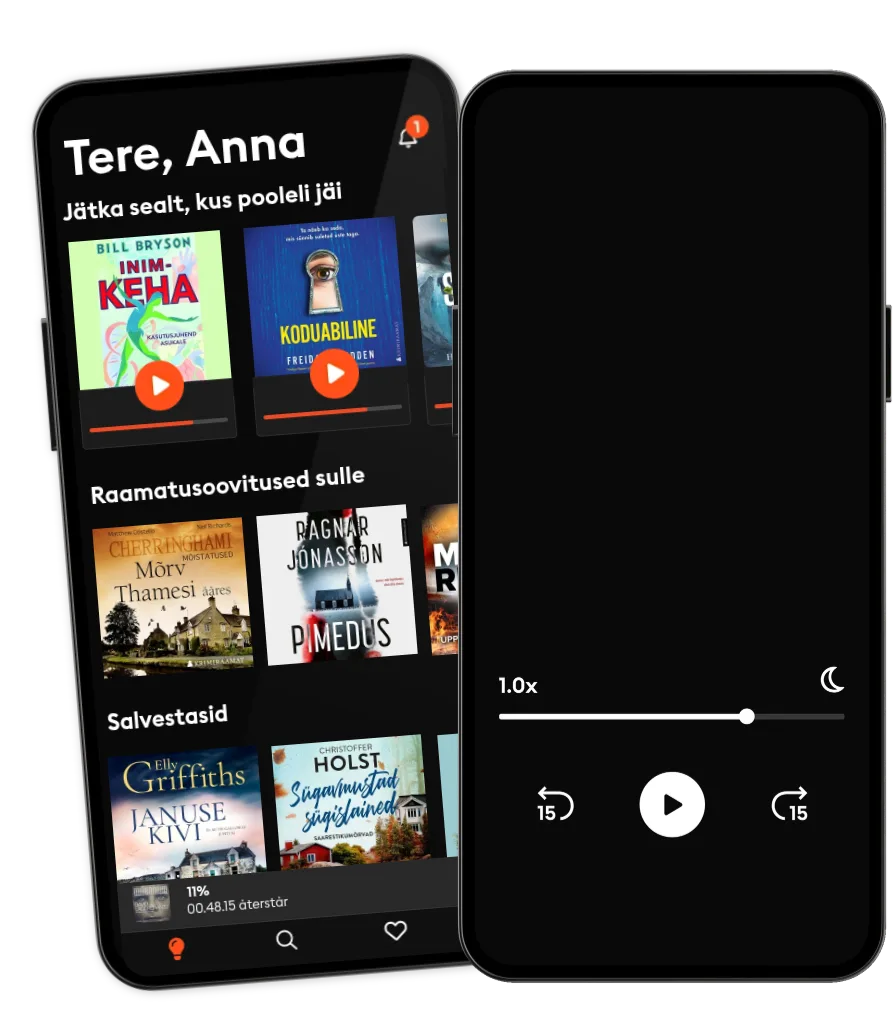

Loe ja kuula

Astu lugude lõputusse maailma

- Proovi tasuta

- Loe ja kuula nii palju, kui soovid

- Suurim valik eestikeelseid raamatuid

- Kokku üle 700 000 raamatu 4 keeles

Dividends Still Don't Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock Market

- Autor

- Esitaja

- Kirjastaja

- 3 hinnangut

4.3

- Kestus

- 5 h 31 min

- Keel

- inglise

- Vorming

- Kategooria

Majandus ja ettevõtlus

In 1988 Geraldine Weiss wrote the classic Dividends Don't Lie, which focuses on the Dividend Yield Theory as a method of producing consistent gains in the stock market. After the market crash of the late 1980's, the book was a large success. Investors were looking for safety and transparency, and dividends offered the yields investors desired. Despite the advent of new technologies and the ability of investors to access information on an unprecedented basis, the old school approach of using the dividend yield to identify values in blue chip stocks still outperforms most investment methods on a risk-adjusted basis. That is the primary purpose of writing Dividends Still Don't Lie. Written by Kelley Wright, Managing Editor of Investment Quality Trends, with a new foreword by Geraldine Weiss, this book teaches a value-based strategy to investing, one that uses a stock's dividend yield as the primary measure of value. Because price on its own, without other factors, means nothing, an investor must find some way to determine whether the price of any given company is high, low or just about what it should be. Even though most investors put their money in the market with the hope of reaping a good rate of return, the most tangible source of return, the dividend, is too often underemphasized in this process. According to the dividend-yield theory, the price of a stock is driven by its yield. When a stock offers a high dividend yield, investors will buy, which pushes the price up and gradually erodes the yield. When the yield falls, the stock is shunned, until an absence of demand allows its price to fall. It then descends to a price level at which, again, the yield is attractive to investors. So rather than emphasize the price cycles of a stock, the company's products, market strategy or other factors, this book stresses dividend-yield patterns. Investors will learn to buy and sell when dividend yields instruct them to do so. The dividend yield lets the investor know, with very little doubt, when a share's price is genuinely high, low or on the move between those two points.

© 2020 Ascent Audio (Audioraamat): 9781469083933

Väljaandmise kuupäev

Audioraamat: 20. juuli 2020

Sildid

- Kadunud sõrmuse mõistatus Ain Kütt

- Viimne vanne M. W. Craven

- Kahetsuse värv Colleen Hoover

- Billy Summers Stephen King

- Ikigai Francesc Miralles

- Asjad, millest me üle ei saa Lucy Score

- Sekt Camilla Läckberg

- Koduabiline Freida McFadden

4.5

- Mustmaja Peter May

- Kehakeemia: kuus elumuutvat ainet David JP Phillips

- Pulmarahvas Alison Espach

- Seltsimees laps Leelo Tungal

- Kadunud keskendumisvõime Johann Hari

- Teiste inimeste majad Clare Mackintosh

- Apteeker Melchior ja nõiutud kabel Indrek Hargla

5

- Eksitaja Viveca Sten

- Lumepimedus Matthew Costello

- Asjad, mida me varjame valguse eest Lucy Score

- Mustmaja Peter May

- Ükshaaval Freida McFadden

4

- Keelutsoon M. W. Craven

- Sulid ja sulased Timo Talvik

- Universaalse ajaloo kokkuvõte Valero Pujol

- Veenide raamat: Et oleks õnnelik, et oleks terve, et oleks õnnelik armastuses ja et võidaks hasartmängudes René Schwaeble

- Loodus räägib Kalevala Tero Kokko

- Kallim Freida McFadden

- Pulmarahvas Alison Espach

- Väike pagariäri Brooklynis Julie Caplin

- Karussell William Somerset Maugham

- Timukas Chris Carter

- Eksitaja Viveca Sten

- Ükshaaval Freida McFadden

4

- Keelutsoon M. W. Craven

- Sulid ja sulased Timo Talvik

- Loodus räägib Kalevala Tero Kokko

- Kallim Freida McFadden

- Pulmarahvas Alison Espach

- Väike pagariäri Brooklynis Julie Caplin

- Timukas Chris Carter

- Seitse imet Arne Dahl

- Rakel Satu Rämö

- Põgene, jänes, põgene Alex Smith

5

- Uus nimi. Septoloogia VI-VII Jon Fosse

- Hinnaline saak Christoffer Holst

- Sirelililla Marje Ernits

Vali pakett

Kokku üle 700 000 raamatu 4 keeles

Suur valik eestikeelseid raamatuid

Uusi raamatuid iga nädal

Kids Mode - lastesõbralik keskkond

Eesti

Eesti