Boom Bust

- 언어학습

- 영어

- 형식

- 컬렉션

경제/경영

In the two and a half years since the first edition appeared (April 2005), events have unfolded as predicted. Then the consensus among forecasters was that the boom in house prices would cool to an annual 2 or 3% rise over the following years. In fact, in keeping with the ‘winner’s curse’ phase of the cycle described by the author, prices rose by more than 10% per annum in Britain. Harrison’s first book, The Power in the Land, predicted the early 1990s recession. Boom Bust, warned that investing in property is not always a safe bet, because the housing market is subject to a sharp downturn at the end of a remarkably regular 18-year cycle. The crash of 2007/8 occurred exactly as predicted. His forecast was based on a careful study of the evidence from property markets in many countries over the last 200 years. Gordon Brown’s claim, last made in his 2007 Budget speech, that ‘we will never return to the old boom and bust’ has been proved false. The reason for the instability, Harrison explains, is not the housing market itself but the land market on which all buildings stand. Land is in fixed supply ‘ as Mark Twain noted: ‘They’re not making any more of it’. Therefore, as the demand for land for new homes and offices rises with population growth and economic expansion, market forces, which normally increase supply to reduce prices, have the reverse effect: prices rise. This encourages speculation, with banks lending more against escalating asset values and reinforcing the upward spiral. Under existing government policies, the only way land prices can be brought back to affordable levels is a slump, undermining the banking system and causing widespread unemployment and repossessions. This is exactly what happened in America with the collapse of the sub-prime mortgage market. The run on Northern Rock showed the UK economy is not immune. The author reveals that the government’s monetary policy only has a marginal impact on land speculation, but as the Bank of England raises interest rates to curb house price inflation, the main victim is the first-time buyer and the productive economy, especially small businesses. The only way to neutralise the boom bust cycle in the housing market is through a reform of taxation, he claims. ‘This book is an important contribution to an overdue debate.’ Martin Ricketts, Chairman of the Academic Advisory Council of the Institute of Economic Affairs and Professor of Economic Organisation, University of Buckingham. Endorsing the thrust of Harrison’s argument, Prof. Ricketts goes on to acknowledge ‘that insufficient attention has been given by policymakers to the rent of land as socially the most efficient source of public revenue’, and that that will ‘have important practical consequences … for the stability of the economic system’. Economic stability is the objective of Gordon Brown and most governments around the world. Harrison explains how this may be achieved.

© 2012 Shepheard Walwyn (Publishers) (전자책): 9780856833120

출시일

전자책: 2012년 8월 8일

다른 사람들도 즐겼습니다 ...

- 생각편의점 김쾌대, 카이

- 쓸 만한 인간 박정민

- 신기한 맛 도깨비 식당 1 김용세, 김병선

- 사춘기 대 갱년기 제성은

- 생각하는 대로 그렇게 된다 제임스 앨런(James Allen)

- 무작정 쇼트트랙 이재영

- 사춘기 대 아빠 갱년기 제성은

- 신기한 맛 도깨비 식당 3 김용세, 김병선

- 신기한 맛 도깨비 식당 2 김용세, 김병선

- 용선생 처음 세계사1: 고대 문명~중세: 고대 문명~중세 김선혜, 정지윤, 노남희, 뭉선생, 윤효식, 이우일, 김선빈, 사회평론 역사연구소

- 죽이고 싶은 아이 이꽃님

- 단톡방을 나갔습니다 2 신은영

- 수상한 기차역 박현숙

- 용선생 처음 세계사2 : 산업 혁명~현대 김선혜, 정지윤, 노남희, 뭉선생, 윤효식, 이우일, 김선빈, 사회평론 역사연구소

- 수상한 지하실 박현숙

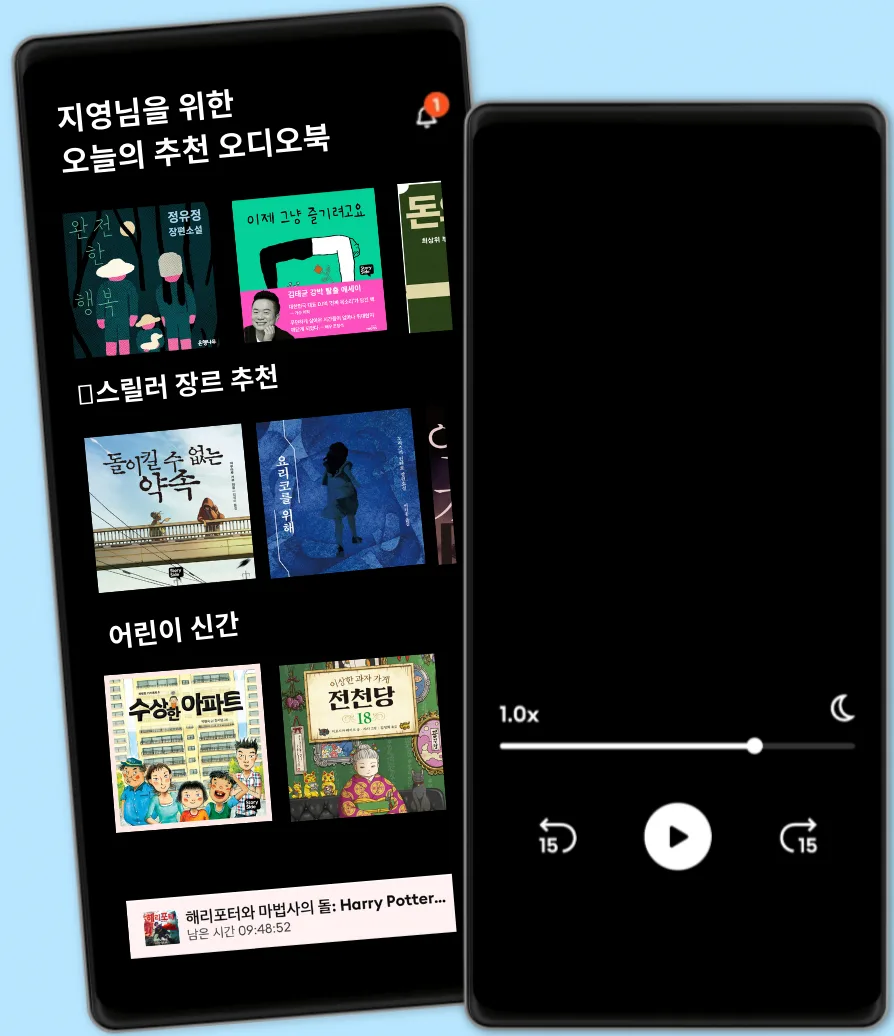

언제 어디서나 스토리텔

국내 유일 해리포터 시리즈 오디오북

5만권이상의 영어/한국어 오디오북

키즈 모드(어린이 안전 환경)

월정액 무제한 청취

언제든 취소 및 해지 가능

오프라인 액세스를 위한 도서 다운로드

스토리텔 언리미티드

5만권 이상의 영어, 한국어 오디오북을 무제한 들어보세요

13800 원 /월

사용자 1인

무제한 청취

언제든 해지하실 수 있어요

패밀리

친구 또는 가족과 함께 오디오북을 즐기고 싶은 분들을 위해

매달 21500 원 원 부터

2-3 계정

무제한 청취

언제든 해지하실 수 있어요

21500 원 /월