- 0 Recensioner

- 0

- Episod

- 911 of 997

- Längd

- 41min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

There's a lot of talk right now about concentration risk in US equities. For instance, the top 10 stocks in the S&P 500 currently account for 38% of the total index, compared to just 17.5% a decade ago. And all the big winners have been tech companies like Apple, Nvidia, Meta, etc., prompting questions about whether investors are getting overly-enthused about AI. For some, it's also bringing back memories of the dotcom bubble. So just how concentrated is the US stock market right now? What exactly is "concentration risk" anyway? What does this trend say about the power of benchmark index providers like S&P? And -- crucially -- are market participants doing anything about it? In this episode we speak with Kevin Muir, a.k.a. the Macro Tourist, about why he thinks the market is now at "peak concentration," and what could change to reduce Big Tech's dominance.

Read more: Index Providers Rule the World—For Now, at Least Nvidia and Five Tech Giants Now Command 30% of the S&P 500 Index

Only Bloomberg.com subscribers can get the Odd Lots newsletter in their inbox — now delivered every weekday — plus unlimited access to the site and app. Subscribe at bloomberg.com/subscriptions/oddlots

See omnystudio.com/listener for privacy information.

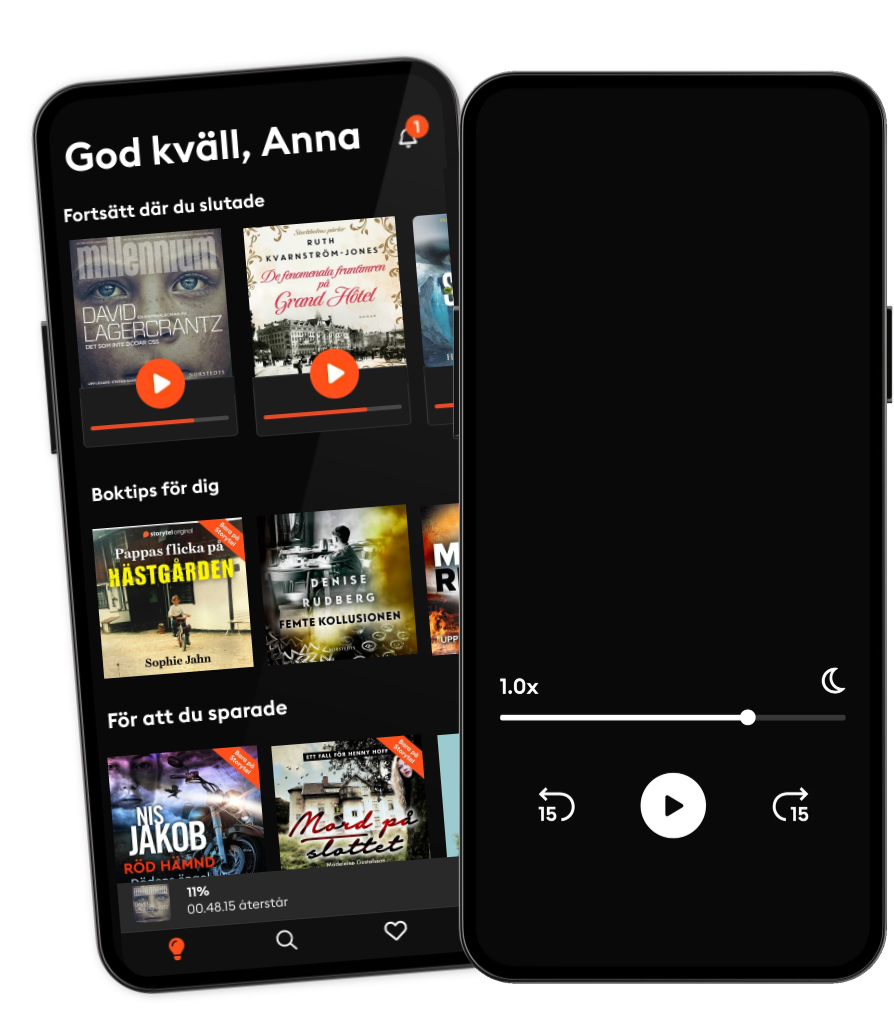

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

Svenska

Sverige