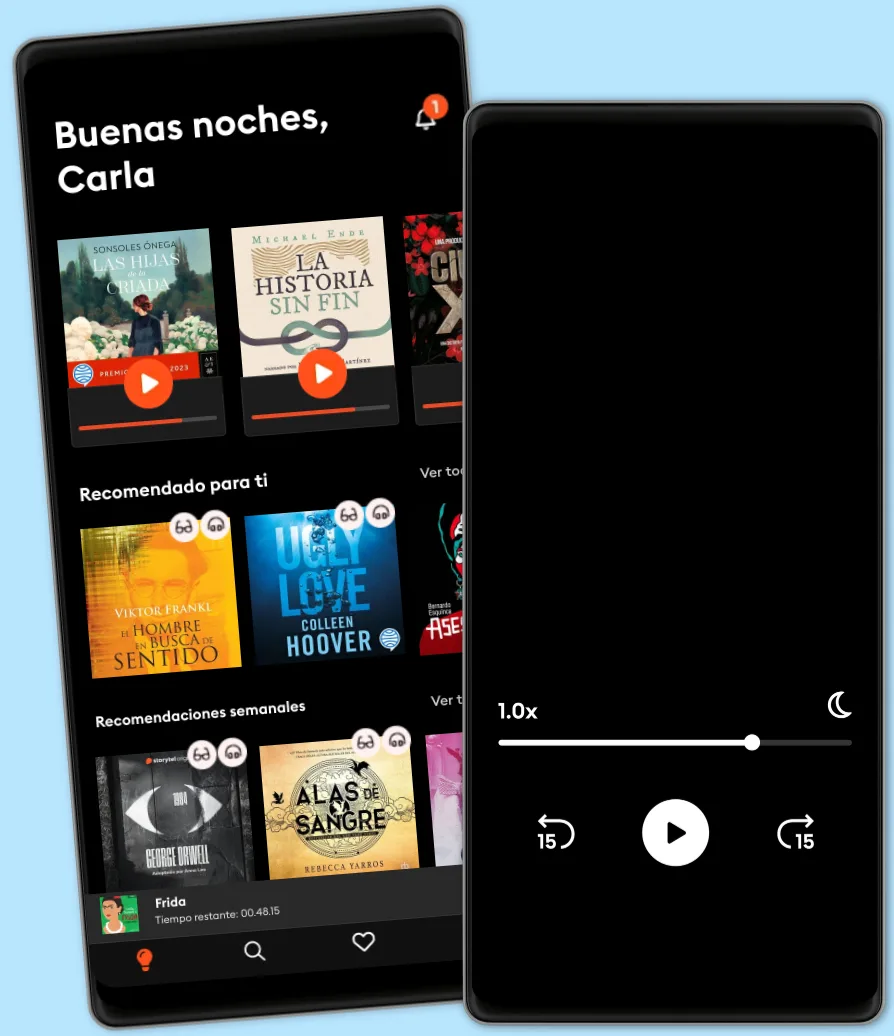

Escucha y lee

Descubre un mundo infinito de historias

- Lee y escucha todo lo que quieras

- Más de 1 millón de títulos

- Títulos exclusivos + Storytel Originals

- 7 días de prueba gratis, luego $7.99 /mes

- Cancela cuando quieras

Beyond Traditional: Unlocking the Potential of Alternative Assets

- Por

- Con:

- Editor

- Duración

- 3 h 57 m

- Idioma

- Inglés

- Formato

- Categoría

Negocios y economía

The Limitations of Traditional Investments

Traditional investments stocks, bonds, and cash have been the backbone of most investment portfolios for decades. They offer liquidity, are relatively easy to understand, and provide a clear path to wealth accumulation over time. However, in today's complex financial landscape, these traditional investments may not be enough to meet all investor needs. Market volatility, low interest rates, and high correlation among asset classes can expose investors to risks that can significantly impact their portfolios.

For example, during the 2008 financial crisis, global stock markets plunged, and the value of many portfolios dropped precipitously. Even bond markets, which are typically seen as safer investments, were not immune to the turmoil. This scenario highlighted a significant limitation of traditional investments: when markets crash, these assets often move together, leading to significant losses across a portfolio. Investors who were heavily weighted in stocks and bonds had little protection against the downturn, which underscored the need for diversification beyond these traditional assets.

© 2025 Chad R. Larson (Audiolibro): 9798318179143

Fecha de lanzamiento

Audiolibro: 24 de mayo de 2025

Etiquetas

Otros también disfrutaron...

