- 0 Recensioner

- 0

- Episod

- 34 of 251

- Längd

- 31min

- Språk

- Engelska

- Format

- Kategori

- Ekonomi & Business

The bond market has taken a major U-turn in recent weeks, causing the ever-important 10-year Treasury yield to jump from a three-year low of less than 1.43% in September to almost 2% on Thursday. Is this a turning point for fixed income or just a correction in an overbought Treasuries market? Robert Tipp, chief investment strategist at PGIM Fixed Income, shares his thoughts. Bloomberg Executive Editor Chris Nagi also explains what the rise in yields means for a U.S. stock market that touched record highs this week.

Mentioned in this podcast:

Career Risk Flashing in Fund Land as Only 29% Beat Benchmarks

U.S. Rates: Low for Long, But Likely Positive

Robinhood Traders Discovered a Glitch That Gave Them ‘Infinite Leverage’

Correction: This post incorrectly identified Robert Tipp’s title. The post has been updated.

See omnystudio.com/listener for privacy information.

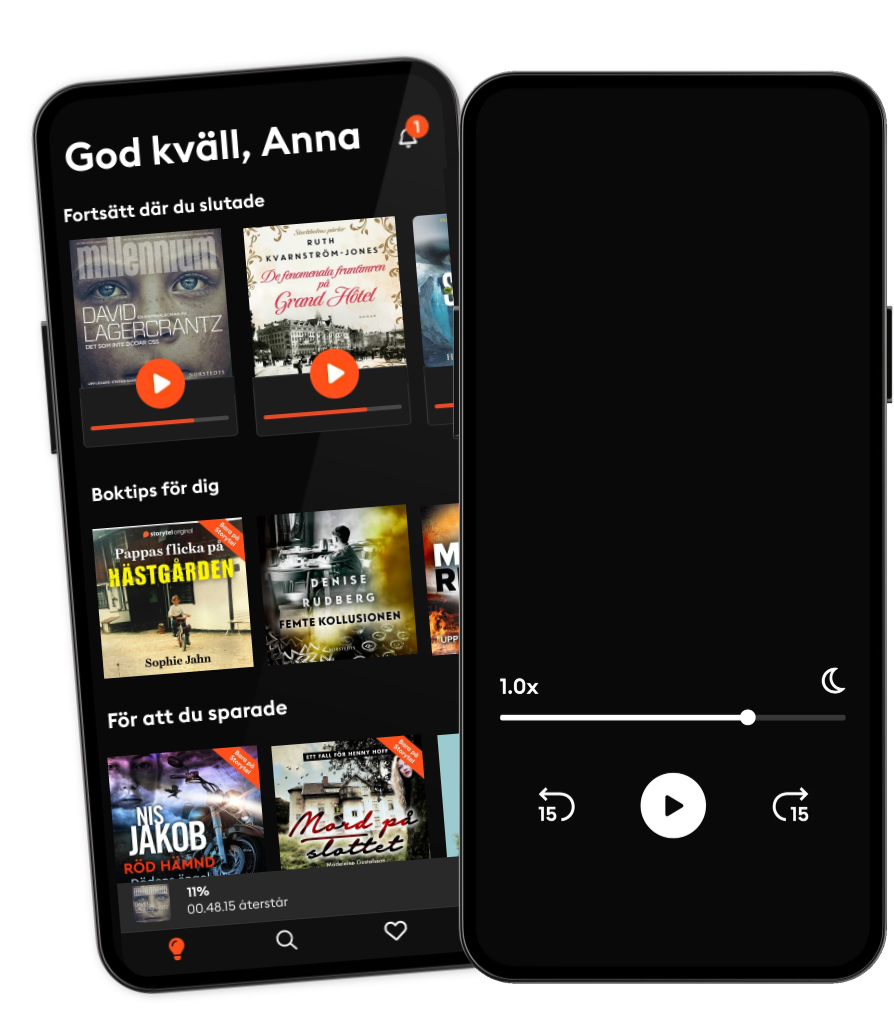

Lyssna när som helst, var som helst

Kliv in i en oändlig värld av stories

- 1 miljon stories

- Hundratals nya stories varje vecka

- Få tillgång till exklusivt innehåll

- Avsluta när du vill

Andra podcasts som du kanske gillar...

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

- The Journal.The Wall Street Journal & Gimlet

- PengekassenTine Gudrun Petersen

- 1,5 graderAndreas Bäckäng

- AktiekompisarUnga Aktiesparare

- Redefining CyberSecuritySean Martin

- The Disciplined InvestorAndrew Horowitz - Host

- Pitchfork Economics with Nick HanauerCivic Ventures

- The Pathless Path with Paul MillerdPaul Millerd

- WorkLife with Adam GrantTED

- Everyone's Talkin' Money | Personal Finance Tips To Stress Less and Live MoreRelationships & Mental Health

Svenska

Sverige