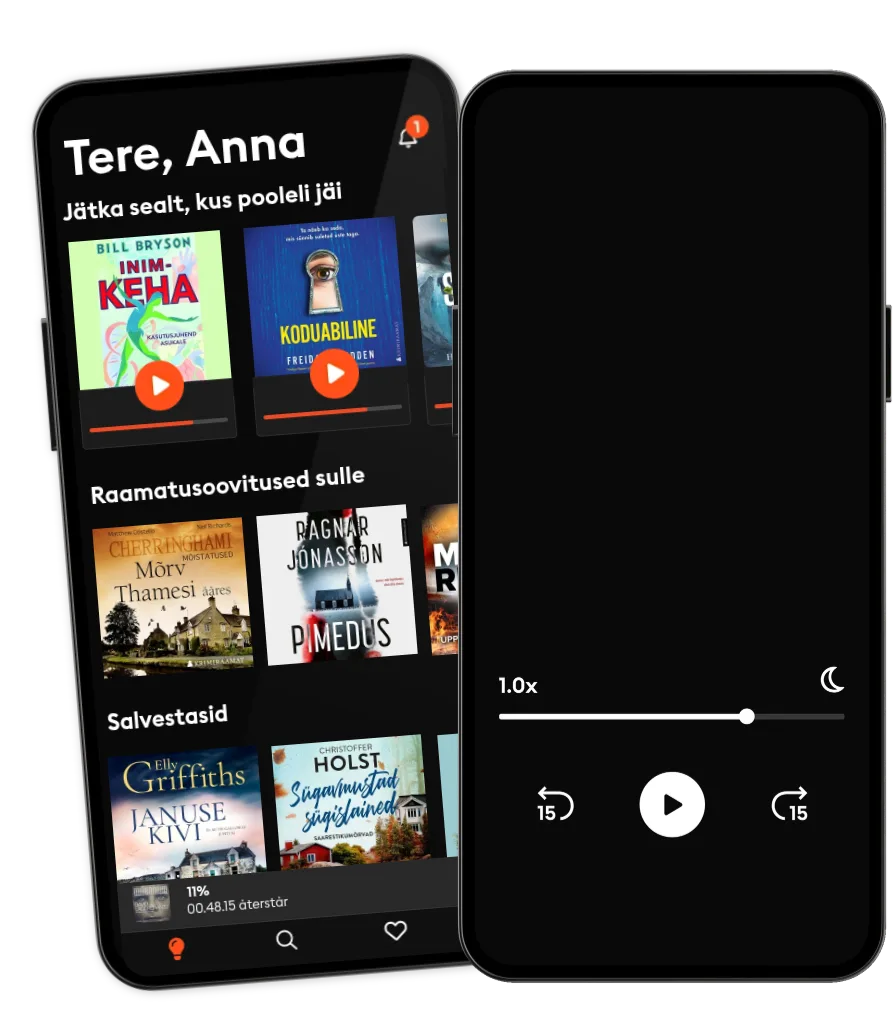

Loe ja kuula

Astu lugude lõputusse maailma

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Suurim valik eestikeelseid raamatuid

