- 0 Hinnangud

- 0

- Osa

- 72 of 1083

- Kestus

- 29 min

- Keel

- inglise

- Vorming

- Kategooria

- Majandus ja ettevõtlus

A few weeks ago on the Odd Lots podcast, we talked to Paul Schmelzing, a Ph.D candidate at Harvard, who explained how the bull market in U.S. Treasuries could come to a screeching halt. This week we examine the other side of the debate. Our guest is Srinivas Thiruvadanthai, director of research at the Jerome Levy Forecasting Center in Mount Kisco, New York. He explains how a combination of structural factors in the global economy and massive levels of debt could depress interest rates on government debt for years to come. In addition to explaining why the bond bull market of more than three decades can survive, Thiruvadanthai explains what everyone gets wrong on how inflation occurs.

See omnystudio.com/listener for privacy information.

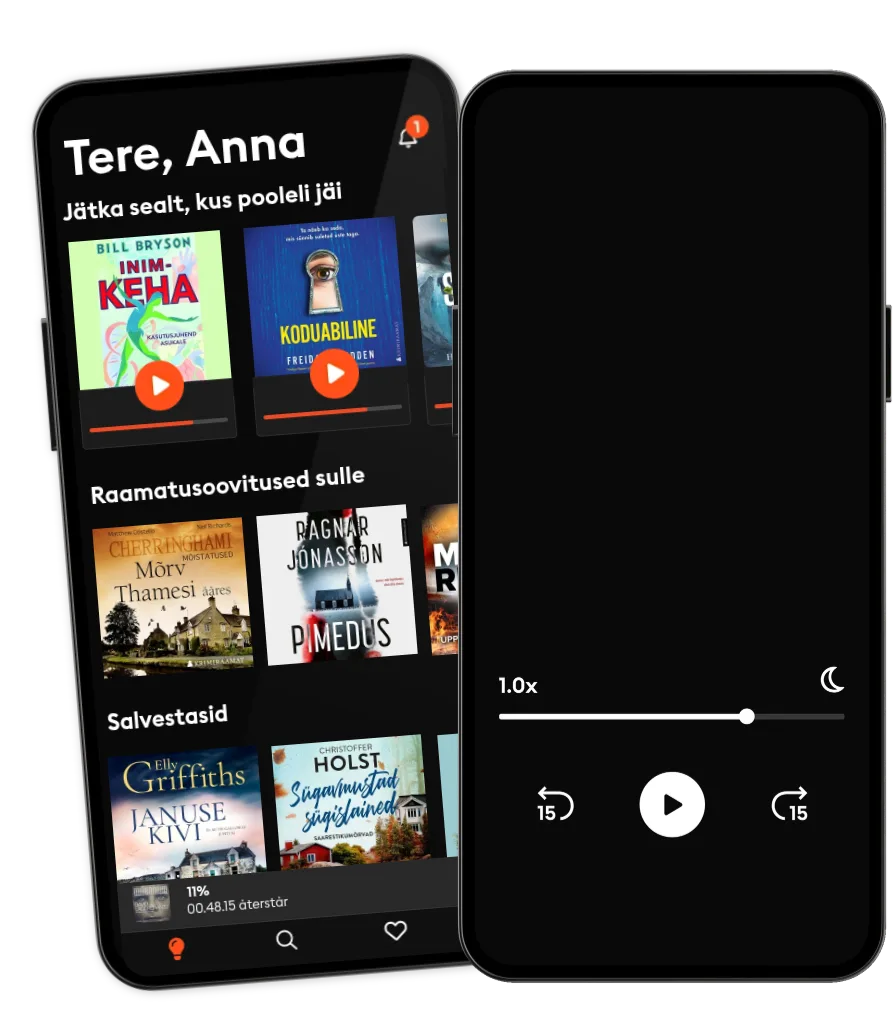

Loe ja kuula

Astu lugude lõputusse maailma

- Suurim valik eestikeelseid audio- ja e-raamatuid

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Lihtne igal ajal tühistada

Muud podcastid, mis võivad sulle meeldida ...

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

Eesti

Eesti