- 0 Hinnangud

- 0

- Osa

- 971 of 1076

- Kestus

- 47 min

- Keel

- inglise

- Vorming

- Kategooria

- Majandus ja ettevõtlus

When stocks are plunging in a typical market environment, people reach for safe haven assets like US Treasuries. But we've seen that phenomenon break down more and more. It broke down in a sustained way during the intense inflation of 2022. And it's been breaking down again, in an acute way, since President Trump's so-called "Liberation Day." On the night of April 8 and early morning of April 9, we saw a major spike in yields. As Trump put it, the bond market was getting the "yips." But what was actually going on? Who was selling? And why? And what have we learned more broadly about technical and economic demand for US government debt? On this episode, we talked to Ira Jersey, the chief US interest rate strategist at Bloomberg Intelligence, for a crash course in what drives the bond market in both the short and long terms. Read more: The Bond Investors Who Got Trump to Pause His Tariffs US Bonds Rally as Fed’s Hammack Revives Odds of a June Rate Cut Only Bloomberg - Business News, Stock Markets, Finance, Breaking & World News subscribers can get the Odd Lots newsletter in their inbox each week, plus unlimited access to the site and app. Subscribe at bloomberg.com/subscriptions/oddlots

See omnystudio.com/listener for privacy information.

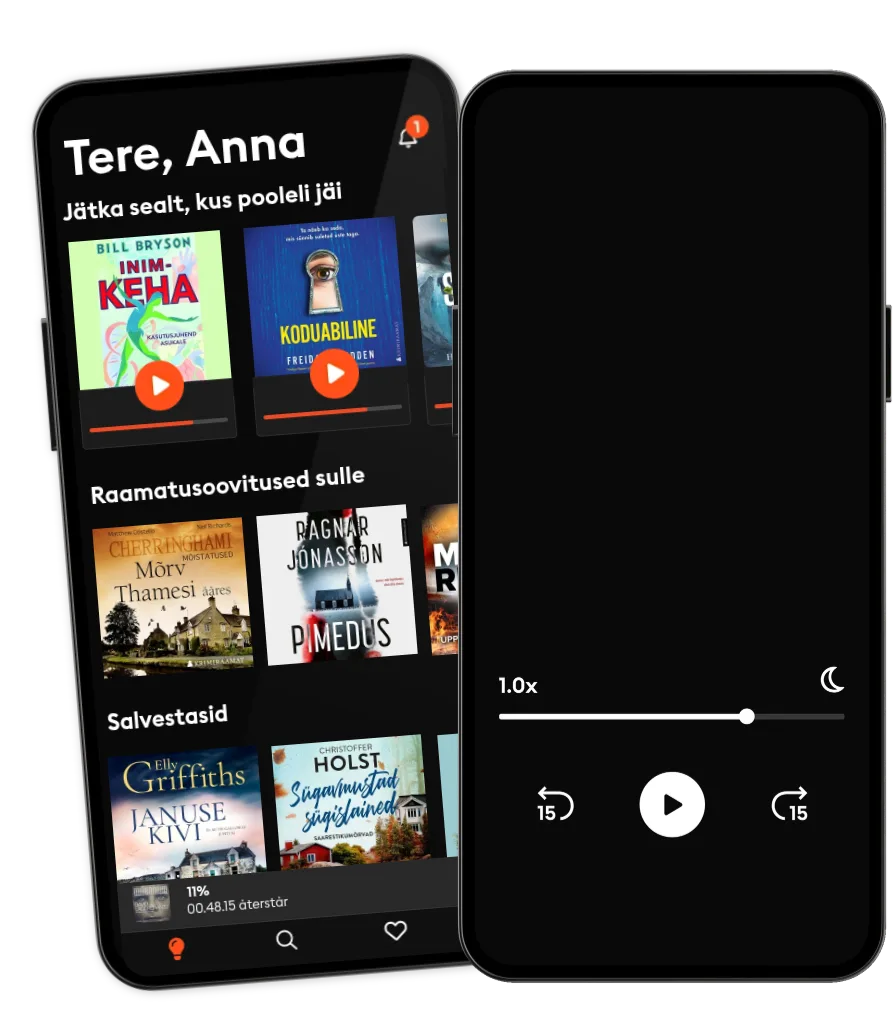

Loe ja kuula

Astu lugude lõputusse maailma

- Suurim valik eestikeelseid audio- ja e-raamatuid

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Lihtne igal ajal tühistada

Muud podcastid, mis võivad sulle meeldida ...

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Angel One (formerly known as Angel Broking)Angel One (formerly Known as Angel Broking)

Eesti

Eesti