The Adaptive Markets Hypothesis: An Evolutionary Approach to Understanding Financial System Dynamics

- Av

- Med

- Forlag

- 1 anmeldelser

5

- Serier

1 av 1

- Spilletid

- 28T 1M

- Språk

- Engelsk

- Format

- Kategori

Økonomi og ledelse

The Adaptive Markets Hypothesis (AMH) presents a formal and systematic exposition of a new narrative about financial markets that reconciles rational investor behavior with periods of temporary financial insanity. In this narrative, intelligent but fallible investors learn from and adapt to randomly shifting environments. Financial markets may not always be efficient, but they are highly competitive, innovative, and adaptive, varying in their degree of efficiency as investor populations and the financial landscape change over time.

Andrew Lo and Ruixun Zhang develop the mathematical foundations of the AMH—a simple yet surprisingly powerful set of evolutionary models of behavior—and then apply these foundations to show how the most fundamental economic behaviors that we take for granted can arise solely through natural selection. Drawing on recent advances in cognitive neuroscience and artificial intelligence, the book also explores how our brain affects economic and financial decision-making.

This volume is a must-listen for anyone who has ever been puzzled and concerned by the behavior of financial markets and the implications for their personal wealth, and seeks to learn how best to respond to such behavior.

© 2024 Ascent Audio (Lydbok): 9781663727565

Utgivelsesdato

Lydbok: 28. mai 2024

Tagger

Andre liker også ...

- Blockchain and Web3: Building the Cryptocurrency, Privacy, and Security Foundations of the Metaverse Winston Ma

- Push Play: Gaming For a Better World SONGYEE YOON

- The Real Business of IT: How CIOs Create and Communicate Value George Westerman

- Results: Getting Beyond Politics to Get Important Work Done Charlie Baker

- The Power of Money: How Governments and Banks Create Money and Help Us All Prosper Paul Sheard

- The Brompton: Engineering for Change Dan Davies

- The Global Debt Trap: How to Escape the Danger and Build a Fortune Claus Vogt

- Country Capitalism: How Corporations from the American South Remade Our Economy and the Planet Bart Elmore

- Paper Money Collapse: The Folly of Elastic Money and the Coming Monetary Breakdown Detlev S. Schlichter

- The Big Pivot: Radically Practical Strategies for a Hotter, Scarcer, and More Open World Andrew Winston

- Stewardship: Lessons Learned from the Lost Culture of Wall Street John C. Bogle

- The Elements of Voice First Style: A Practical Guide to Voice User Interface Design Ahmed Bouzid

- Big Picture Economics: How to Navigate the New Global Economy Joel Naroff

- Your Data, Their Billions: Unraveling and Simplifying Big Tech Jane S. Hoffman

- Wordcraft: The Complete Guide to Clear, Powerful Writing Jack Hart

- Hidden Truths: What Leaders Need to Hear but are Rarely Told David Fubini

- Nanovation: How a Little Car Can Teach the World to Think Big and Act Bold Kevin Freiberg

- Inspired INC.: Become a Company the World Will Get Behind Nicole Howson

- Stephen Roach on the Next Asia: Opportunities and Challenges for a New Globalization Stephen S. Roach

- The End of Money: Counterfeiters, Preachers, Techies, Dreamers--and the Coming Cashless Society David Wolman

- We the Possibility: Harnessing Public Entrepreneurship to Solve Our Most Urgent Problems Mitchell Weiss

- Business to Diplomacy: The Complexity of Leadership Dr Andrew Campbell

- Zero-Sum Game: The Rise of the World's Largest Derivatives Exchange Erika S. Olson

- Reinventing the Supply Chain: A 21st-Century Covenant with America Jack Buffington

- Cyber Crisis: Protecting Your Business from Real Threats in the Virtual World Eric Cole

- Sustainably Investing in Digital Assets Globally Selva Ozelli

- Geopolitical Alpha: An Investment Framework for Predicting the Future Marko Papic

