331: Mortgage Chaos with Aaron Kopelson

- Av

- Episod

- 307

- Publicerad

- 7 juni 2020

- Förlag

- 0 Recensioner

- 0

- Episod

- 307 of 436

- Längd

- 26min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

Banks are worried, lenders are tightening up, and the overall mortgage process has changed. Aaron Kopelson discusses with Jason Hartman, some of the biggest changes he has seen in the last few months. Key Takeaways: [1:30] One of the mortgage lenders' current biggest fears, and reason for tightening up, is an early payment default or a first payment default. [3:00] What is a jumbo loan, and what defines the limits per market? [5:00] There’s no appetite from investors that want to buy mortgage-backed securities for these non-QM loans. [7:00] Real estate is a credit backed asset. When the financing starts to dry up, so do the prices. [10:00] Nobody was paid to put the breaks on and look at where we ended up (2008 recession)? [11:20] Fannie and Freddie are allowing for drive-by and desktop appraisals. [14:25] Is mortgage insurance allowed on investment properties? [18:10] V.O.E. Verification of Employment [19:45] What’s an overlay? Websites: Kopelson Team awmloan.com JasonHartman.com JasonHartman.com/properties Jason Hartman PropertyCast (Libsyn) Jason Hartman PropertyCast (iTunes) 1-800-HARTMAN

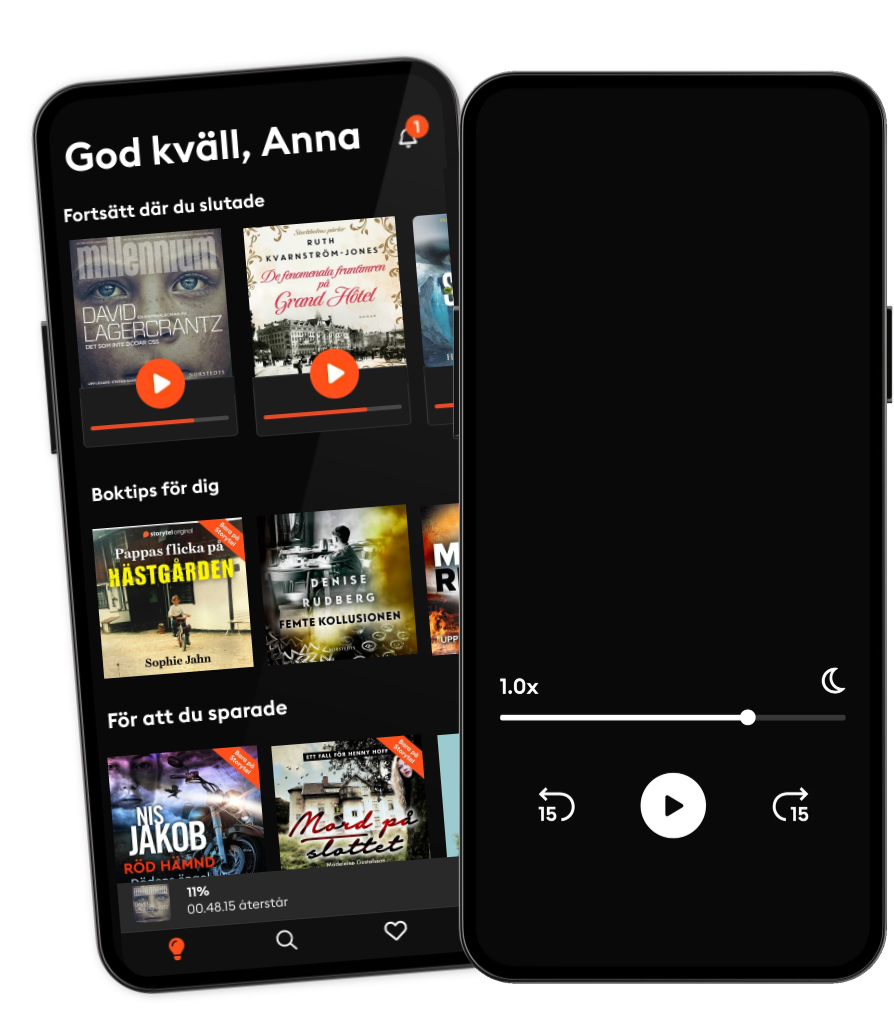

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

Svenska

Sverige