- Kokku üle 700 000 raamatu 4 keeles

How to Change Financial Habits with the Help of Financial Education

- Kirjastaja

- Keel

- inglise

- Vorming

- Kategooria

Majandus ja ettevõtlus

Hello everyone! I'm excited to introduce you to the fascinating world of financial psychology. In this series, we'll explore how our emotions, beliefs, and behaviors influence our financial decisions. We'll see how this understanding can transform our relationship with money and help us achieve our goals. Financial psychology studies the relationship between the human mind and money. It explores how psychological factors such as emotions, perceptions, and beliefs influence our financial decisions. It combines concepts from psychology and economics to understand financial behavior. Financial psychology isn't just about numbers and graphs. It helps us understand why we sometimes make financial decisions that don't make rational sense. By understanding the psychological mechanisms behind our decisions, we can make more informed decisions that align with our goals. Emotions such as fear, greed, and anxiety significantly influence our financial decisions. Fear of losing money can lead to conservative decisions, while greed can lead to excessive risk-taking. Hope for a better future can motivate us to save, but it can also lead us to invest in high-risk assets. Emotions are like an internal GPS that guides us in our financial decisions. However, they can lead us down a wrong path if not managed properly. By identifying and understanding our emotions, we can make more rational decisions that are aligned with our long-term goals. Cognitive biases are mental shortcuts we use to make decisions faster, but they can lead us to make mistakes. Examples of biases include loss aversion, confirmation bias, and herd behavior. How to identify and overcome these biases to make sounder financial decisions. Our brains are incredible machines, but they are also prone to making mistakes. Cognitive biases are like optical illusions that distort our perception of reality. By being aware of these biases, we can take steps to counteract their effects and make more rational decisions. Our financial habits are shaped by our experiences and beliefs. The importance of developing healthy financial habits, such as saving, investing, and planning for the future. How to create new habits and break old financial habits. Our financial habits are like paths we follow on autopilot. If we want to change our financial results, we need to change our paths. By developing new positive financial habits, we can transform our financial lives. Financial psychology offers us a new perspective on money. Instead of seeing money as an end in itself, we can see it as a means to achieve our goals and live a more fulfilling life.

© 2024 Digital World (E-raamat): 9781723462245

Väljaandmise kuupäev

E-raamat: 6. september 2024

Sildid

- Kuidas tappa oma perekonda Bella Mackie

5

- Lilledele värsket vett Valérie Perrin

4.9

- Magamise kunst Henri Tuomilehto

5

- Hinnaline saak Christoffer Holst

4.3

- Lapsehoidja Sofie Sarenbrant

4.5

- Anna O Matthew Blake

5

- Prantsuse kokanduskool Caroline James

4.3

- Ekraaniaju Anders Hansen

5

- Loomade farm George Orwell

- Kolgas Max Seeck

4.9

- Tegevjuhi päevik Steven Bartlett

5

- Cinnamon Fallsi saladus R.L. Killmore

4.8

- Kaabaka surm M. C. Beaton

- Must rada Antonio Manzini

- Tüdrukute õhtu – Tove Tönniesi mõrv Lars Olof Lampers

4.3

- Joulud Westini pagaritöökojas Solja Krapu-Kallio

4

- Kallim Freida McFadden

4.7

- Rääkida surnutega Anna Jansson

4.6

- Surmakosk L. J. Ross

5

- Koduabiline Freida McFadden

4.9

- Viimne vanne M. W. Craven

4.8

- Õpetaja Freida McFadden

4.8

- Anna O Matthew Blake

5

- Suvi Applemore’is Rachael Lucas

4.5

- Koduabilise saladus Freida McFadden

4.6

- Lapsehoidja Sofie Sarenbrant

4.5

- Lilledele värsket vett Valérie Perrin

4.9

- Kolgas Max Seeck

4.9

- Kuidas tappa oma perekonda Bella Mackie

5

- Toateenija saladus Nita Prose

4.8

- Kallim Freida McFadden

4.7

- Viimne vanne M. W. Craven

4.8

- Suvi Applemore’is Rachael Lucas

4.5

- Koduabiline Freida McFadden

4.9

- Koduabiline jälgib sind Freida McFadden

4.9

- Kolgas Max Seeck

4.9

- Anna O Matthew Blake

5

- Koduabilise saladus Freida McFadden

4.6

- Lapsehoidja Sofie Sarenbrant

4.5

- Toateenija saladus Nita Prose

4.8

- Pulmarahvas Alison Espach

4.6

- Kuidas tappa oma perekonda Bella Mackie

5

- Saladuslik külastaja Nita Prose

5

- Keelutsoon M. W. Craven

4.5

- Prantsuse kokanduskool Caroline James

4.3

Vali pakett

Kokku üle 700 000 raamatu 4 keeles

Suur valik eestikeelseid raamatuid

Uusi raamatuid iga nädal

Kids Mode lastesõbralik keskkond

Unlimited

14.99 € /kuus

Tühista igal ajal

Unlimited (aastane)

119.99 € /aasta

Säästa 33%

Eesti

Eesti