- Risk Parity: How to Invest for All Market Environments Alex Shahidi

- From Red To Black: A Short Journey From Debt To Liberty Chris Greenwood

- Human Being Ashkan Tashvir

- The Future of Us: The Science of What We'll Eat, Where We'll Live, and Who We'll Be Jay Ingram

- The Kaggle Book: Data analysis and machine learning for competitive data science Luca Massaron

- The Upside of Down: Why the Rise of the Rest is Good for the West Charles Kenny

- Software Architectures for Beginners: Navigating the Building Blocks of Modern Software Design Steve Abrams

- Optimal Money Flow: A New Vision of How a Dynamic-Growth Economy Can Work for Everyone Lawrence C. Marsh

- Present Future: Business, Science, and the Deep Tech Revolution Guy Perelmuter

- Kick Up Some Dust: Lessons on Thinking Big, Giving Back, and Doing It Yourself Bernie Marcus

- Gold, Oil and Avocados: A Recent History of Latin America in Sixteen Commodities Andy Robinson

- Being Online: On Computing, Data, the Internet, and the Cloud Jian Wang

- Winning Fixes Everything: How Baseball’s Brightest Minds Created Sports’ Biggest Mess Evan Drellich

- The Oxford Handbook of IPOs Douglas Cumming

- Converge: Transforming Business at the Intersection of Marketing and Technology Ray Velez

- Security Chaos Engineering: Sustaining Resilience in Software and Systems Aaron Rinehart

- Charging Ahead: GM, Mary Barra, and the Reinvention of an American Icon David Welch

- Unequals: The Power of Status and Expectations in our Social Lives

- Get in Gear: The Seven Gears that Drive Strategy to Results Sean T. Ryan

- How to Interpret the Constitution Cass R. Sunstein

- Failure to Disrupt: Why Technology Alone Can’t Transform Education Justin Reich

- My Journeys in Economic Theory Edmund Phelps

- Chaos is a Gift: Leading Oneself in Times of Uncertain and Complex Environment Dr Andrew Campbell

- Big Tech and the Digital Economy: The Moligopoly Scenario Nicolas Petit

- Unequal: How extreme inequality is damaging democracy and what we can do about it David Buckham

- Money and Promises: A History of the World in Seven Deals Paolo Zannoni

- The Universe Next Door, Sixth Edition: A Basic Worldview Catalog James W Sire

- Dreams That Built America: Inspiring Stories of Grit, Purpose, and Triumph Alan Elliott

- Quantum Care: A Deep Dive into AI for Health Delivery and Research Rohit Mahajan

- Rethinking Work: Seismic Changes in the Where, When, and Why Rishad Tobaccowala

- Saving Main Street: Small Business in the Time of COVID-19 Gary Rivlin

- Artificial Intelligence for Asset Management and Investment: A Strategic Perspective Al Naqvi

- Generation Gap: Why the Baby Boomers Still Dominate American Politics and Culture Kevin Munger

- Defending the Free Market: The Moral Case for a Free Economy Reverend Robert Sirico

- Life in the Financial Markets: How They Really Work And Why They Matter To You Daniel Lacalle

- Our Data, Ourselves: A Personal Guide to Digital Privacy, First Edition Jacqueline D. Lipton

- The Engineering Executive's Primer: Impactful Technical Leadership Will Larson

- Deep Dive (Greenleaf): The Proven Method for Building Strategy, Focusing Your Resources, and Taking Smart Action Rich Horwath

- The New Normal in IT: How the Global Pandemic Changed Information Technology Forever Gregory S. Smith

- The Soul of the Deal: Creative Frameworks for Buying, Selling, and Investing in Any Business Marc H. Morgenstern

- When Gadgets Betray Us: The Dark Side of Our Infatuation With New Technologies Robert Vamosi

- Empty Promises: The Truth About You, Your Desires, and the Lies You're Believing Pete Wilson

