AIPIS 116 – Why Income Property is the Most Tax-Favored Asset Class with Diane Kennedy, CPA

- Av

- Episod

- 94

- Publicerad

- 3 feb. 2016

- Förlag

- 0 Recensioner

- 0

- Episod

- 94 of 436

- Längd

- 46min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

This episode is all about taxes, and how as a real estate investor you may be able to avoid paying them. Think of how much faster you can build your wealth if you use the 30% you would be giving to the IRS to re-invest in additional properties. The government wants us to do this. And, if you are a real estate professional who owns an investment property you should not be paying taxes. If you are paying taxes, you have the wrong CPA working for you.

Key Takeaways:

[2:48] Defining tax drag

[5:31] A stepped-up basis – aka no depreciation recapture for heirs

[7:10] CRT – Charitable Remainder Trust

[9:09] Life insurance policy as an investment or as asset protection

[11:31] The magic of the Real Estate Professional status

[18:50] Getting a retroactive Aggregation Election within the statute of limitations

[21:40] Effectively self-managing a distant property

[27:07] What if I have a real estate license?

[29:54] ‘Married filing jointly’ is required for US taxes

[31:24] Contact Diane for tax advice

[31:40] Pay attention to the business structure you have for your properties

[34:56] Investors need to be careful with LLCs and offshore corporations

[35:44] Depreciation is the Holy Grail to tax write-offs

[36:02] Qualifying for the IRS tax depreciation for owners of investment properties

Mentions:

Hartman Media

Jason Hartman - Properties

US Tax Aid

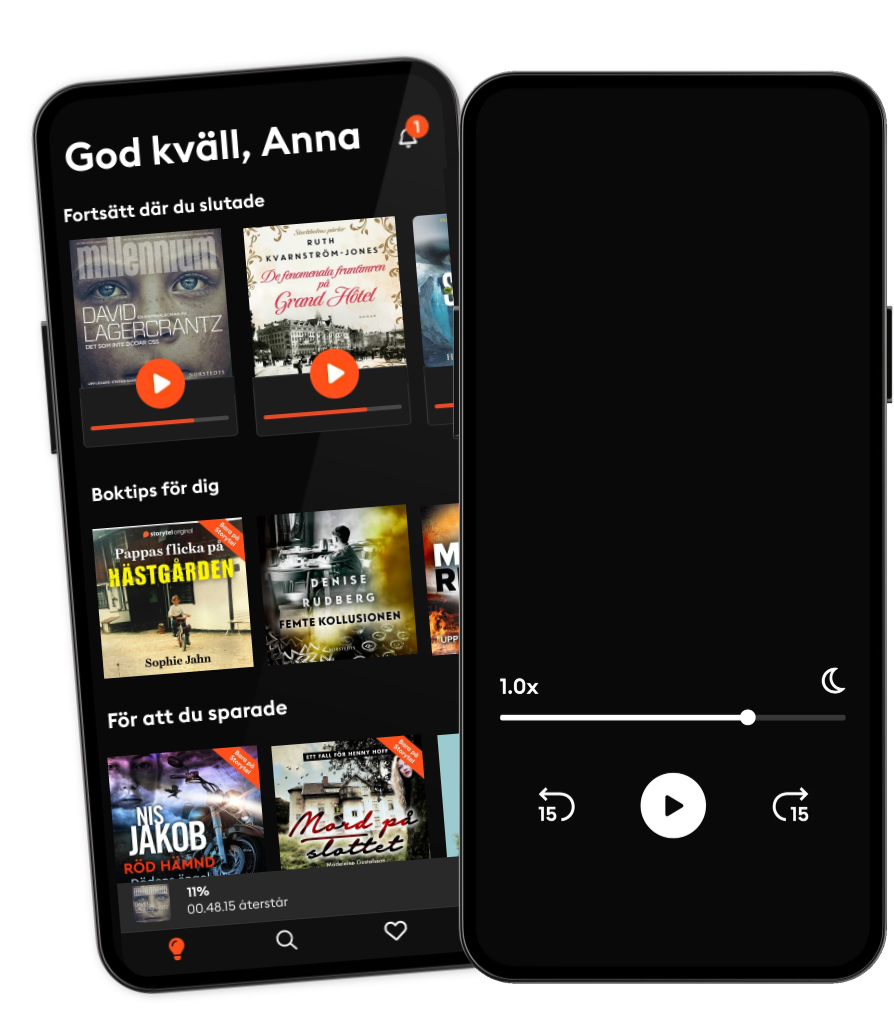

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

Svenska

Sverige