- 0 Hinnangud

- 0

- Osa

- 885 of 1076

- Kestus

- 49 min

- Keel

- inglise

- Vorming

- Kategooria

- Majandus ja ettevõtlus

For years, investors have relied on the classic 60/40 portfolio of stocks and bonds. The idea behind this was simple: bonds tend to go up when stocks go down, so the two things should act as a natural hedge. But when inflation spiked in 2022 and 2023, the 60/40 portfolio performed terribly and bonds failed to act as a safety cushion. In this episode, we speak with Nouriel Roubini, chief economist and portfolio manager of the new Atlas America Fund, an ETF that is trying to create a new type of safe asset that can withstand big risks, including stagflation, deficits, and de-dollarization. We also talk about the outlook for the US economy in 2025, and the big risks that the chief economist and portfolio manager of the Atlas America Fund sees on the horizon.

Read more: Roubini Launches Treasury-Alternative ETF to Ride Trump-Era Risk Crypto Critic Nouriel Roubini Is Working on a Tokenized Dollar Replacement

Become a Bloomberg - Business News, Stock Markets, Finance, Breaking & World News subscriber using our special intro offer at Bloomberg Subscriptions | Digital, All Access, Corporate & Student . You’ll get episodes of this podcast ad-free and exclusive access to our daily Odd Lots newsletter. Already a subscriber? Connect your account on the Bloomberg channel page in Apple Podcasts to listen ad-free.

See omnystudio.com/listener for privacy information.

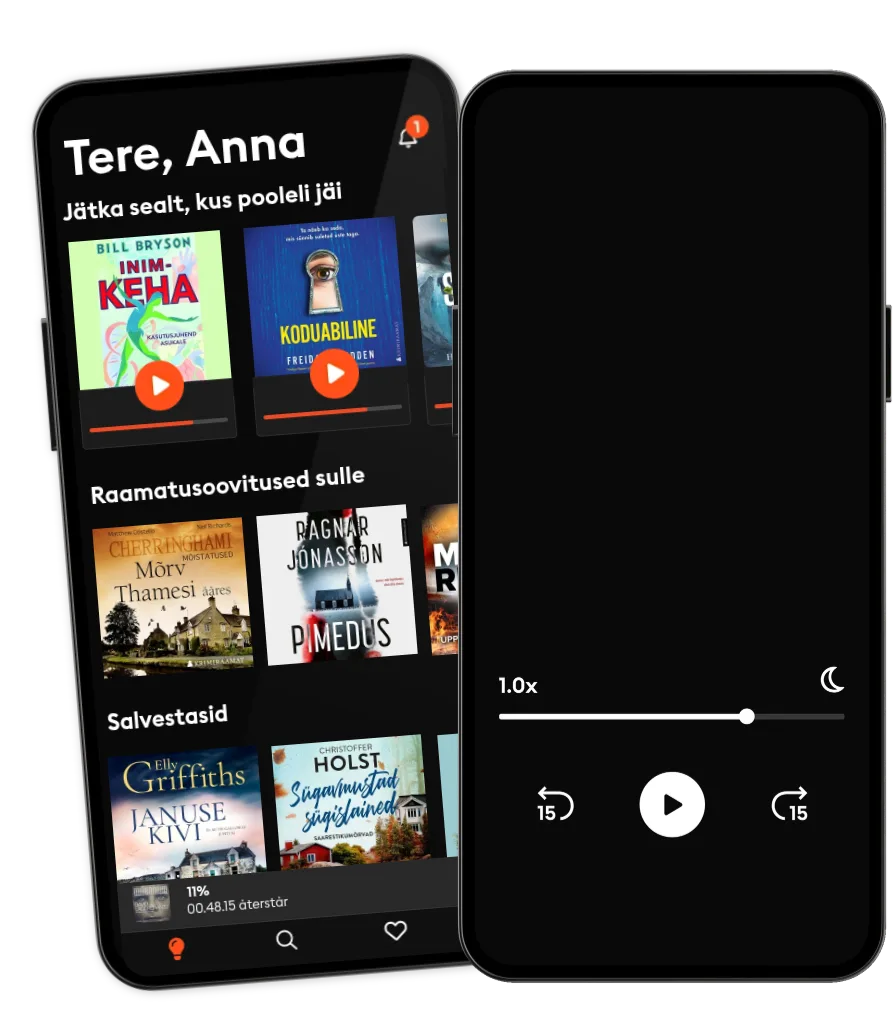

Loe ja kuula

Astu lugude lõputusse maailma

- Suurim valik eestikeelseid audio- ja e-raamatuid

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Lihtne igal ajal tühistada

Muud podcastid, mis võivad sulle meeldida ...

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

Eesti

Eesti