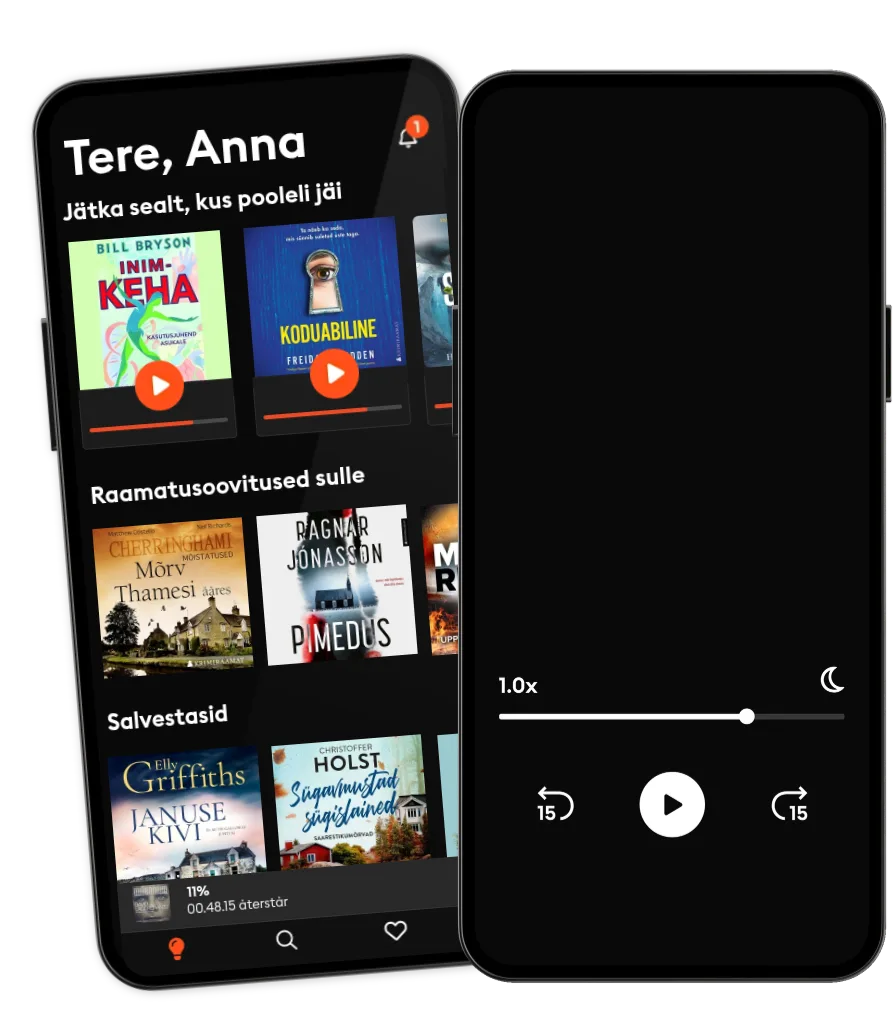

Loe ja kuula

Astu lugude lõputusse maailma

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Suurim valik eestikeelseid raamatuid

- Kokku üle 700 000 raamatu 4 keeles

- Keel

- inglise

- Vorming

- Kategooria

Ajalugu

Please note: This is a companion version & not the original book.

Book Preview:

#1 Income taxes are a cost that reduces the amount of money suppliers receive for selling a product. This necessarily makes supply go down. A tax lowers a buyer’s interest in buying, and the squeeze on profit margins from a tax makes producers sour on their own enterprises.

#2 The US income tax is an effective wealth tax that reduces supply and makes people lose interest in their own companies. It is a cost that reduces the amount of money suppliers receive for selling a product, and this necessarily makes supply go down.

#3 The focus on the top rate of the income tax and those subject to it, the richest people, is because these people are especially determined to avoid paying that top rate.

#4 The Sixteenth Amendment to the Constitution ratified in 1913, with its provision that Congress shall have power to lay and collect taxes on incomes, from whatever source derived, established the modern US income tax.

© 2022 IRB Media (E-raamat): 9798350039337

Väljaandmise kuupäev

E-raamat: 7. oktoober 2022

- Apteeker Melchior ja nõiutud kabel Indrek Hargla

5

- Koduabiline Freida McFadden

4.9

- Pettuste rulett Donna Leon

- Billy Summers Stephen King

5

- Ikigai Francesc Miralles

- Sõna on mõrv Anthony Horowitz

- Kadunud sõrmuse mõistatus Ain Kütt

3

- Dorian Gray portree Oscar Wilde

- Viimne vanne M. W. Craven

5

- Kahetsuse värv Colleen Hoover

5

- Lahutamatud Sylvia Frank

- Asjad, millest me üle ei saa Lucy Score

3.5

- Kadunud keskendumisvõime Johann Hari

- Mustmaja Peter May

5

- Sekt Camilla Läckberg

- Kallim Freida McFadden

4.9

- Tuhat nuga selga Verni Leivak

4.5

- Koduabiline Freida McFadden

4.9

- Kadunud sõrmuse mõistatus Ain Kütt

3

- Pulmarahvas Alison Espach

4

- Viimne vanne M. W. Craven

5

- Apteeker Melchior ja nõiutud kabel Indrek Hargla

5

- Kahetsuse värv Colleen Hoover

5

- Manifesteeri Roxie Nafousi

5

- Hõbedased tiivad Camilla Läckberg

4

- Vanamees ja meri Ernest Hemingway

- Ikigai Francesc Miralles

- Kevad Applemore'is Rachael Lucas

4.5

- Väike pagariäri Brooklynis Julie Caplin

5

- Tagasi Applemore´i Rachael Lucas

- Kallim Freida McFadden

4.9

- Tuhat nuga selga Verni Leivak

4.5

- Kadunud sõrmuse mõistatus Ain Kütt

3

- Koduabiline Freida McFadden

4.9

- Pulmarahvas Alison Espach

4

- Kahetsuse värv Colleen Hoover

5

- Manifesteeri Roxie Nafousi

5

- Ikigai Francesc Miralles

- Hõbedased tiivad Camilla Läckberg

4

- Unustatud kokaraamat Christoffer Holst

5

- Väike pagariäri Brooklynis Julie Caplin

5

- Unistuste jahtimise suvi Holly Martin

- Mõrv Thamesi ääres Matthew Costello

4.7

- Lumepimedus Matthew Costello

- Äratõugatud surnud Elly Griffiths

5

Vali pakett

Kokku üle 700 000 raamatu 4 keeles

Suur valik eestikeelseid raamatuid

Uusi raamatuid iga nädal

Kids Mode lastesõbralik keskkond

Eesti

Eesti