The Age of Deleveraging: Investment Strategies for a Decade of Slow Growth and Deflation

- Av

- Med

- Forlag

- Spilletid

- 19T 34M

- Språk

- Engelsk

- Format

- Kategori

Økonomi og ledelse

While many investors fear a rapid rise in inflation, Gary Shilling argues they should be really preparing for the opposite: an extended period of falling prices. A top economist with a superb forecasting record, Shilling asserts that slow global growth; increased consumer spending; and efficiencies created by technology will lead to falling prices throughout the economy in the years ahead. As a result, many investments will suffer, including real estate, commodities, and most stocks. In The Deflation Beating Portfolio, Shilling says that investors should invest in Treasury bonds, utilities, consumer staples, and some dividend paying stocks. And investors should avoid commodity, automotive, and consumer durable stocks; precious metals; and real estate. The book will provide an overview of the U.S. economy since the 1960s juxtaposed against Shillings forecasts demonstrating that Shilling has been generally right about major economic trends since he began forecasting in the early 1980s. Shilling then will lay out a convincing case why investors need to be prepared for deflation not inflation in the years ahead.

© 2020 Ascent Audio (Lydbok): 9781663706959

Utgivelsesdato

Lydbok: 20. juli 2020

Tagger

Andre liker også ...

- Corner Grocery Store Principles: Seven Family Business Principles That Will Create Customers For Life Joe Mangiaracina

- The Opportunity Index: A Solution-Based Framework to Dismantle the Racial Wealth Gap Gavin Lewis

- Creating Business Agility: How Convergence of Cloud, Social, Mobile, Video, and Big Data Enables Competitive Advantage Rodney Heisterberg

- Income Generating Solutions: How to Create a River of Extra Cash Flow! John Cummuta

- Ending Checkbox Diversity: Rewriting the Story of Performative Allyship in Corporate America Dannie Lynn Fountain

- Successful Black Entrepreneurs: Hidden Histories, Inspirational Stories, and Extraordinary Business Achievements Steven Rogers

- Money for Tomorrow: How to Build and Protect Generational Wealth Whitney Elkins-Hutten

- Fundamentals of Credit and Credit Analysis: Corporate Credit Analysis Arnold Ziegel

- Get Scrappy: Smarter Digital Marketing for Businesses Big and Small Nick Westergaard

- If You Build It Will They Come?: Three Steps to Test and Validate Any Market Opportunity Rob Adams

- Marketing in the Participation Age : A Guide to Motivating People to Join, Share, Take Part, Connect and Engage: A Guide to Motivating People to Join, Share, Take Part, Connect, and Engage Daina Middleton

- Next Level Nonprofit: Build A Dream Team + Increase Lasting Impact Dr. Chris Lambert

- Finding the Uncommon Deal: A Top New York Lawyer Explains How to Buy a Home For the Lowest Possible Price Adam Leitman Bailey

- NOT Accountable: Rethinking the Constitutionality of Public Employee Unions Philip K. Howard

- 609 Letters Templates & Credit Repair Secrets Bradley Caulfield

- Positively Geared Lloyd Edge

- The Benevolent Dictator: Empower Your Employees, Build Your Business, and Outwit the Competition Michael Feuer

- Streetsmart Financial Basics for Nonprofit Managers: 4th Edition Thomas A. McLaughlin

- Jolt!: Get the Jump on a World That's Constantly Changing Phil Howard Cooke

- At the Speed of Irrelevance: How America Blew Its AI Leadership Position and How to Regain It, 1st Edition Al Naqvi

- Option Trading: A complete guide with strategies to start making money and become a successful investor Steve Diamond

- Real Estate Deal Maker: Winning Strategies to Find and Finance Successful Rental Properties in Any Market Henry Washington

- Improve Your Memory: A Guide to Increasing Brain Power Using Advanced Techniques and Methods David Spencer

- Blogging for Profit: Earn Passive Income and Reach Financial Freedom Using your Blog as a Money Maker Lucas Lee

- Principles of Real Estate Practice in Michigan: 2nd Edition Stephen Mettling

- The Entrepreneur's Journey: 8 Steps from Inspiration to Global Impact Alon Braun

- The Offsite: A Leadership Challenge Fable Robert H. Thompson

- Selling Beyond Your Own Style Jennifer Sedlock

- Don’t Spread the Wealth: How to Leverage the Family Banking System to Own All the Gold, Make the Rules, and Enjoy Generational Riches Richard Canfield

