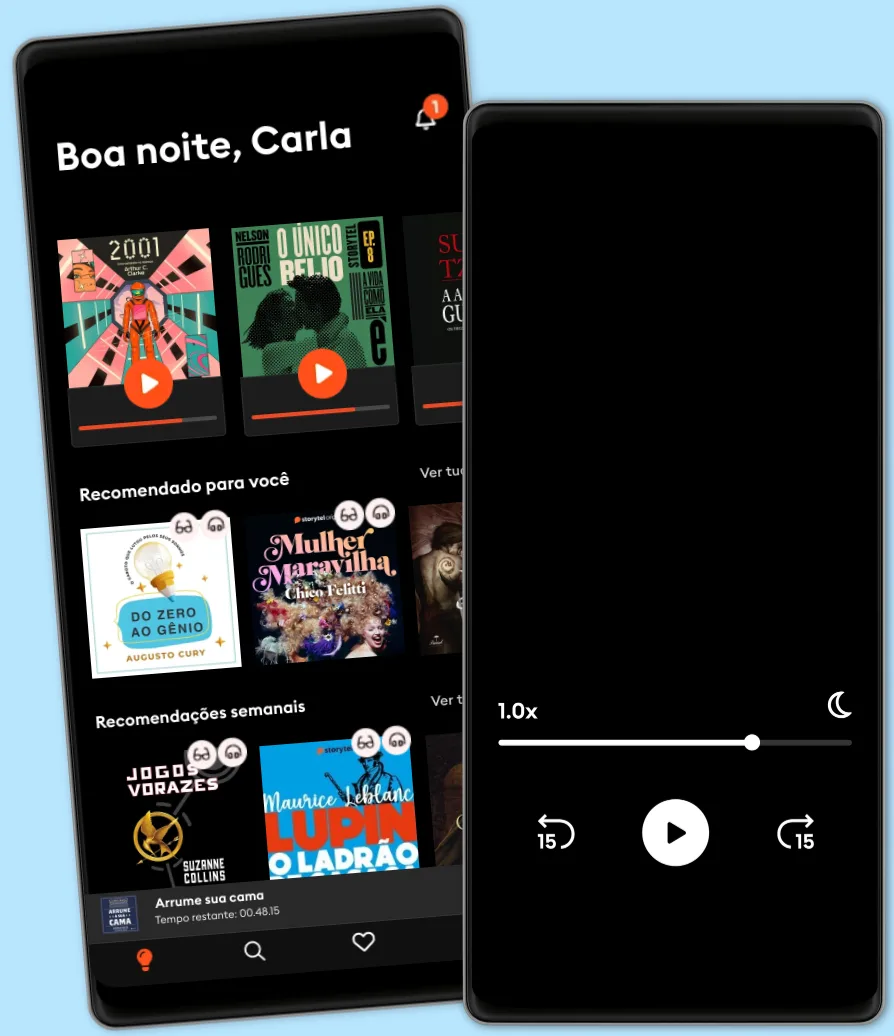

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

The Number That Killed Us: A Story of Modern Banking, Flawed Mathematics, and a Big Financial Crisis

- Por

- Com:

- Editor

- 1 Avaliações

4

- Duração

- 11H 1m

- Idioma

- Inglês

- Formato

- Categoria

Economia & Negócios

In the 1990s regulators and policy makers worried about the risk that financial institutions were carrying. Once the walls between investment and commercial banking came down with the repeal of Glass-Steagall, both trading and lending (and everything in between) were now housed under one roof with institutions freely accessing funds from one part of the institution to the other. But Glass-Steagall had just been repealed so how to fix the risk problem? Where there is a problem, there can usually be found an entrepreneur to give the market the product they want. And thus VAR was born and quickly embraced by financial institutions and regulators as the answer to managing risk. As long as an institutions VAR number was in an acceptable range, it could do what it wanted. Weren't we all safer now? As it turns out, the answer was No. The metric not only hid the iceberg lurking beneath the surface but allowed banks to pile on more and greater risk. Each bubble, mania, and crash that emerged in the intervening years became more pronounced, thanks to VAR.

In The Number That Killed Us, derivatives expert Pablo Triana takes readers through the development of VAR and shows how it was not only not a tool for accurately measuring risk but allowed banks to take on even greater risks. Embraced worldwide, VAR is just starting to be examined as problematic, led by a coterie of experts such as Nassim Taleb. VAR is a problem. Triana looks at it analytically and uncovers why and how it makes our financial world a more dangerous place.

© 2020 Tantor Media (Audiobook): 9781705262825

Data de lançamento

Audiobook: 20 de julho de 2020

Outros também usufruíram...

