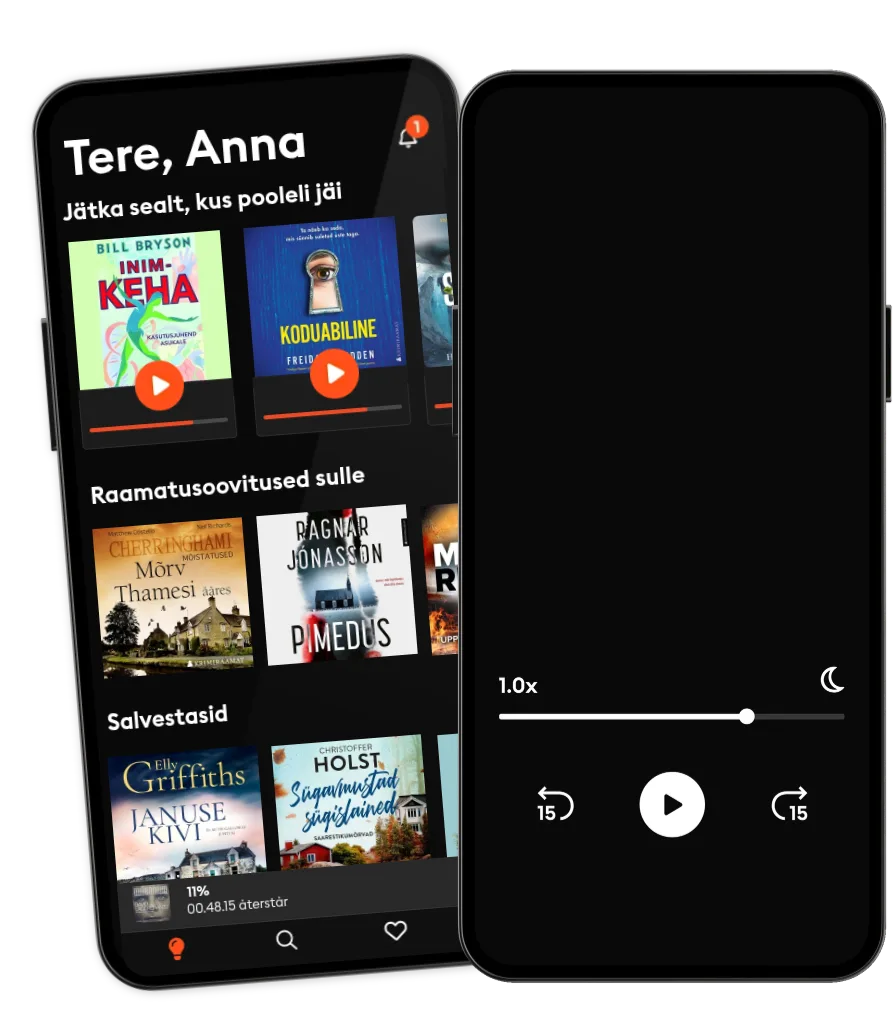

Loe ja kuula

Astu lugude lõputusse maailma

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Suurim valik eestikeelseid raamatuid

- Kokku üle 700 000 raamatu 4 keeles

Accounting Fundamentals

- Autor

- Esitaja

- Kirjastaja

- 11 hinnangut

3.6

- Kestus

- 0 h 43 min

- Keel

- inglise

- Vorming

- Kategooria

Majandus ja ettevõtlus

There are a lot of talks going around when it comes to adjustment of fixed assets and depreciation expense in accounting terms. Depreciation is almost similar to that of any other expenses in the fact that all expenses are deducted from sales revenue to determine profit. Keeping this apart, however, depreciation is very different from most other expenses. (Amortization expense, which we get to later, is a kissing cousin of depreciation. ) When a business buys or builds a long-term operating asset, the cost of the asset is recorded in a specific fixed asset account. Fixed is an overstatement; although the assets may last a long time, eventually they're retired from service.

The main point is that the cost of a long-term operating or fixed asset is spread out, or allocated, over its expected useful life to the business. Each year of use bears some portion of the cost of the fixed asset. The depreciation expense recorded in the period doesn't require any cash outlay during the period. (The cash outlay occurred when the fixed asset was acquired, or perhaps later when a loan was secured for part of the total cost.

© 2020 IntroBooks (Audioraamat): 9781987175615

Väljaandmise kuupäev

Audioraamat: 11. märts 2020

Sildid

- Anna O Matthew Blake

5

- Lilledele värsket vett Valérie Perrin

4.9

- Prantsuse kokanduskool Caroline James

4

- Ekraaniaju Anders Hansen

5

- Lapsehoidja Sofie Sarenbrant

4.5

- Loomade farm George Orwell

- Kolgas Max Seeck

4.9

- Tegevjuhi päevik Steven Bartlett

5

- Cinnamon Fallsi saladus R.L. Killmore

4.9

- Kaabaka surm M. C. Beaton

- Must rada Antonio Manzini

- Tüdrukute õhtu – Tove Tönniesi mõrv Lars Olof Lampers

4.3

- Toateenija saladus Nita Prose

4.8

- Neitsi Maarja neli päeva Leelo Tungal

4.3

- Suvi Applemore’is Rachael Lucas

5

- Kallim Freida McFadden

4.8

- Viimne vanne M. W. Craven

4.8

- Lilledele värsket vett Valérie Perrin

4.9

- Anna O Matthew Blake

5

- Kolgas Max Seeck

4.9

- Neitsi Maarja neli päeva Leelo Tungal

4.3

- Õpetaja Freida McFadden

4.7

- Suvi Applemore’is Rachael Lucas

5

- Koduabiline Freida McFadden

4.9

- Koduabiline jälgib sind Freida McFadden

4.9

- Pronksist unelmad Camilla Läckberg

4.5

- Koduabilise saladus Freida McFadden

4.7

- Pulmarahvas Alison Espach

4.5

- Lapsehoidja Sofie Sarenbrant

4.5

- Hinnaline saak Christoffer Holst

4.3

- Kallim Freida McFadden

4.8

- Viimne vanne M. W. Craven

4.8

- Anna O Matthew Blake

5

- Kolgas Max Seeck

4.9

- Suvi Applemore’is Rachael Lucas

5

- Koduabiline Freida McFadden

4.9

- Koduabiline jälgib sind Freida McFadden

4.9

- Pronksist unelmad Camilla Läckberg

4.5

- Pulmarahvas Alison Espach

4.5

- Lapsehoidja Sofie Sarenbrant

4.5

- Koduabilise saladus Freida McFadden

4.7

- Hõbedased tiivad Camilla Läckberg

4.5

- Nukumäng M.W. Craven

4.7

- Tuhat nuga selga Verni Leivak

4.3

- Kadunud sõrmuse mõistatus Ain Kütt

4.3

Vali pakett

Kokku üle 700 000 raamatu 4 keeles

Suur valik eestikeelseid raamatuid

Uusi raamatuid iga nädal

Kids Mode lastesõbralik keskkond

Unlimited

14.99 € /kuus

Tühista igal ajal

Unlimited (aastane)

119.99 € /aasta

Säästa 33%

Eesti

Eesti