- 0 Hinnangud

- 0

- Osa

- 858 of 1078

- Kestus

- 54 min

- Keel

- inglise

- Vorming

- Kategooria

- Majandus ja ettevõtlus

For decades, investors have been told that diversifying is a good thing. You should hold a basket of stocks across different sectors and geographies, plus bonds, maybe some commodities or real estate, and so on. But, it turns out that you probably would have done better if you just bought large-cap US stocks in the form of an S&P 500 ETF like SPY. So why haven't diversified investments performed better? In this episode, we speak with Meb Faber, CIO of Cambria Investment Management, the host of the Meb Faber show, and the author of one of the most-downloaded research papers on SSRN. He says the last 15 years have "arguably been the worst period ever for an asset allocation portfolio. Read more: Great ‘Bear Market’ in Diversification Haunts Wall Street Pros The Fate of the World’s Largest ETF Is Tied to 11 Random Millennials

Only Bloomberg.com subscribers can get the Odd Lots newsletter in their inbox — now delivered every weekday — plus unlimited access to the site and app. Subscribe at bloomberg.com/subscriptions/oddlots

See omnystudio.com/listener for privacy information.

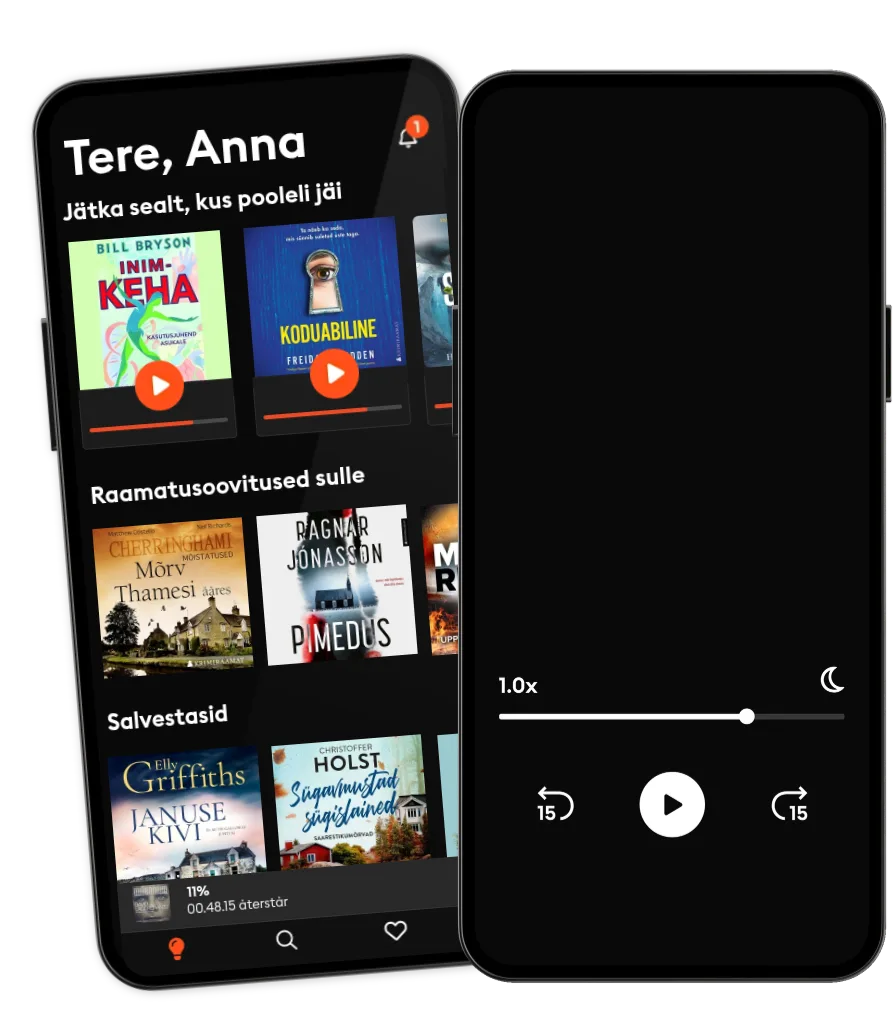

Loe ja kuula

Astu lugude lõputusse maailma

- Suurim valik eestikeelseid audio- ja e-raamatuid

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Lihtne igal ajal tühistada

Muud podcastid, mis võivad sulle meeldida ...

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

Eesti

Eesti