- Stop Engaging Employees: Start Making Work More Human Eryc Eyl

- Leaving the Golden Cage: A hands-on guide to starting and building your life science consulting practice Norbert Farkas

- Tested: Big Decisions. Small Decisions. The remarkable power of resolve.Australia's Test cricket captain in conversation with inspiring leaders and Pat Cummins

- Choosing Leadership: Revised and Expanded: How to Create a Better Future by Building Your Courage, Capacity, and Wisdom Linda Ginzel, PhD

- Startup Boards: Getting the Most Out of Your Board of Directors Brad Feld

- The Nordstrom Way to Customer Experience Excellence: Creating a Values-Driven Service Culture, 3rd Edition Robert Spector

- Your Seat at the Table: How to Create and Run Your Own Peer Advisory Council Tina Corner-Stolz

- Creepy Analytics: Avoid Crossing the Line and Establish Ethical HR Analytics for Smarter Workforce Decisions Salvatore V. Falletta

- The Strategy Activation Playbook: A Practical Approach to Bringing Your Strategies to Life Aric Wood

- The Boomerang Principle: Inspire Lifetime Loyalty from Your Employees Lee Caraher

- Adaptable: How to Lead with Curiosity, Pivot with Purpose, and Thrive through Change Alexa Carlin

- The Datapreneurs: The Promise of AI and the Creators Building Our Future Bob Muglia

- Pitch the Perfect Investment: The Essential Guide to Winning on Wall Street Paul Johnson

- Decision Intelligence: Transform Your Team and Organization with AI-Driven Decision-Making Thorsten Heilig

- Strategy Discovery: Achieving Business Resilience, Engagement and Performance Graham Kenny

- DEMAND TRANSPARENCY: Stop Wall Street Greed and Rising Taxes From Destroying Your Wealth Jason G Mandel

- Opening the Drawers of Organizational Development: Two consulting models applied in a Case Study Jose Gerardo Lara Portal

- Digital Transformation in the Electronics Industry: Business and Technical Evolution in Electronic Components Procurement Casimir Saternos

- Good Influence: How to Engage Influencers for Purpose and Profit Paul M. Katz

- Rattiner’s Secrets of Financial Planning: From Running Your Practice to Optimizing Your Client's Experience Jeffrey H. Rattiner

- What Gives You the Right to Freelance?: Overcome your mental blocks, find your work-life balance, and achieve the career of your dreams Reese Hopper

- Beyond the Building: How to Use Innovation to Create and Grow Your Commercial Real Estate Portfolio Rob Finlay

- A Question of Leadership: Leading Organizational Change in Times of Crisis Keith Leslie

- The Sales Contrarian: Opening the Minds of Salespeople and Sales Leaders for the Greater Good Steve Heroux

- Taxocracy: What You Don't Know About Taxes and How They Rule Your Daily Life Scott Hodge

- Leadership for a Digital World: The Transformation of GE Appliances Annika Steiber

- The #PACE Process for Early Career Success Mark Zides

- Timing The Market: How to Profit in the Stock Market Using the Yield Curve, Market Sentiment, and Cultural Indicators Deborah Weir

- Industrial Designs: Ideas and Inventive Problem Solving for Industrial Design Phil Gilberts

- One Report: Integrated Reporting for a Sustainable Strategy Don Tapscott

- MBA or PhD: The Ultimate Guide for Aspiring Scholars Darius Robinson, PhD

- Brilliant, Crazy, Cocky: How the Top 1% of Entrepreneurs Profit from Global Chaos Sarah Lacy

- Intended Consequences: How to Build Market-Leading Companies with Responsible Innovation Hemant Taneja

- Leadership for the New Millennium Alison Cameron

- Turnaround Time: Uniting an Airline and Its Employees in the Friendly Skies Oscar Munoz

- Building Leaders the West Point Way: Ten Principles from the Nation's Most Powerful Leadership Lab Joseph P. Franklin

- Failure Management: Malfunctions of Technologies, Organizations, and Society William B. Rouse

- PowerNomics: The National Plan to Empower Black America Dr. Claud Anderson

- Captains of Industry Paul Allen

- Coaching for Leadership: Writings on Leadership from the World's Greatest Coaches Marshall Goldsmith

- The Functions Of Management Trevor Clinger

- From Breakthrough to Blockbuster: The Business of Biotechnology Donald L. Drakeman

- Breaking Into Venture: An Outsider Turned Venture Capitalist Shares How to Take Risks, Create Power, and Build Life-Changing Wealth Allison Baum Gates

- Private Debt Stephen L. Nesbitt

- Social Media Strategies for Professionals and Their Firms: The Guide to Establishing Credibility and Accelerating Relationships Bruce W. Marcus

- The Invisible Game: The Secrets and the Science of Winning Minds and Winning Deals Kai-Markus Mueller

