- Språk

- Engelsk

- Format

- Kategori

Økonomi og ledelse

Please note: This is a companion version & not the original book. Book Preview:

#1 Investing is about forecasting returns. It is hard to call yourself an investor if you don’t think you have insights about expected returns. There are many ways to estimate expected returns, from fundamental to quantitative approaches and everything in between.

#2 The challenge of combining fundamental and quantitative approaches is how to marry them. I will make suggestions in this chapter.

#3 The capital asset pricing model is a basic way to estimate expected returns for investors. It links expected returns to an objective measure of risk and current interest rate levels. However, there are issues with the model.

#4 The Capital Asset Pricing Model is a theory that was developed to explain the relationship between risk and return, but it has been criticized for its flaws. It was developed by Nobel Prize winners William Sharpe and John Markowitz, but many academics have argued that it is flawed.

© 2022 IRB Media (E-bok): 9798822514874

Utgivelsesdato

E-bok: 12. mai 2022

Tagger

Andre liker også ...

- Jordmoren i Auschwitz Anna Stuart

4.8

- Jakten på en serieovergriper Anne-Britt Harsem

4.8

- Skriket Jan-Erik Fjell

4.2

- Hushjelpen Freida McFadden

4.4

- Alle mine barn, kom hjem May Lis Ruus

3.9

- Aldri være trygg May Lis Ruus

4.3

- Fare, fare, krigsmann May Lis Ruus

4.3

- Ta den ring og la den vandre May Lis Ruus

4.2

- Mirakelkuren Harlan Coben

4

- Sydney i fare Clive Cussler

4.4

- Slinger i brudevalsen Carole Matthews

3.6

- Jævla menn Andrev Walden

4.3

- Markens grøde Knut Hamsun

4.8

- Hushjelpens hemmelighet Freida McFadden

4.3

- Sannhetens øyeblikk Kristin Hannah

4.5

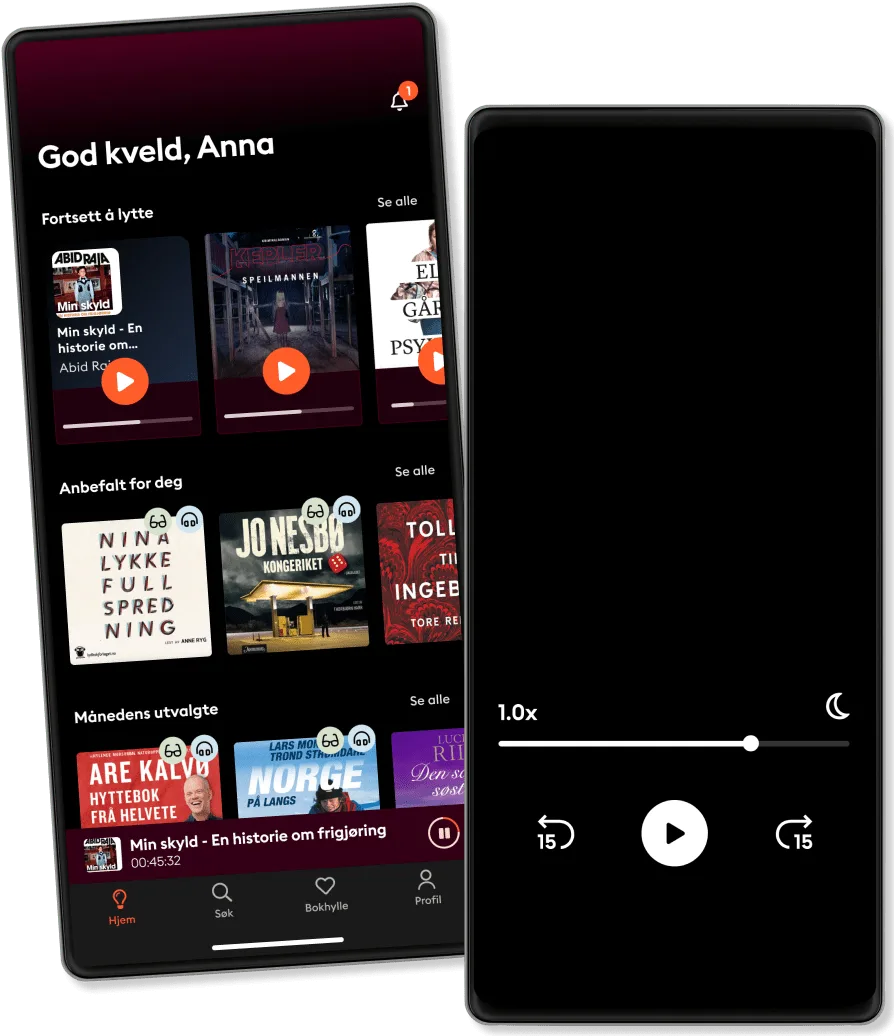

Derfor vil du elske Storytel:

Over 900 000 lydbøker og e-bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

1 konto

Ubegrenset lytting

Lytt så mye du vil

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

2-3 kontoer

Ubegrenset lytting

Lytt så mye du vil

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

2 kontoer

289 kr /månedPremium

For deg som lytter og leser ofte.

1 konto

50 timer/måned

Lytt opptil 50 timer per måned

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Basic

For deg som lytter og leser av og til.

1 konto

20 timer/måned

Lytt opp til 20 timer per måned

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Lytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge