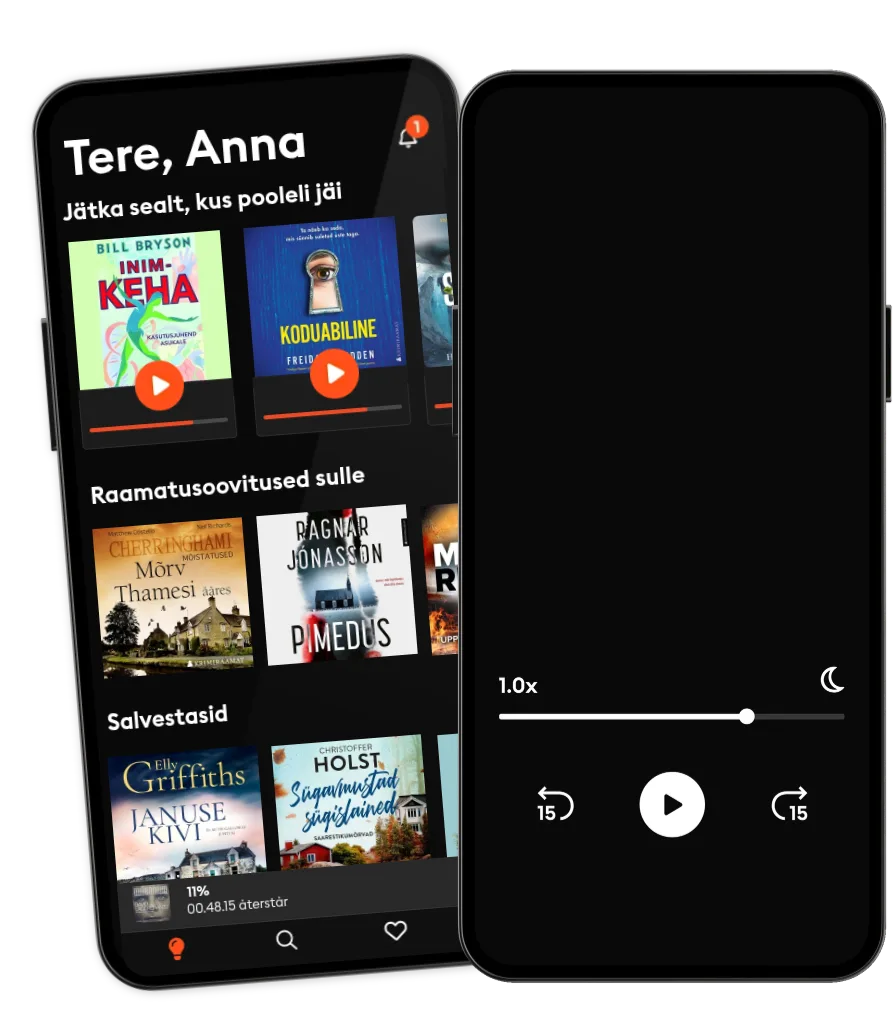

Loe ja kuula

Astu lugude lõputusse maailma

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Suurim valik eestikeelseid raamatuid

- Kokku üle 700 000 raamatu 4 keeles

- Keel

- inglise

- Vorming

- Kategooria

Majandus ja ettevõtlus

Please note: This is a companion version & not the original book. Book Preview:

#1 Investing is about forecasting returns. It is hard to call yourself an investor if you don’t think you have insights about expected returns. There are many ways to estimate expected returns, from fundamental to quantitative approaches and everything in between.

#2 The challenge of combining fundamental and quantitative approaches is how to marry them. I will make suggestions in this chapter.

#3 The capital asset pricing model is a basic way to estimate expected returns for investors. It links expected returns to an objective measure of risk and current interest rate levels. However, there are issues with the model.

#4 The Capital Asset Pricing Model is a theory that was developed to explain the relationship between risk and return, but it has been criticized for its flaws. It was developed by Nobel Prize winners William Sharpe and John Markowitz, but many academics have argued that it is flawed.

© 2022 IRB Media (E-raamat): 9798822514874

Väljaandmise kuupäev

E-raamat: 12. mai 2022

Sildid

- Anna O Matthew Blake

5

- Lilledele värsket vett Valérie Perrin

4.9

- Prantsuse kokanduskool Caroline James

4

- Lapsehoidja Sofie Sarenbrant

4.5

- Ekraaniaju Anders Hansen

5

- Loomade farm George Orwell

- Kolgas Max Seeck

4.9

- Tegevjuhi päevik Steven Bartlett

5

- Cinnamon Fallsi saladus R.L. Killmore

4.9

- Kaabaka surm M. C. Beaton

- Must rada Antonio Manzini

- Tüdrukute õhtu – Tove Tönniesi mõrv Lars Olof Lampers

4.3

- Toateenija saladus Nita Prose

4.8

- Suvi Applemore’is Rachael Lucas

4.5

- Neitsi Maarja neli päeva Leelo Tungal

4.3

- Kallim Freida McFadden

4.8

- Viimne vanne M. W. Craven

4.8

- Lilledele värsket vett Valérie Perrin

4.9

- Anna O Matthew Blake

5

- Suvi Applemore’is Rachael Lucas

4.5

- Koduabiline Freida McFadden

4.9

- Kolgas Max Seeck

4.9

- Koduabiline jälgib sind Freida McFadden

4.9

- Koduabilise saladus Freida McFadden

4.7

- Pulmarahvas Alison Espach

4.5

- Õpetaja Freida McFadden

4.7

- Neitsi Maarja neli päeva Leelo Tungal

4.3

- Mees, kes teadis ussisõnu Andrus Kivirähk

5

- Avatud uksed Sofie Sarenbrant

5

- Hõbedased tiivad Camilla Läckberg

4.5

- Kallim Freida McFadden

4.8

- Viimne vanne M. W. Craven

4.8

- Anna O Matthew Blake

5

- Suvi Applemore’is Rachael Lucas

4.5

- Koduabiline Freida McFadden

4.9

- Kolgas Max Seeck

4.9

- Koduabiline jälgib sind Freida McFadden

4.9

- Koduabilise saladus Freida McFadden

4.7

- Pulmarahvas Alison Espach

4.5

- Avatud uksed Sofie Sarenbrant

5

- Hõbedased tiivad Camilla Läckberg

4.5

- Lapsehoidja Sofie Sarenbrant

4.5

- Pronksist unelmad Camilla Läckberg

4.6

- Võõras Veri M. W. Craven

4.8

- Nukumäng M. W. Craven

4.7

Vali pakett

Kokku üle 700 000 raamatu 4 keeles

Suur valik eestikeelseid raamatuid

Uusi raamatuid iga nädal

Kids Mode lastesõbralik keskkond

Unlimited

14.99 € /kuus

Tühista igal ajal

Unlimited (aastane)

119.99 € /aasta

Säästa 33%

Eesti

Eesti