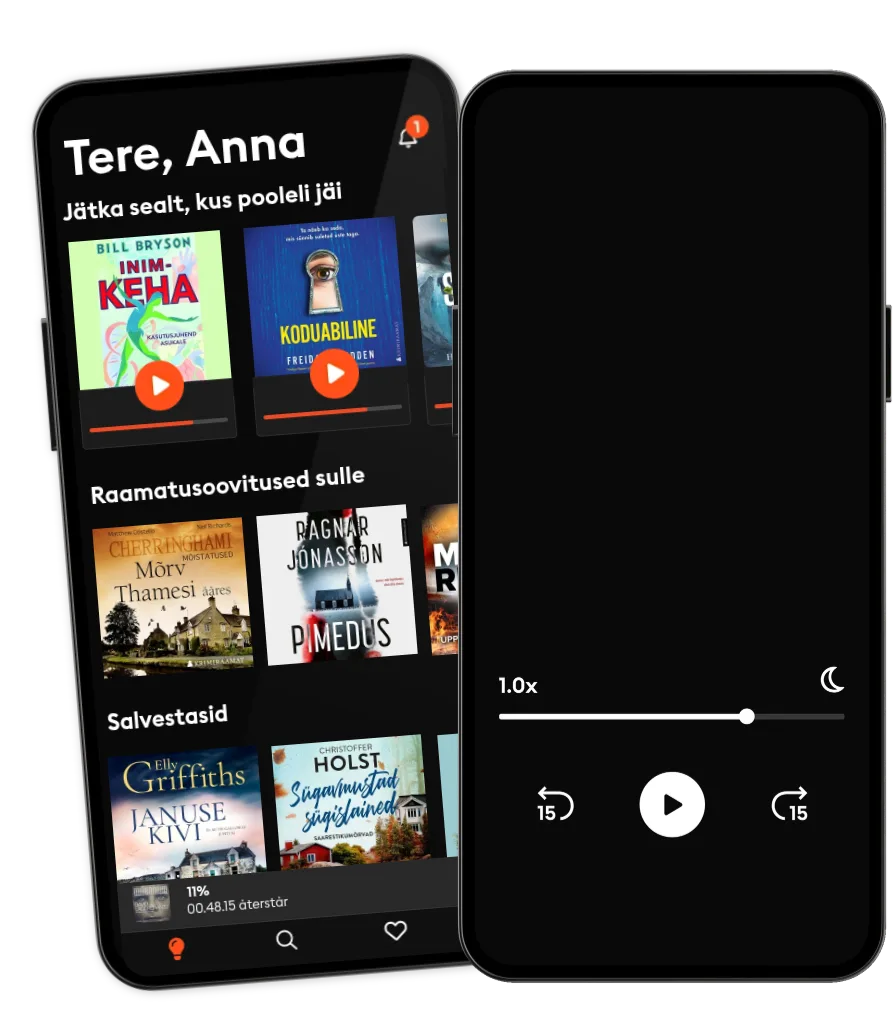

Loe ja kuula

Astu lugude lõputusse maailma

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Suurim valik eestikeelseid raamatuid

- Kokku üle 700 000 raamatu 4 keeles

The effects of contagion during the Global Financial Crisis in Government Regulated: And Sponsored Assets in Emerging Markets: The case of Colombian pension funds and State Owned Enterprises (SOEs) in BRIC countries

- Autor

- Kirjastaja

- Keel

- inglise

- Vorming

- Kategooria

Majandus ja ettevõtlus

The effects of financial contagion during the Global Financial Crisis (GFC) have been extensively studied in the finance literarure.

One of the key issues is the devastating effect of the crisis on wealth and asset prices. However, one key difference between this crisis and other crises in the past was the resilience (immunity) or the short term effect of the crisis on emerging markets.

Dooley and Hutchison (2009) were the first ones to find evidence in support of the decoupling hypothesis of emerging markets during the early phases of the crisis. Since then the hypothesis have been tested by other researchers (for recent surveys see: Beirne and Gieck, 2014; Koksal and Orhan, 2013).

© 2015 CESA (E-raamat): 9789588722849

Väljaandmise kuupäev

E-raamat: 1. jaanuar 2015

- Kuidas tappa oma perekonda Bella Mackie

5

- Lilledele värsket vett Valérie Perrin

4.9

- Magamise kunst Henri Tuomilehto

5

- Hinnaline saak Christoffer Holst

4.3

- Anna O Matthew Blake

5

- Lapsehoidja Sofie Sarenbrant

4.5

- Ekraaniaju Anders Hansen

5

- Prantsuse kokanduskool Caroline James

4.3

- Kolgas Max Seeck

4.9

- Cinnamon Fallsi saladus R.L. Killmore

4.8

- Loomade farm George Orwell

- Tegevjuhi päevik Steven Bartlett

5

- Kaabaka surm M. C. Beaton

- Must rada Antonio Manzini

- Toateenija saladus Nita Prose

4.8

- Kallim Freida McFadden

4.7

- Rääkida surnutega Anna Jansson

4.6

- Lilledele värsket vett Valérie Perrin

4.9

- Anna O Matthew Blake

5

- Viimne vanne M. W. Craven

4.8

- Koduabiline jälgib sind Freida McFadden

4.9

- Joulud Westini pagaritöökojas Solja Krapu-Kallio

4

- Koduabiline Freida McFadden

4.9

- Kolgas Max Seeck

4.9

- Suvi Applemore’is Rachael Lucas

4.5

- Õpetaja Freida McFadden

4.8

- Lapsehoidja Sofie Sarenbrant

4.5

- Toateenija saladus Nita Prose

4.8

- Koduabilise saladus Freida McFadden

4.6

- Punane elavhõbe Andres Anvelt

4.7

- Kallim Freida McFadden

4.7

- Viimne vanne M. W. Craven

4.8

- Koduabiline jälgib sind Freida McFadden

4.9

- Koduabiline Freida McFadden

4.9

- Kolgas Max Seeck

4.9

- Suvi Applemore’is Rachael Lucas

4.5

- Anna O Matthew Blake

5

- Lapsehoidja Sofie Sarenbrant

4.5

- Toateenija saladus Nita Prose

4.8

- Koduabilise saladus Freida McFadden

4.6

- Pulmarahvas Alison Espach

4.6

- Kuraator M. W. Craven

5

- Avatud uksed Sofie Sarenbrant

5

- Prantsuse kokanduskool Caroline James

4.3

- Kuidas tappa oma perekonda Bella Mackie

5

Vali pakett

Kokku üle 700 000 raamatu 4 keeles

Suur valik eestikeelseid raamatuid

Uusi raamatuid iga nädal

Kids Mode lastesõbralik keskkond

Unlimited

14.99 € /kuus

Tühista igal ajal

Unlimited (aastane)

119.99 € /aasta

Säästa 33%

Eesti

Eesti