Junk Spreads Are Too Tight, Says Loomis; iHeart Focus

- Autor

- Osa

- 61

- Avaldatud

- 21. märts 2024

- Kirjastaja

- 0 Hinnangud

- 0

- Osa

- 61 of 145

- Kestus

- 42 min

- Keel

- inglise

- Vorming

- Kategooria

- Majandus ja ettevõtlus

Credit investors aren’t getting enough compensation for corporate credit risk, says Matthew Eagan, a portfolio manager and head of the full discretion team at Loomis Sayles & Co. “Judging from the spread levels, I think they’ve gone a bit too far,” Eagan tells Bloomberg News’ Lisa Lee and James Crombie and Bloomberg Intelligence’s Stephen Flynn in the latest Credit Edge podcast. He sees investment grade debt as an opportunity, given decent corporate earnings and the fact that debt costs are mostly locked in. Loomis likes BBB rated debt, as well as bonds issued by banks and media companies. Eagan also says ongoing concern about commercial real estate risk is not likely to hurt major banks, and should remain contained to smaller institutions. Also in this episode, BI’s Flynn analyzes improving credit prospects at Paramount Global and predicts a US election boost for iHeartMedia.

See omnystudio.com/listener for privacy information.

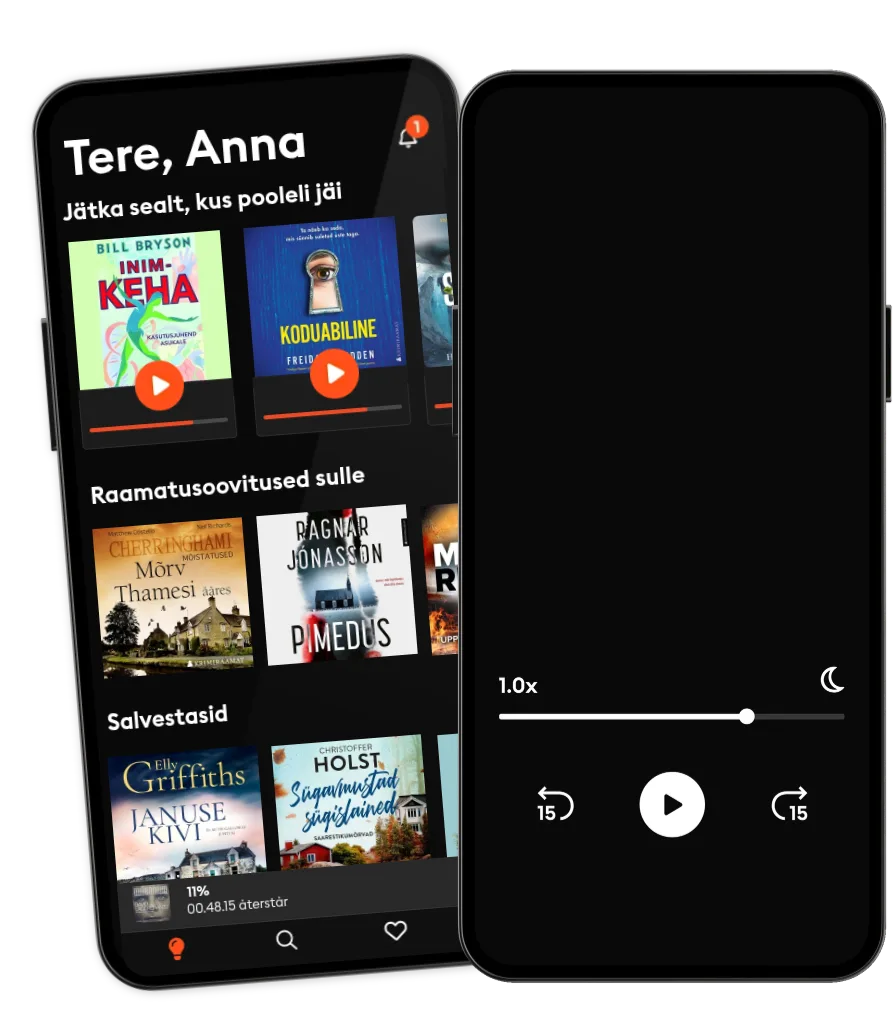

Loe ja kuula

Astu lugude lõputusse maailma

- Suurim valik eestikeelseid audio- ja e-raamatuid

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Lihtne igal ajal tühistada

Muud podcastid, mis võivad sulle meeldida ...

- Lisatulu podcastLisatulu podcast

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

- Lisatulu podcastLisatulu podcast

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- HW News Business Tit-BitsHW News Network

- HW News Business HeadlinesHW News Network

- DREAMERS, DISRUPTORSThe Quint and Bloomberg Quint

Eesti

Eesti