Business WarsWondery

2020 Year end tax planning and tax saving strategies for 2021 & beyond

- Autor

- Osa

- 21

- Avaldatud

- 8. dets 2020

- Kirjastaja

- 0 Hinnangud

- 0

- Osa

- 21 of 71

- Kestus

- 55 min

- Keel

- inglise

- Vorming

- Kategooria

- Majandus ja ettevõtlus

•Year end tax planning and tax saving strategies for 2021 & beyond •Saving for education – credits, deductions and Qualified Tuition Plan •State tax implications of working remotely •PPP Loan Forgiveness •CARES Act – Economic Impact Payments what to expect when you file your 2020 tax returns. •International Taxation •Foreign Capital Gains •Foreign earned income exclusion •Foreign tax credit •FATCA (Form 8938)FBAR (Form Fincen 114) disclaimer: •Information shared in this webinar are for educational purposes. Individual situations may vary and needs to be considered on a case to case basis. Users discretion advised to consult their tax advisers

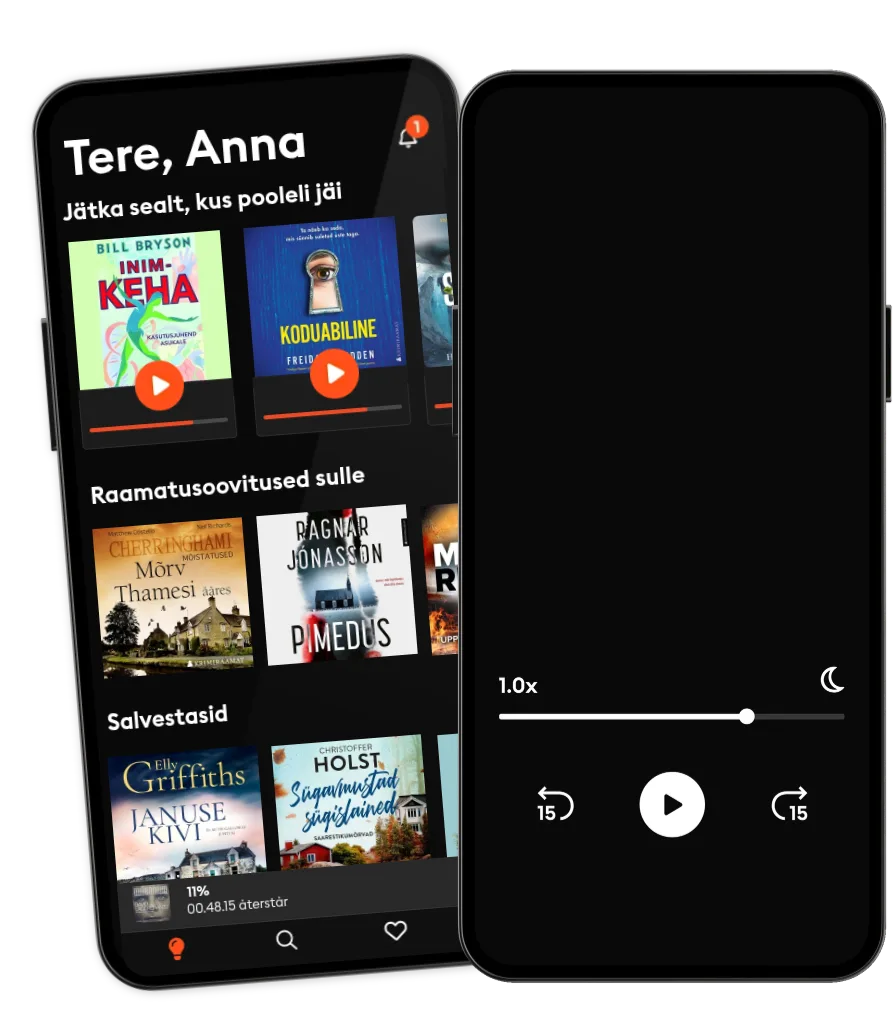

Loe ja kuula

Astu lugude lõputusse maailma

- Suurim valik eestikeelseid audio- ja e-raamatuid

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Lihtne igal ajal tühistada

Muud podcastid, mis võivad sulle meeldida ...

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

Kasulikud lingid

Keel ja piirkond

Eesti

Eesti