- Economic Warfare: Secrets of Wealth Creation in the Age of Welfare Politics Herman Cain

- Tech Monopoly: (The MIT Press Essential Knowledge series) Herbert Hovenkamp

- And Then the Roof Caved In: How Wall Street's Greed and Stupidity Brought Capitalism to Its Knees David Faber

- Debt, Deficits, and the Demise of the American Economy Jeff Cox

- The New Financial Deal: Understanding the Dodd-Frank Act and Its (Unintended) Consequences William D. Cohan

- Why The New Deal Matters Eric Rauchway

- Inside the Black Box : The Simple Truth About Quantitative Trading: The Simple Truth About Quantitative Trading Rishi K. Narang

- AI and the Future of the Public Sector: The Creation of Public Sector 4.0 Tony Boobier

- Corporatizing American Health Care: How We Lost Our Health Care System Robert W. Derlet

- The Money Revolution: How to Finance the Next American Century Richard Duncan

- The Knowledge Gene Lynne Kelly

- Beyond Banks: Technology, Regulation, and the Future of Money Dan Awrey

- Management Divided: Contradictions of Labor Management Matt Vidal

- Confessions of a Radical Tax Protestor: An Inside Expose of the Tax Resistance Movement Larry R. Williams

- Lombard Street: A Description of the Money Market Walter Bagehot

- The $10 Trillion Prize: Captivating the Newly Affluent in China and India Michael J. Silverstein

- Rigged Money: Beating Wall Street at Its Own Game Lee Munson

- The Servant Economy Jeff Faux

- The Midrange Theory: Basketball’s Evolution in the Age of Analytics Seth Partnow

- Rattiner’s Secrets of Financial Planning: From Running Your Practice to Optimizing Your Client's Experience Jeffrey H. Rattiner

- The Unintended Consequences of Technology: Solutions, Breakthroughs, and the Restart We Need Chris Ategeka

- The Great U.S.-China Tech War Gordon G. Chang

- Exchange-Traded Funds For Dummies Russell Wild

- The Land of Enterprise: A Business History of the United States Benjamin C. Waterhouse

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull Markets Craig Callahan

- Factor Investing For Dummies James Maendel, BFA

- The Anti-Oligarchy Constitution: Reconstructing the Economic Foundations of American Democracy William E. Forbath

- The Bombardier Story: From Snowmobiles to Global Transportation Powerhouse Larry MacDonald

- The Great American Bank Robbery: The Unauthorized Report About What Really Caused the Great Recession Paul Sperry

- The Immigrant Exodus: Why America Is Losing the Global Race to Capture Entrepreneurial Talent Vivek Wadhwa

- News and Democratic Citizens in the Mobile Era Johanna Dunaway

- Brilliant, Crazy, Cocky: How the Top 1% of Entrepreneurs Profit from Global Chaos Sarah Lacy

- The Making of a Democratic Economy: Building Prosperity for the Many, Not Just the Few Marjorie Kelly

- The Tyranny of Dead Ideas: Revolutionary Thinking for a New Age of Prosperity Matt Miller

- Long Hard Road: The Lithium-Ion Battery and the Electric Car Charles J. Murray

- Universal Basic Income: What Everyone Needs to Know® Matt Zwolinski

- Exile on Wall Street: One Analyst's Fight to Save the Big Banks from Themselves Mike Mayo

- Can Finance Save the World?: Regaining Power over Money to Serve the Common Good Bertrand Badré

- Defensive Security Handbook: Best Practices for Securing Infrastructure (2nd Edition) Amanda Berlin

- Our Fair Share: How One Small Change Can Create a More Equitable American Economy Brian C. Johnson

- Pratique o poder do "Eu posso" Bruno Gimenes

4.5

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- O sonho de um homem ridículo Fiódor Dostoiévski

4.7

- 10 Maneiras de manter o foco James Fries

3.8

- Gerencie suas emoções Augusto Cury

4.5

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- Os "nãos" que você não disse Patrícia Cândido

4.2

- A gente mira no amor e acerta na solidão Ana Suy

4.5

- A metamorfose Franz Kafka

4.4

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- Jogos vorazes Suzanne Collins

4.8

- A arte da guerra Sun Tzu

4.6

- Primeiro eu tive que morrer Lorena Portela

4.3

- talvez a sua jornada agora seja só sobre você: crônicas Iandê Albuquerque

4.5

- Pare de Procrastinar: Supere a preguiça e conquiste seus objetivos Giovanni Rigters

4.3

Português

Brasil