of the World is Just the Beginning: Mapping the Collapse of Globalization Peter Zeihan

- HBR's 10 Must Reads on Entrepreneurship and Startups Reid Hoffman

- Teen Recidivism Rate PBS NewsHour

- HBR's 10 Must Reads on Change Management, Vol. 2 (with bonus article "Accelerate!" by John P. Kotter) Harvard Business Review

- HBR's 10 Must Reads on Business Model Innovation Clayton M. Christensen

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- O sonho de um homem ridículo Fiódor Dostoiévski

4.7

- Pratique o poder do "Eu posso" Bruno Gimenes

4.5

- Gerencie suas emoções Augusto Cury

4.5

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- 10 Maneiras de manter o foco James Fries

3.8

- Arrume sua cama William McRaven

4.5

- Jogos vorazes Suzanne Collins

4.8

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- A metamorfose Franz Kafka

4.4

- A cantiga dos pássaros e das serpentes Suzanne Collins

4.6

- Pare de Procrastinar: Supere a preguiça e conquiste seus objetivos Giovanni Rigters

4.3

- Poder e Manipulação Jacob Petry

4.6

- A gente mira no amor e acerta na solidão Ana Suy

4.4

- A arte da guerra Sun Tzu

4.6

Português

Brasil