Amundi Tips AT1s in ‘Goldilocks’ View; Shipping Focus

- Autor

- Osa

- 63

- Avaldatud

- 4. apr 2024

- Kirjastaja

- 0 Hinnangud

- 0

- Osa

- 63 of 145

- Kestus

- 44 min

- Keel

- inglise

- Vorming

- Kategooria

- Majandus ja ettevõtlus

Europe’s largest asset manager, Amundi, expects Additional Tier 1 bank bonds to extend gains in what it sees as a broadly positive market for corporate debt. “We’re obviously in this kind of Goldilocks scenario, I think, where the central bank put remains on the table,” Steven Fawn, head of global credit at Amundi Asset Management, tells Bloomberg News’ James Crombie and Bloomberg Intelligence’s Stephane Kovatchev. “Sub-debt is one part of the market which we like,” Fawn says in the latest Credit Edge podcast, referring to subordinated bonds, including bank AT1s. In addition, the portfolio manager discusses Amundi’s macroeconomic outlook, fund flows and positioning by industry sector and ratings tier. Also in this episode, BI’s Kovatchev analyzes the impact of the Baltimore bridge collapse on the global supply chain.

See omnystudio.com/listener for privacy information.

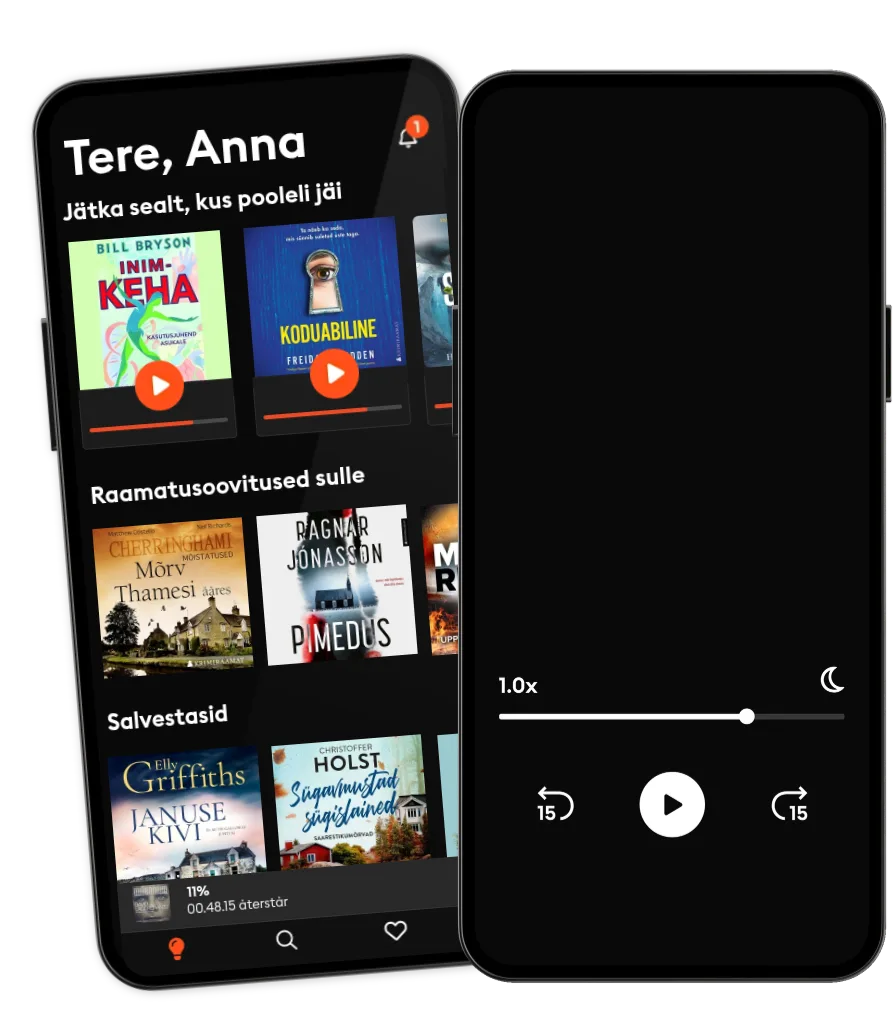

Loe ja kuula

Astu lugude lõputusse maailma

- Suurim valik eestikeelseid audio- ja e-raamatuid

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Lihtne igal ajal tühistada

Muud podcastid, mis võivad sulle meeldida ...

- Lisatulu podcastLisatulu podcast

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Lisatulu podcastLisatulu podcast

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

Eesti

Eesti