- Restarting the Future: How to Fix the Intangible Economy Stian Westlake

- The Ages of the Investor William J. Bernstein

- World Development Report 2015: Mind, Society, and Behavior The World Bank

- Rage Inside the Machine : The Prejudice of Algorithms and How to Stop the Internet Making Bigots of Us All: The Prejudice of Algorithms, and How to Stop the Internet Making Bigots of Us All Robert Elliott Smith

- Bootstrapped: Liberating Ourselves from the American Dream Alissa Quart

- Making Work Human: How Human-Centered Companies are Changing the Future of Work and the World Eric Mosley

- Relentless (Greenleaf): How a Massive Stroke Changed My Life for the Better Ted W. Baxter

- Spatial Computing Pamela Vold

- The Price of Health: The Modern Pharmaceutical Industry and the Betrayal of a History of Care Michael Kinch

- Common Sense on Mutual Funds John C. Bogle

- Lawfare: Judging Politics in South Africa Michelle le Roux

- The Organization Man William H. Whyte

- The 7 Most Important Equations for Your Retirement: The Fascinating People and Ideas Behind Planning Your Retirement Income Moshe A. Milevsky

- Making Futures Work: Integrating Futures Thinking for Design, Innovation, and Strategy Phil Balagtas

- Citizenship: What Everyone Needs to Know Peter J. Spiro

- The Infinite Desire for Growth Daniel Cohen

- The Art of the Strategist: 10 Essential Principles for Leading Your Company to Victory William Cohen

- Social Innovation, Inc.: 5 Strategies for Driving Business Growth through Social Change Jason Saul

- Code Blue: Inside America’s Medical Industrial Complex Mike Magee, MD

- The AI Conundrum: Harnessing the Power of AI for Your Organization--Profitably and Safely Cales Briggs

- Battling Drought Scientific American

- The Language of Deception: Weaponizing Next Generation AI Justin Hutchens

- The Right Questions: Truth, Meaning & Public Debate Phillip E. Johnson

- On Classical Economics Thomas Sowell

- Economic Theories and Policies: Understanding Key Economic Systems and Strategies (4 in 1) Arlo Holders

- Financial Reckoning Day Fallout: Surviving Today's Global Depression William Bonner

- Seeing the Unseen: Behind Chinese Tech Giants' Global Venturing Guoli Chen

- Run With the Bulls Without Getting Trampled: The Qualities You Need to Stay Out of Harm's Way and Thrive at Work Tim Irwin

- Shocks, Crises, and False Alarms: How to Assess True Macroeconomic Risk Paul Swartz