- Stop Guessing: The 9 Behaviors of Great Problem Solvers Nat Greene

- The #ArtOfTwitter: A Twitter Guide with 114 Powerful Tips for Artists, Authors, Musicians, Writers, and Other Creative Professionals Daniel Parsons

- Accounting: Figuring out Financial Risks, Obligations, and Opportunities Gerard Howles

- Skills for Career Success: Maximizing Your Potential at Work Elaine Biech

- The Tradeshow Chronicles: Everything you need to succeed at exhibitions in a unique novel Julien Rio

- The Power of Evolved Leadership: Inspire Top Performance by Fostering Inclusive Teams Stephen Young

- Healthy Leadership for Thriving Organizations: Creating Contexts Where People Flourish Justin A. Irving

- Tax-Savvy Solo: Smart Strategies for Solo Entrepreneurs Well-Being Publishing

- PreachersNSneakers: Authenticity in an Age of For-Profit Faith and (Wannabe) Celebrities Benjamin Kirby

- AIRBNB, SHORT & TOURIST RENTALS: More Strategy To Earn Your Property And Make Money With Airbnb,Short And Tourist Rentals A Fast And Simple Business In Real Estate. MARK AUKLUND

- Let's Close a Deal: Turn Contacts into Paying Customers for Your Company, Product, Service or Cause Christine Clifford

- Unleashing the Power of IT: Bringing People, Business, and Technology Together Dan Roberts

- Augment It: How Architecture, Engineering and Construction Leaders Leverage Data and Artificial Intelligence to Build a Sustainable Future Mehdi Nourbakhsh PhD.

- Teetering: Why So Many Live On A Financial Tightrope And What To Do About It Ken Rees

- Business Productivity RWG Publishing

- Do Good: Embracing Brand Citizenship to Fuel Both Purpose and Profit Anne Bahr Thompson

- Infonomics: How to Monetize, Manage, and Measure Information as an Asset for Competitive Advantage Douglas B. Laney

- Make the Deal: Negotiating Mergers and Acquisitions Christopher S. Harrison

- Stock Market Investing And Trading For Beginners 3 Books In 1: How To Invest In Stocks, Index Funds, Oil, Gold, Bonds, Startup Businesses & Venture Deals Will Weiser

- Social Machines: How to Develop Connected Products That Change Customers' Lives Peter Semmelhack

- Work in the Future: The Automation Revolution

- Overload!: How Too Much Information is Hazardous to Your Organization Jonathan B. Spira

- The Golden Apple: Redefining Work-Life Balance for a Diverse Workforce Mason Donovan

- Constructive Finance: Insight into the world of Australian Construction Finance Daniel Holden

- World’s Best Bank: A Strategic Guide to Digital Transformation Robin Speculand

- Dealing with the Tough Stuff: How to Achieve Results from Key Conversations Alison Hill

- Exit Path: How to Win the Startup End Game Touraj Parang

- How to Make Money While you Sleep!: A 7-Step Plan for Starting Your Own Profitable Online Business Brett McFall

- Selling Like A Vendor Jerry More Nyazungu

- Money Shackles: The Breakout Guide to Alternative Investing Dutch Mendenhall

- Top 50 Cryptocurrency to Invest in 2022 and Beyond: A Highly-Researched Shortlist of the Best Cryptocurrencies to Invest in (Must for All Crypto Investors & Enthusiasts) Rik Riqueza

- How To Foretell All Prices: Being A Discourse On The Fundamentals For Forecasting Changes In Price According To Time. Nsingo

- Prosperity in The Age of Decline: How to Lead Your Business and Preserve Wealth Through the Coming Business Cycles Alan Beaulieu

- The Profit Secret: How to sell more at a higher margin Nick Baldock

- Unlocking the Code: Crack the Business Success Formula Sachin Naha

- Leveraging the Impact of 360-Degree Feedback, Second Edition John W. Fleenor

- Choice Not Chance: Rules for Building a Fierce Competitor Mike Krzyzewski

- How Product Managers Can Use Better Communication to Boost Sales: How Product Managers Can Use Communication Skills to Make Their Product a Success Dr. Jim Anderson

- Mixed: Embracing Complexity by Uncovering Your God-led Identity Eli Bonilla Jr.

- Jakten på en serieovergriper Anne-Britt Harsem

4.8

- Jordmoren i Auschwitz Anna Stuart

4.8

- Skriket Jan-Erik Fjell

4.2

- Hushjelpen Freida McFadden

4.4

- Alle mine barn, kom hjem May Lis Ruus

3.9

- Aldri være trygg May Lis Ruus

4.3

- Fare, fare, krigsmann May Lis Ruus

4.3

- Ta den ring og la den vandre May Lis Ruus

4.2

- Ektepakten Simona Ahrnstedt

3.9

- Befrielse og bedrag Eva J. Stensrud

4.6

- Markens grøde Knut Hamsun

4.8

- Ravnen Wilbur Smith

4.2

- Stormberget Liza Marklund

4

- Hushjelpens hemmelighet Freida McFadden

4.3

- Jævla menn Andrev Walden

4.4

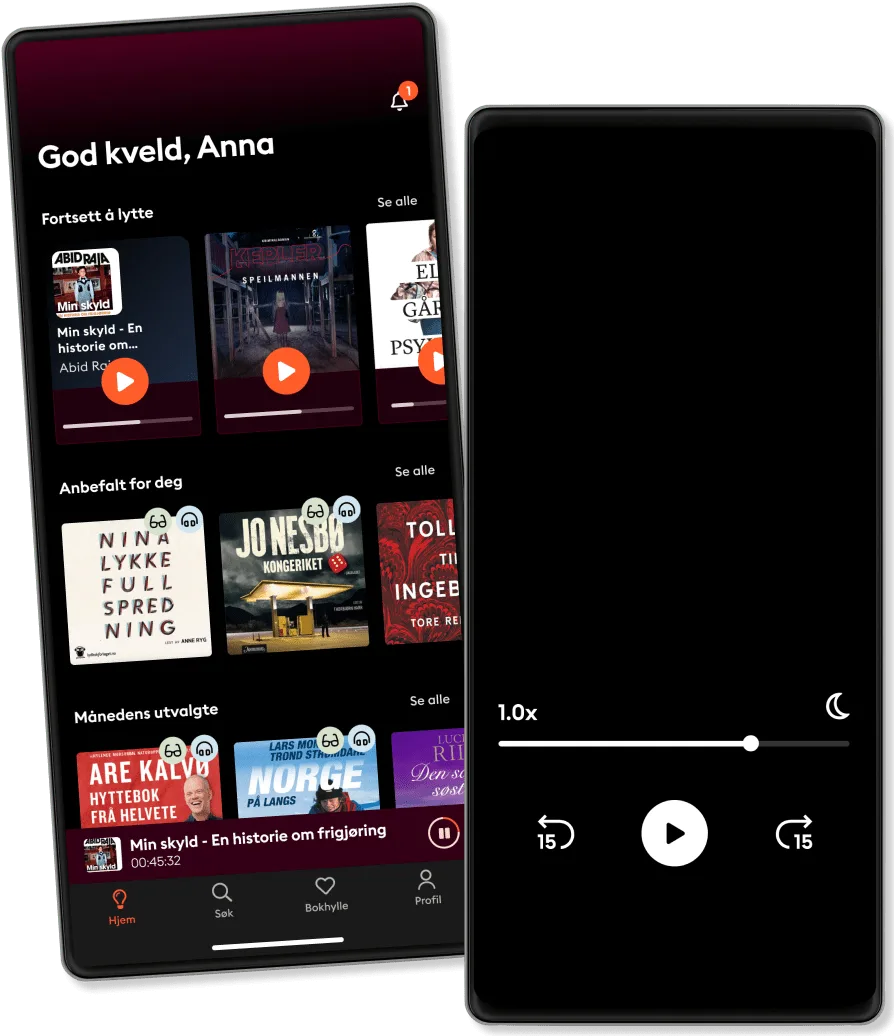

Derfor vil du elske Storytel:

Over 900 000 lydbøker og e-bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

219 kr /måned

Lytt så mye du vil

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

Fra 289 kr /måned

Lytt så mye du vil

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

289 kr /måned

Premium

For deg som lytter og leser ofte.

189 kr /måned

Lytt opptil 50 timer per måned

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Basic

For deg som lytter og leser av og til.

149 kr /måned

Lytt opp til 20 timer per måned

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Lytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge