How to avoid foreseeable blind spots

- Autor

- Osa

- 139

- Avaldatud

- 25. jaan 2018

- Kirjastaja

- 0 Hinnangud

- 0

- Osa

- 139 of 1247

- Kestus

- 7 min

- Keel

- inglise

- Vorming

- Kategooria

- Majandus ja ettevõtlus

Sometimes the best trades are the ones that you don't enter. I know this might sound cute, but entering orders around big announcements can be a big gamble. Consider how you feel around trading the EIA, API, NOPA Crush numbers, quarterly earning announcements, and the FOMC announcements. Are you keeping orders on the book or do you lift them? Is part of the payoff the excitement around the trade ? Lift the orders around these moments of uncertainly. If you're trading options, that's a different story. I don't think it's a good idea to make your bones trying to trade announcements as a strategy. Allocators won't know how you can model this in a way that has high expected values, and in today's world, low daily volatility. Cancel existing orders around the releasing of key data points. I'm not saying to offset existing positions.

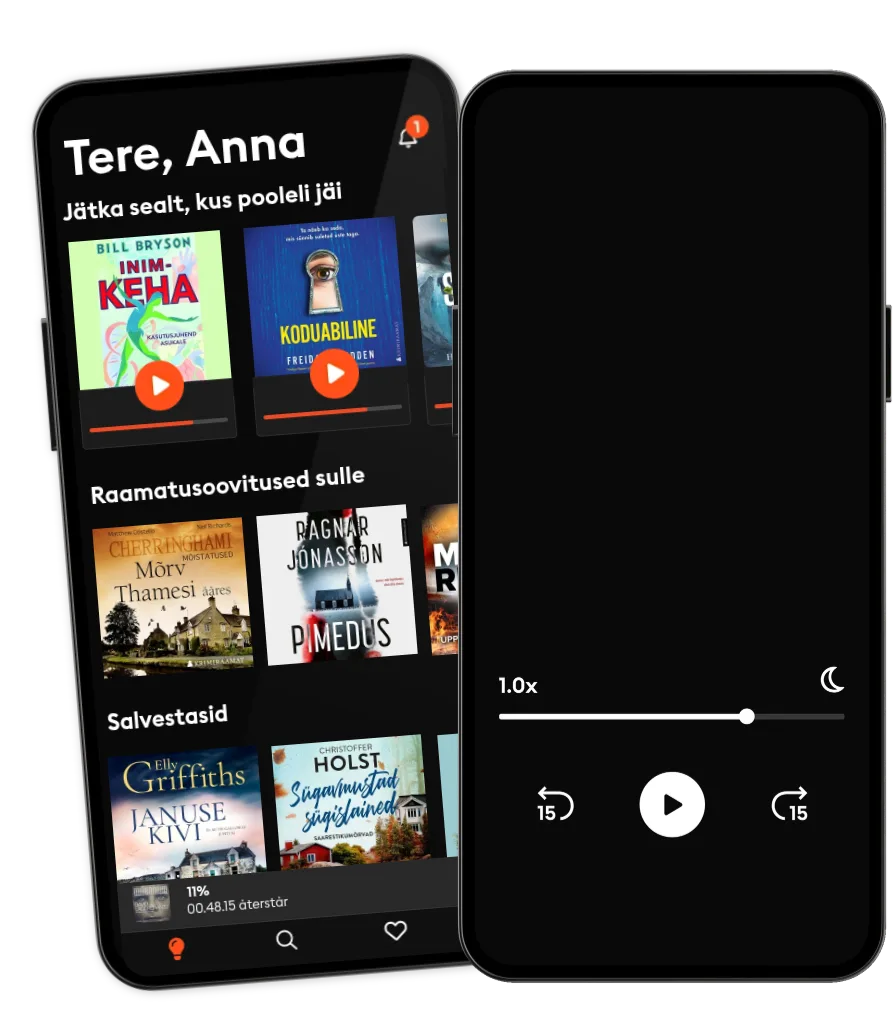

Loe ja kuula

Astu lugude lõputusse maailma

- Suurim valik eestikeelseid audio- ja e-raamatuid

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Lihtne igal ajal tühistada

Muud podcastid, mis võivad sulle meeldida ...

- Motley Fool MoneyThe Motley Fool

- The Jordan Harbinger ShowJordan Harbinger

- On Purpose with Jay ShettyiHeartPodcasts

- Lisatulu podcastLisatulu podcast

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- Motley Fool MoneyThe Motley Fool

- The Jordan Harbinger ShowJordan Harbinger

- On Purpose with Jay ShettyiHeartPodcasts

- Lisatulu podcastLisatulu podcast

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

Eesti

Eesti