Times they are a’changin: Series A is not what it used to be

- Autor

- Osa

- 17

- Avaldatud

- 29. juuli 2019

- Kirjastaja

- 0 Hinnangud

- 0

- Osa

- 17 of 111

- Kestus

- 43 min

- Keel

- inglise

- Vorming

- Kategooria

- Majandus ja ettevõtlus

“If you look at the firms that were traditionally the early-stage ventures firms, the Series-A firms, and you look at their fund sizes and their firm sizes and compositions, it’s changed significantly in the last ten years. Your typical early-stage venture fund was a $250M Series A fund. Now your typical early stage fund is anywhere from $500M to 1B.”

In this episode, Ben and David dive into the evolution of Seed Funds and how early-stage investing has changed in the last two decades both for investors and founders alike. Understanding the past changes in the ecosystem helps founders and investors establish themselves for the future. If you are an early-stage founder, this episode will contextualize the information you need to prepare your company for investment.

Sponsors:

Koyfin: https://bit.ly/acquiredkoyfin

Be sure to follow the Acquired Podcast:

Acquired.fm

@AcquiredFM

Links from the Show:

Wing’s analysis of the current state of the early-stage venture ecosystem: Seed is the new A, A is the new B

Secrets of Sand Hill Road

Gartner Hype Cycle

Value of VC Investment (1995-2018)

US VC Investment Surpasses Dot-Com Era

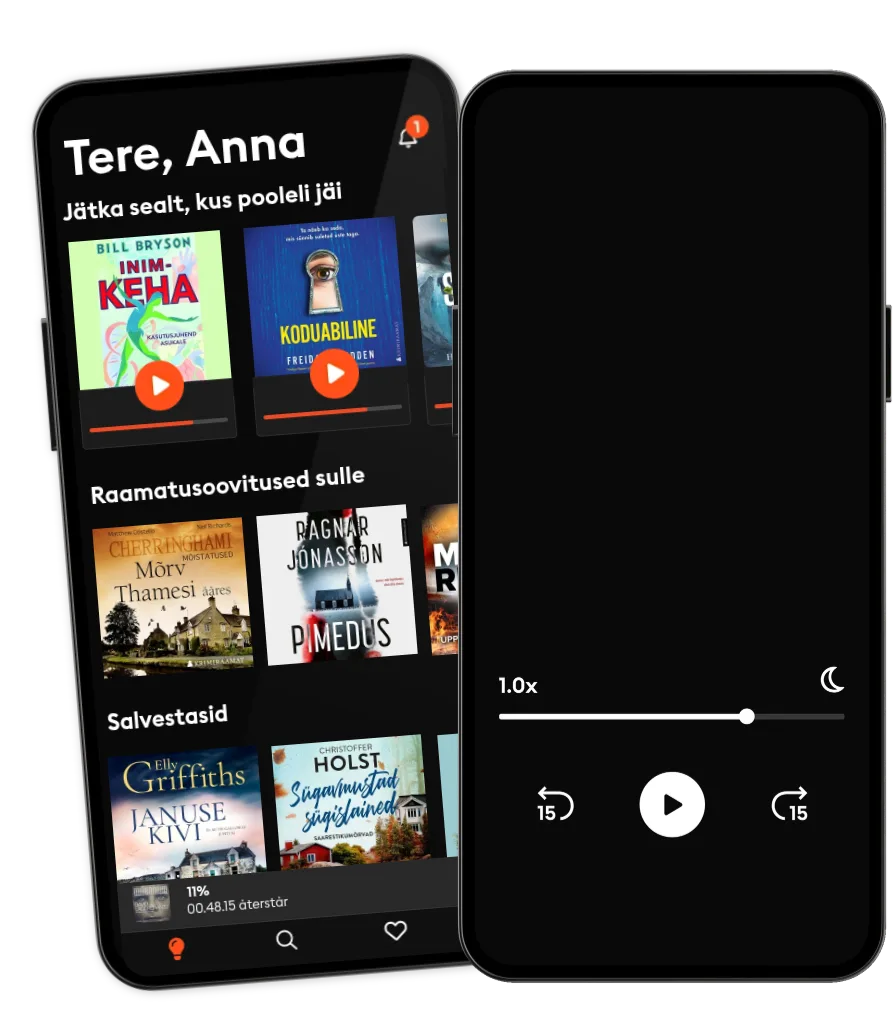

Loe ja kuula

Astu lugude lõputusse maailma

- Suurim valik eestikeelseid audio- ja e-raamatuid

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Lihtne igal ajal tühistada

Muud podcastid, mis võivad sulle meeldida ...

- Lisatulu podcastLisatulu podcast

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Lisatulu podcastLisatulu podcast

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

Eesti

Eesti