335: Global Macro Advisor To World’s Largest Hedge Funds Adam Robinson, The Princeton Review

- Av

- Episod

- 311

- Publicerad

- 4 juli 2020

- Förlag

- 0 Recensioner

- 0

- Episod

- 311 of 436

- Längd

- 38min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

Adam Robinson is on the show today to dive deep into the collapse of a global market. It’s not just about inflation and deflation; it’s about understanding the collapse of the velocity of money. Now, the majority is trying to understand negative interest rates. Adam Robinson returns to the show to further his discussion with Jason about macroeconomics. A system based on radical consumption is a losing battle. How has this shaped us, and how has the coronavirus changed how we eat, dress, consume, and even view real estate? Key Takeaways: [1:00] Millennials, Gen Z, or people in the prime of their life can afford Manhattan and are looking to migrate away from high-density areas. [3:00] Are we looking at a collapse in the global economy? [9:15] What would the economy look like if everyone got a check for $100k? [13:10] Inflation and deflation aside, what we care about, is the velocity of money, which has collapsed. [15:45] With negative interest rates, we are paid to own gold. [22:10] A system based on radical consumption is a losing battle. [25:45] Let’s break away for a Google/Psychology session. [31:00] Our home life has changed so much. How we eat, dress, and purchase, things have shifted because of the Stay-At-Home orders. Websites: IAmAdamRobinson.com JasonHartman.com/Webinar www.JasonHartman.com www.JasonHartman.com/properties Jason Hartman Quick Start Jason Hartman PropertyCast (Libsyn) Jason Hartman PropertyCast (iTunes)

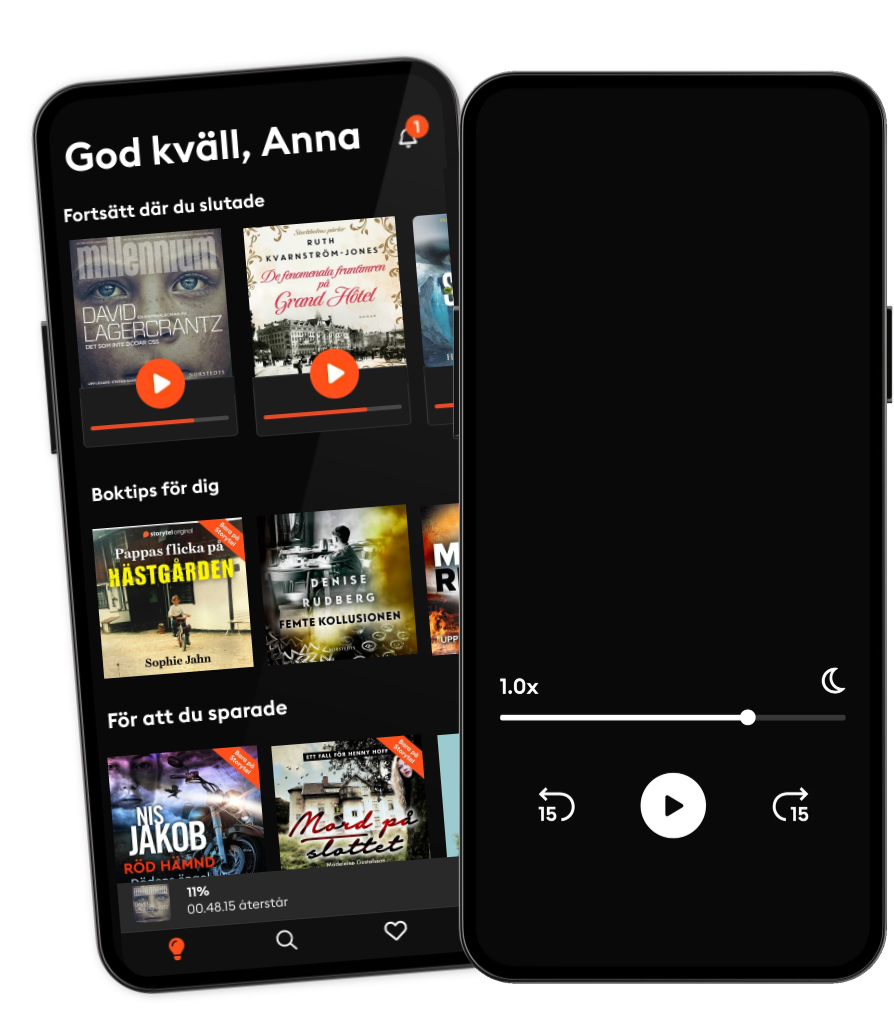

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

Svenska

Sverige