- Showing Up: How Men Can Become Effective Allies in the Workplace Ray Arata

- Immigrant, Inc.: Why Immigrant Entrepreneurs Are Driving the New Economy (and how they will save the American worker) Richard T. Herman

- TouchPoints: Creating Powerful Leadership Connections in the Smallest of Moments Mette Norgaard

- Business Owner's Secret Sauce: The Recipe For Success Natalia Alaine

- Fair Pay, Fair Play: Aligning Executive Performance and Pay Robin A. Ferracone

- Reimagining Industry Growth: Strategic Partnership Strategies in an Era of Uncertainty Daniel A. Varroney

- The Intention Economy: When Customers Take Charge Doc Searls

- NextGen Author: How trendsetting creators use web3 and AI to set a new standard for authorship Malene Bendtsen

- Disrupting Digital Business: Create an Authentic Experience in the Peer-to-Peer Economy R "Ray" Wang

- Rebooting Work: Transform How You Work in the Age of Entrepreneurship Carlye Adler

- PMP Secrets Unleashed: Propel Your Project Success: "Transform your project management skills! Energizing audio lessons designed to boost your PMP exam readiness await you!" Cyrus Fenwick

- Estimating Construction Profitably: Developing a System for Residential Estimating Michael C. Stone

- Product Owner Interview Preparation: Stand Out with Confidence Jimmy Mathew

- Why Are We Bad at Picking Good Leaders? A Better Way to Evaluate Leadership Potential Jeffrey Cohn

- The Opportunity Index: A Solution-Based Framework to Dismantle the Racial Wealth Gap Gavin Lewis

- Open Talent: Leveraging the Global Workforce to Solve Your Biggest Challenges Jin H. Paik

- Agile Manifesto: Unleashing Innovation, Collaboration, and Adaptive Excellence in Modern Development Practices Daniel Green

- The RoboSphere: Robots Among Us: Insights into the World of Robotics and Automation Zoe Carter

- Cash Flow: How to Build a Great Company That Endures in Tough Economies and Thrives in Booming Ones Steve Coughran

- The Start Up Visa: Key to Job Growth & Economic Prosperity in America Tahmina Watson

- Business Models for the Social Mobile Cloud: Transform Your Business Using Social Media, Mobile Internet, and Cloud Computing Ted Shelton

- IT'S A FREAKIN' MESS: How to Thrive in Divisive Times Richard Gillett

- Rigged Money: Beating Wall Street at Its Own Game Lee Munson

- Outward Bound Lessons to Live a Life of Leadership: To Serve, to Strive, and Not to Yield Mark Michaux Brown

- Why I Do VFX: The Untold Truths About Working in Visual Effects Vicki Lau

- Metaverse Management Orion Zander

- The Golden Apple: Redefining Work-Life Balance for a Diverse Workforce Mason Donovan

- UnSelling: The New Customer Experience Scott Stratten

- Skills for Career Success: Maximizing Your Potential at Work Elaine Biech

- Future-Proofing Your Business: Real Life Strategies to Prepare Your Business for Tomorrow, Today Troy Hazard

- The Revenue Accelerator: The 21 Boosters to Launch Your Start-Up Allan Colman

- Unraveling the Secrets to Nations' Success and Collapse: "Unlock the secrets of nations' rise and fall with immersive audio lessons for your listening pleasure!" Cyrus Treadway

- Por si un día volvemos María Dueñas

4.6

- Mi recuerdo es más fuerte que tu olvido: Premio de Novela Fernando Lara 2016 Paloma Sánchez-Garnica

4.4

- La última huella Marcos Nieto Pallarés

4.2

- JAMES: Premio Pulitzer 2025 Percival Everett

4.5

- Las hijas de la criada: Premio Planeta 2023 Sonsoles Ónega

4.4

- Pecados 1. Rey de la ira Ana Huang

3.8

- La saga de los longevos 3. El Camino del Padre Eva García Sáenz de Urturi

4.2

- El lejano país de los estanques Lorenzo Silva

4.1

- La protegida Rafael Tarradas Bultó

4.5

- Corazón de oro Luz Gabás

4.3

- Nada de esto es verdad Lisa Jewell

4.2

- Mi querida Lucía La Vecina Rubia

4

- Brujería para chicas descarriadas Grady Hendrix

4.3

- Mil cosas Juan Tallón

4.2

- Venganza Carme Chaparro

4.2

Explora nuevos mundos

Más de 1 millón de títulos

Modo sin conexión

Kids Mode

Cancela en cualquier momento

Unlimited

Para los que quieren escuchar y leer sin límites.

1 cuenta

Acceso ilimitado

Escucha y lee los títulos que quieras

Modo sin conexión + Modo Infantil

Cancela en cualquier momento

Español

América Latina