- Free Enterprise: An American History Lawrence B. Glickman

- Overcomplicated: Technology at the Limits of Comprehension Samuel Arbesman

- Jordmoren i Auschwitz Anna Stuart

4.8

- Jakten på en serieovergriper Anne-Britt Harsem

4.8

- Skriket Jan-Erik Fjell

4.2

- Alle mine barn, kom hjem May Lis Ruus

3.9

- Hushjelpen Freida McFadden

4.4

- Fare, fare, krigsmann May Lis Ruus

4.3

- Ta den ring og la den vandre May Lis Ruus

4.2

- Mirakelkuren Harlan Coben

4

- Slinger i brudevalsen Carole Matthews

3.6

- Jævla menn Andrev Walden

4.4

- Aldri være trygg May Lis Ruus

4.3

- Sydney i fare Clive Cussler

4.4

- Markens grøde Knut Hamsun

4.8

- Sannhetens øyeblikk Kristin Hannah

4.5

- Hushjelpens hemmelighet Freida McFadden

4.3

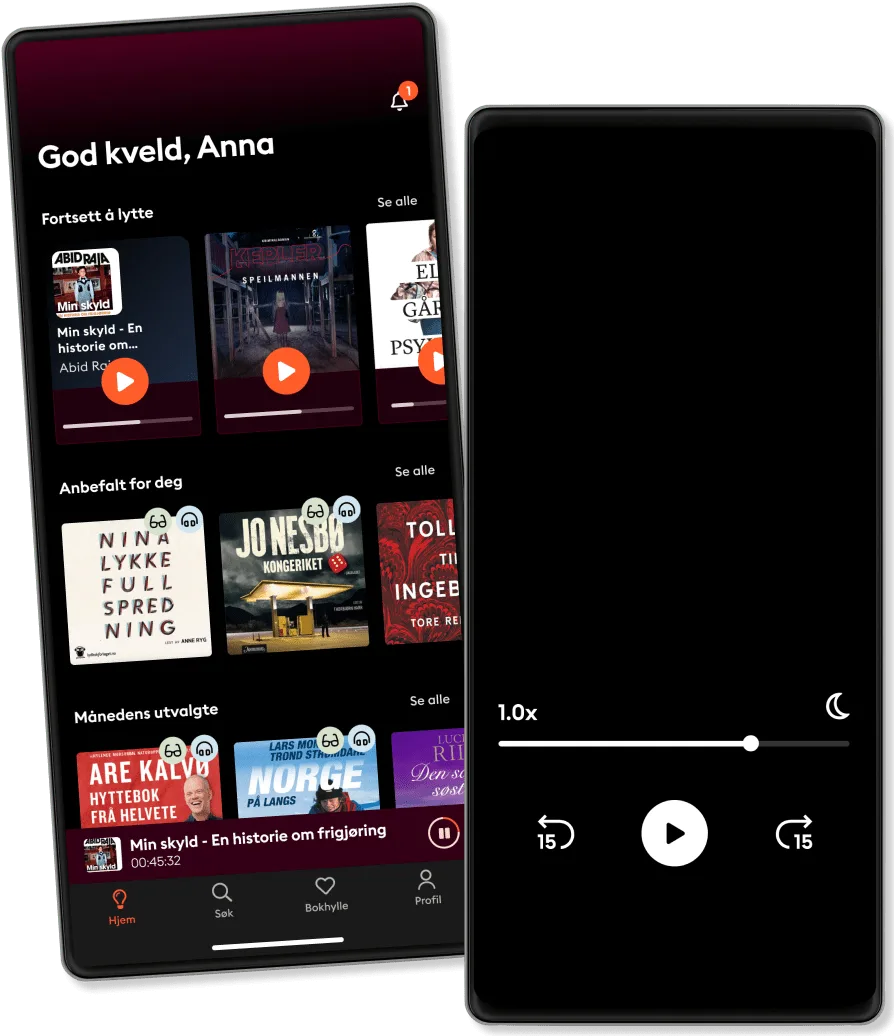

Derfor vil du elske Storytel:

Over 900 000 lydbøker og e-bøker

Eksklusive nyheter hver uke

Lytt og les offline

Kids Mode (barnevennlig visning)

Avslutt når du vil

Unlimited

For deg som vil lytte og lese ubegrenset.

1 konto

Ubegrenset lytting

Lytt så mye du vil

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Family

For deg som ønsker å dele historier med familien.

2-3 kontoer

Ubegrenset lytting

Lytt så mye du vil

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

2 kontoer

289 kr /månedPremium

For deg som lytter og leser ofte.

1 konto

50 timer/måned

Lytt opptil 50 timer per måned

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Basic

For deg som lytter og leser av og til.

1 konto

20 timer/måned

Lytt opp til 20 timer per måned

Over 900 000 bøker

Nye eksklusive bøker hver uke

Avslutt når du vil

Lytt og les ubegrenset

Kos deg med ubegrenset tilgang til mer enn 700 000 titler.

- Lytt og les så mye du vil

- Utforsk et stort bibliotek med fortellinger

- Over 1500 serier på norsk

- Ingen bindingstid, avslutt når du vil

Norsk

Norge