- Språk

- Engelsk

- Format

- Kategori

Historie

Please note: This is a companion version & not the original book.

Book Preview:

#1 Income taxes are a cost that reduces the amount of money suppliers receive for selling a product. This necessarily makes supply go down. A tax lowers a buyer’s interest in buying, and the squeeze on profit margins from a tax makes producers sour on their own enterprises.

#2 The US income tax is an effective wealth tax that reduces supply and makes people lose interest in their own companies. It is a cost that reduces the amount of money suppliers receive for selling a product, and this necessarily makes supply go down.

#3 The focus on the top rate of the income tax and those subject to it, the richest people, is because these people are especially determined to avoid paying that top rate.

#4 The Sixteenth Amendment to the Constitution ratified in 1913, with its provision that Congress shall have power to lay and collect taxes on incomes, from whatever source derived, established the modern US income tax.

© 2022 IRB Media (E-bok): 9798350039337

Utgivelsesdato

E-bok: 7. oktober 2022

Andre liker også ...

- Summary of Bob Goff's Everybody Always IRB Media

- Instagram Moms are Full of Sh*t Lesley Prosko

- Summary of W. Phillip Keller's A Shepherd Looks at Psalm 23 IRB Media

- Negotiate Like a Pro: Secrets to Unleashing Your Winning Edge: "Elevate your negotiation skills! Unlock powerful audio lessons for mastering every deal with confidence." Ronan Ashcroft

- Easily Cope with Stress: Relieve Stress Effectively and Feel More Centered with Meditation Elizabeth Snow

- Lysets rustning - Del 1 Ken Follett

4.5

- Brent Jane Casey

3.9

- Jakten på en serieovergriper Anne-Britt Harsem

4.8

- Lysets rustning - Del 2 Ken Follett

4.3

- Mordkoden Helge Thime-Iversen

4.1

- Oppgjør Jane Casey

4.2

- Skriket Jan-Erik Fjell

4.2

- Skyggeadvokaten Eva J. Stensrud

4.5

- Mine drømmers land Merice Briffa

4.2

- Veien over klippene Gøril Emilie Hellen

4.3

- Jordmoren i Auschwitz Anna Stuart

4.8

- Herr Knapps uforrettede saker Lars Saabye Christensen

4.2

- Mormor danset i regnet Trude Teige

4.5

- 25 konspirasjoner å snakke om i lunsjen Bjørn-Henning Ødegaard

4.2

- Atlas - Historien om Pa Salt Lucinda Riley

4.7

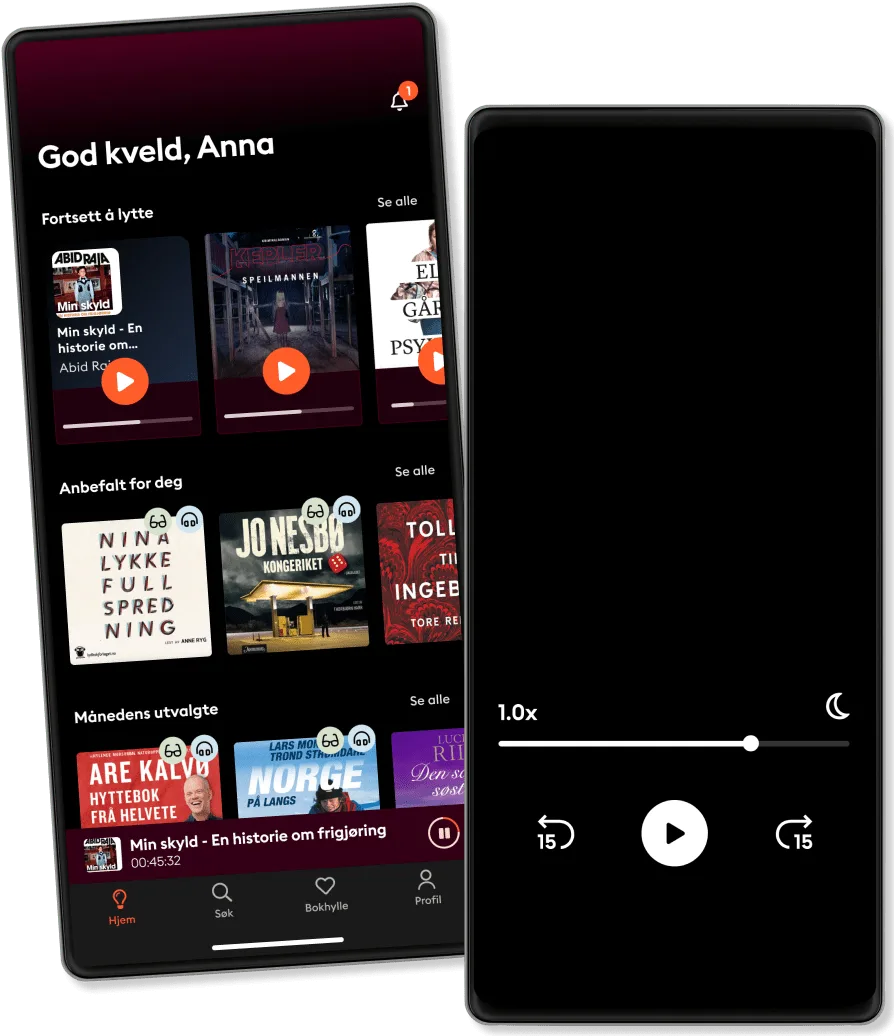

Derfor vil du elske Storytel:

Over 700 000 bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

1 konto

Ubegrenset lytting

Lytt så mye du vil

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

2-3 kontoer

Ubegrenset lytting

Lytt så mye du vil

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

2 kontoer

289 kr /månedBasic

For deg som lytter og leser av og til.

1 konto

20 timer/måned

Lytt opp til 20 timer per måned

Over 700 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Lytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge