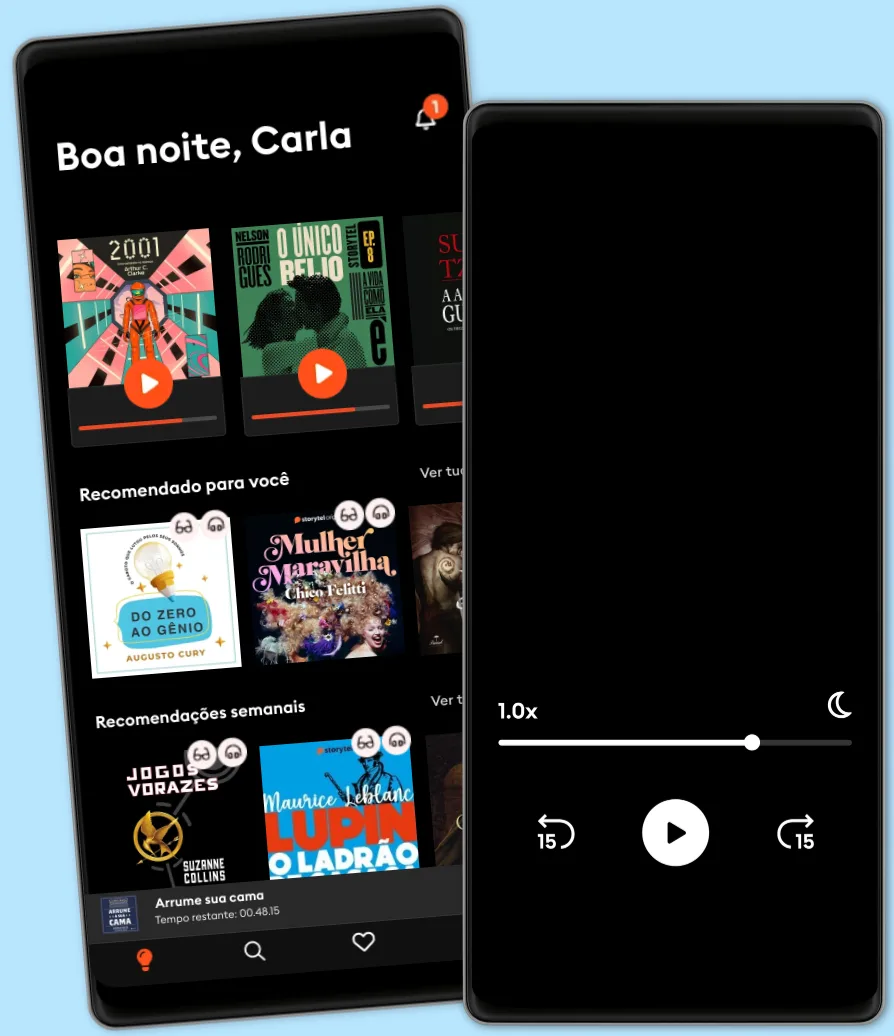

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

Investors and Markets: Portfolio Choices, Asset Prices, and Investment Advice

- por

- Editora

- Séries

3 of 2

- Idiomas

- Inglês

- Format

- Categoria

Economia & Negócios

In Investors and Markets, Nobel Prize-winning financial economist William Sharpe shows that investment professionals cannot make good portfolio choices unless they understand the determinants of asset prices. But until now asset-price analysis has largely been inaccessible to everyone except PhDs in financial economics. In this book, Sharpe changes that by setting out his state-of-the-art approach to asset pricing in a nonmathematical form that will be comprehensible to a broad range of investment professionals, including investment advisors, money managers, and financial analysts. Bridging the gap between the best financial theory and investment practice, Investors and Markets will help investment professionals make better portfolio choices by being smarter about asset prices.

Based on Sharpe's Princeton Lectures in Finance, Investors and Markets presents a method of analyzing asset prices that accounts for the real behavior of investors. Sharpe makes this technique accessible through a new, one-of-a-kind computer program (available for free on his Web site, at http://www.stanford.edu/~wfsharpe/apsim/index.html) that enables users to create virtual markets, setting the starting conditions and then allowing trading until equilibrium is reached and trading stops. Program users can then analyze the final portfolios and asset prices, see expected returns, and measure risk.

In addition to popularizing the most sophisticated form of asset-price analysis, Investors and Markets summarizes much of Sharpe's most important previous work and reflects a lifetime of thinking about investing by one of the leading minds in financial economics. Any serious investment professional will benefit from Sharpe's unique insights.

© 2011 Princeton University Press (Ebook): 9781400830183

Data de lançamento

Ebook: 1 de janeiro de 2011

Tags

Outros também usufruíram...

- Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway's Vice Chairman on Life, Business, and the Pursuit of Wealth With Commentary by David Clark David Clark

- The Intelligent Investor Benjamin Graham

- The Warren Buffett Stock Portfolio: Warren Buffett's Stock Picks: When and Why He Is Investing in Them Mary Buffett

- The Art of Value Investing: Essential Strategies for Market-Beating Returns John Heins

- 7 Secrets to Investing Like Warren Buffett Mary Buffett

- Asset Pricing Theory Costis Skiadas

- Rules for Investment Success: How to Make Money in Stocks Sir John Templeton

- The Little Book That Still Beats the Market Joel Greenblatt

- Learn to Earn: A Beginner's Guide to the Basics of Investing Peter Lynch

- A Random Walk Down Wall Street: Including a Life-Cycle Guide to Personal Investing Burton G. Malkiel

- The Intelligent Investor Rev Ed. Benjamin Graham

- Investment under Uncertainty Robert S. Pindyck

- Investment Basics Explained Introbooks Team

- In Pursuit of the Perfect Portfolio: The Stories, Voices, and Key Insights of the Pioneers Who Shaped the Way We Invest Andrew W. Lo

- Simply Invest Goh Yang Chye

- The Hedge Funds Book: How to Invest In Hedge Funds & Earn High Rates of Returns Safely Alan Northcott

- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market Peter Lynch

- John Neff on Investing John Neff

- The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit Aswath Damodaran

- Codes of Finance: Engineering Derivatives in a Global Bank Vincent Antonin Lépinay

- Mastering The Market Cycle: Getting the odds on your side Howard Marks

- The New Buffettology: How Warren Buffett Got and Stayed Rich in Markets Like This and How You Can Too! Mary Buffett

- The Little Book of Bulletproof Investing: Do's and Don'ts to Protect Your Financial Life Phil DeMuth

- Bogle on Mutual Funds: New Perspectives For The Intelligent Investor John C. Bogle

- Principles: Life and Work Ray Dalio

- The Big Secret for the Small Investor: The Shortest Route to Long-Term Investment Success Joel Greenblatt

- Warren Buffett's Ground Rules: Words of Wisdom from the Partnership Letters of the World's Greatest Investor Jeremy C. Miller

- Common Stocks and Common Sense: The Strategies, Analyses, Decisions, and Emotions of a Particularly Successful Value Investor Edgar Wachenheim

- The Little Book of Investing Like the Pros: Five Steps for Picking Stocks Josh Pearl

- Warren Buffett Speaks: Wit and Wisdom from the World's Greatest Investor Janet Lowe

- The Little Book Big Profits from Small Stocks + Website: Why You'll Never Buy a Stock Over $10 Again (Little Books. Big Profits) Hilary Kramer

- The Elements of Investing Charles D. Ellis

- Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition John C. Bogle

- The Triumph of Value Investing: Smart Money Tactics for the Post-Recession Era Janet Lowe

- Beating the Street: How to Use What You Already Know to Make Money in the Market Peter Lynch

- Financial Statements Thomas R. Ittelson

- Gamechanger Investing Hilary Kramer

- The Elements of Investing: Easy Lessons for Every Investor: Easy Lessons for Every Investor, Updated Edition Charles D. Ellis

- Return on Investment Crash Course Introbooks Team

- The Little Book of Behavioral Investing: How not to be your own worst enemy (Little Book, Big Profits) James Montier

- Stock Market Investing for Beginners & Dummies Giovanni Rigters

- Value Investing Introbooks Team

- Mathematical Techniques in Finance: Tools for Incomplete Markets - Second Edition Ales Cerný

- Artificial Intelligence for Asset Management and Investment: A Strategic Perspective Al Naqvi

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- Pratique o poder do "Eu posso" Bruno Gimenes

4.6

- O sonho de um homem ridículo Fiódor Dostoiévski

4.7

- Gerencie suas emoções Augusto Cury

4.5

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- 10 Maneiras de manter o foco James Fries

3.8

- Jogos vorazes Suzanne Collins

4.8

- A metamorfose Franz Kafka

4.4

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- Poder e Manipulação Jacob Petry

4.6

- A gente mira no amor e acerta na solidão Ana Suy

4.4

- A arte da guerra Sun Tzu

4.6

- A cantiga dos pássaros e das serpentes Suzanne Collins

4.5

- Os "nãos" que você não disse Patrícia Cândido

4.9

- Pare de Procrastinar: Supere a preguiça e conquiste seus objetivos Giovanni Rigters

4.3

Português

Brasil