How to own revenge trading

- Autor

- Osa

- 161

- Avaldatud

- 27. veebr 2018

- Kirjastaja

- 0 Hinnangud

- 0

- Osa

- 161 of 1247

- Kestus

- 8 min

- Keel

- inglise

- Vorming

- Kategooria

- Majandus ja ettevõtlus

Has this every happened to you? You're in a great trade, you have unrealized gains, and you're feeling good about your execution. You're about to add to your winner, when the market craps the bed and takes the entire market down so that your gains are wiped out in less than an hour. Worse, the market rebounds entirely over the next few days as you watch your former position rally to new highs. Do you chase it? Not a good idea. Getting back in because you're angry is another form of revenge trading. If you don't have a bona fide rule for re-entering such a trade, consider looking at reversal patterns. If your market sells off with the overall market, but rebounds, it might show up as a reversal pattern. A good one to start with is Victor Sperandeo's "2B Reversal" as depicted in his book "Methods of a Wall St. Master." You can trade this as a chart pattern or code it into your systematized rules.

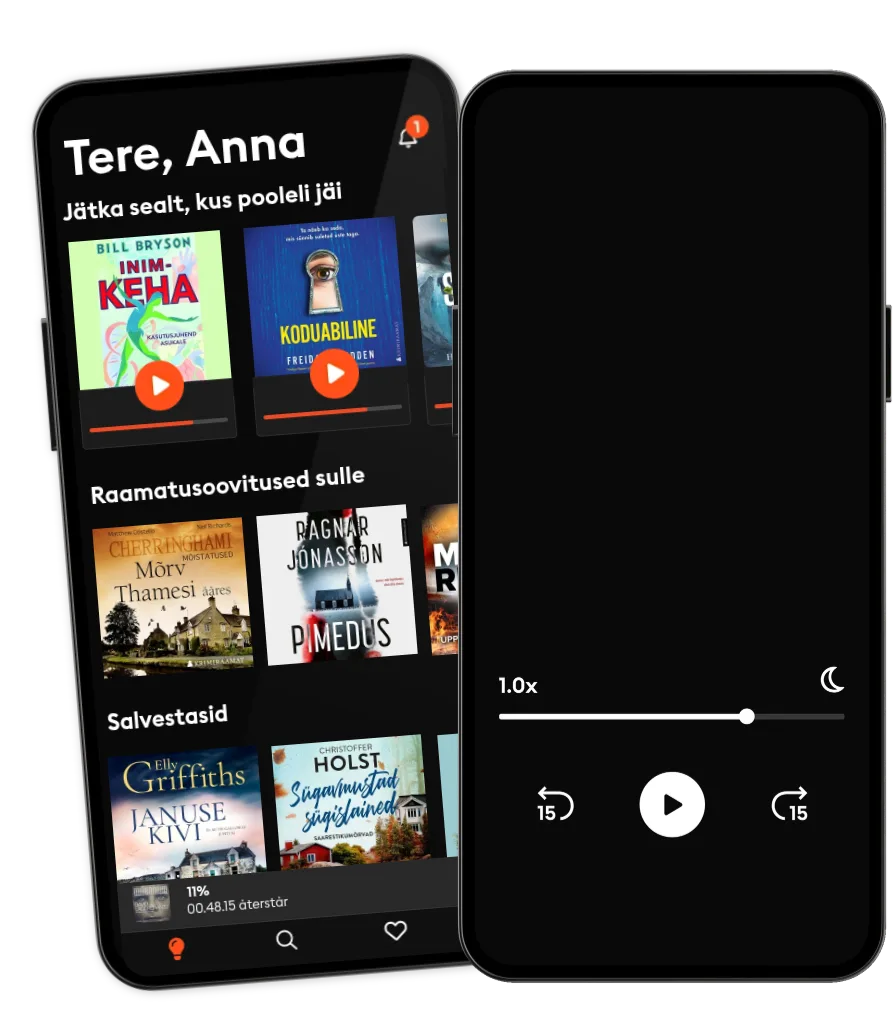

Loe ja kuula

Astu lugude lõputusse maailma

- Suurim valik eestikeelseid audio- ja e-raamatuid

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Lihtne igal ajal tühistada

Muud podcastid, mis võivad sulle meeldida ...

- Motley Fool MoneyThe Motley Fool

- The Jordan Harbinger ShowJordan Harbinger

- On Purpose with Jay ShettyiHeartPodcasts

- Lisatulu podcastLisatulu podcast

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

- Motley Fool MoneyThe Motley Fool

- The Jordan Harbinger ShowJordan Harbinger

- On Purpose with Jay ShettyiHeartPodcasts

- Lisatulu podcastLisatulu podcast

- Business WarsWondery

- The Journal.The Wall Street Journal & Spotify Studios

- Lutz & Jasper powered by Cherry VenturesCherry Ventures

- The Punekar PodcastIdeabrew Studios

- The Can Do WayTheCanDoWay

- HW News Editorial with Sujit NairHW News Network

Eesti

Eesti