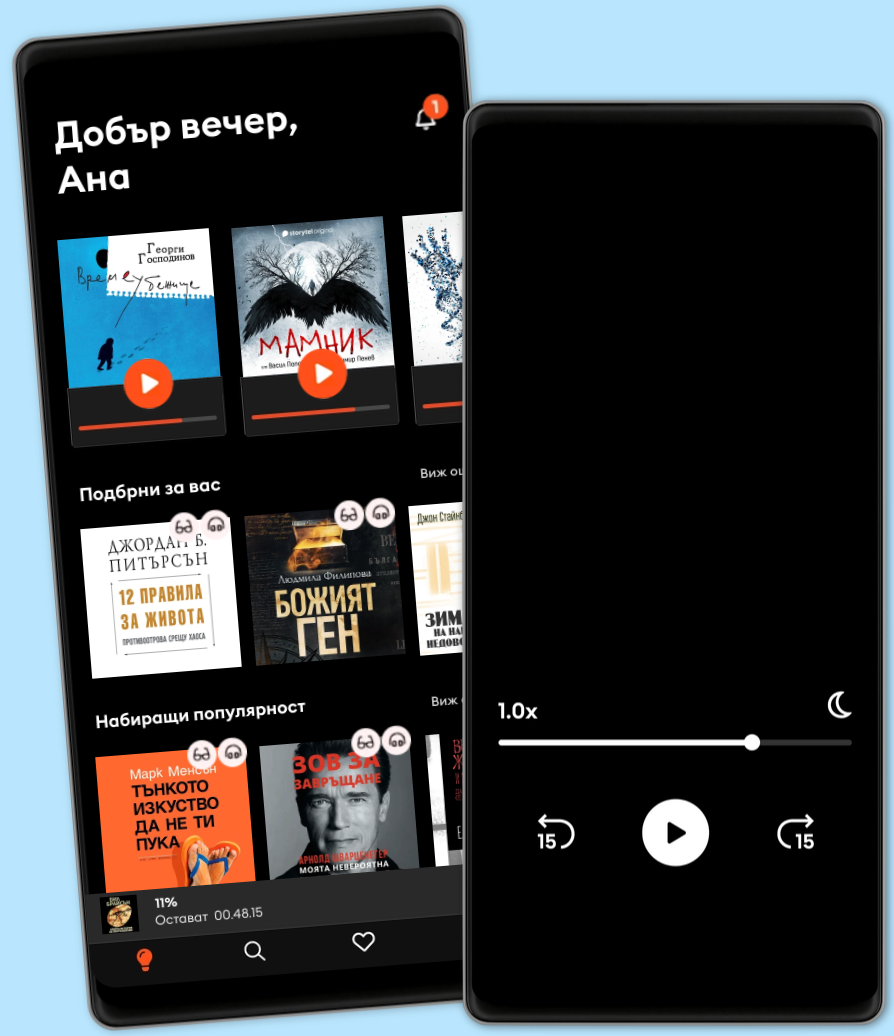

Слушайте и четете

Открийте безкрайна вселена от истории

- Слушайте и четете неограничено

- Над 500 000 заглавия

- Ексклузивни и Storytel Original заглавия

- Можете да прекратите лесно по всяко време

No Debt High Growth Low Tax

- От:

- Издател:

- Език

- Английски

- Format

- Категория

Бизнес и икономика

Governments around the world are wrestling with the problems of enormous debts, low growth, high unemployment and a gap between the demands of public expenditure and what can be raised through taxation. This problem has been acute since the financial crisis, but has been a hallmark of western economies for decades.Only a few countries have been able to avoid this pattern, mostly those blessed with vast natural resources such as oil. However, there are two small islands with no natural resources which have also enjoyed high growth combined with low taxation: Hong Kong and Singapore. Nor do they have any public debts, in fact, on the contrary, they generally run a budget surplus, and investment income is a feature of their government revenue.Andrew Purves, who grew up on the island of Hong Kong, has gone beyond the conventional analysis of taxation, and asked what each jurisdiction has in common, to bring about this happy state of affairs.The result is quite surprising for two countries which sit at the top of the table for promoting free markets and other capitalist ideals of small government.All land in Hong Kong is owned by the government, who makes it available for use by lease in return for a Government Rent, while Singapore now controls over half of its land area, as well as significant stakes in its strategic industries, which deliver a steady stream of unconventional income. Although in Hong Kong this situation has developed almost by accident, Purves suggests that here lies a model for generating public revenue that could be adopted in other countries to allow a shift in taxation from production and consumption to the Economic Rent of land, as advocated by Adam Smith over two hundred years ago.As a businessman in London, Andrew Purves, is keenly aware of the damaging impact of current taxation on economic activity.

© 2021 Shepheard Walwyn (Publishers) (Е-книга): 9780856834264

Дата на публикуване

Е-книга: 6 януари 2021 г.

Разгледай още от

Другите харесаха също...

- The Fourth Age: Smart Robots, Conscious Computers, and the Future of Humanity Byron Reese

- Plagues Upon the Earth: Disease and the Course of Human History Kyle Harper

- One Economics, Many Recipes: Globalization, Institutions, and Economic Growth Dani Rodrik

- Falling Behind?: Boom, Bust, and the Global Race for Scientific Talent Michael S. Teitelbaum

- Unified Growth Theory Oded Galor

- Thinking like an Economist: How Efficiency Replaced Equality in U.S. Public Policy Elizabeth Popp Berman

- Europe's Orphan: The Future of the Euro and the Politics of Debt – New Edition: The Future of the Euro and the Politics of Debt - New Edition Martin Sandbu

- The Currency of Politics: The Political Theory of Money from Aristotle to Keynes Stefan Eich

- The Leaderless Economy: Why the World Economic System Fell Apart and How to Fix It Peter Temin

- Why Not Default?: The Political Economy of Sovereign Debt Jerome E. Roos

- Мамник - E1 Васил Попов

4.7

- Вирусът на паниката: Подкаст на Мадлен Алгафари S01E01 Мадлен Алгафари

4.9

- Градинарят и смъртта Георги Господинов

4.8

- Хиляда сияйни слънца Халед Хосейни

4.9

- Дървото на ангелите Лусинда Райли

4.8

- Глюкозната революция Джеси Инчауспе

4.7

- Ловецът на хвърчила Халед Хосейни

4.8

- Богат татко, беден татко: Актуализиран за съвременния свят и с 9 нови обучителни раздела Робърт Кийосаки

4.4

- Железен пламък Ребека Ярос

4.7

- Лейди Гергана Цветелина Цветкова

4.7

- Чук и Пук Турбьорн Егнер

4.7

- Четвърто крило Ребека Ярос

4.6

- Четирите споразумения: Толтекска книга на мъдростта Дон Мигел Руис

4.6

- Лехуса Васил Попов

4.6

- Подсъзнанието може всичко Джон Кехоу

4.7

Избери своя абонамент:

Над 500 000 заглавия

Сваляте книги за офлайн слушане

Ексклузивни заглавия + Storytel Original

Детски режим (безопасна зона за деца)

Лесно прекратявате по всяко време

Unlimited

Най-добрият избор. Открийте хиляди незабравими истории.

1 профил

Неограничен достъп

Избирайте от хиляди заглавия

Слушайте и четете неограничено

Прекратете по всяко време

Unlimited Годишен

12 месеца на цената на 8. Избирайте от хиляди заглавия.

1 профил

Неограничен достъп

9.99 лв./месец

Слушайте и четете неограничено

Прекратете по всяко време

Family

Споделете историите със семейството или приятелите си.

2-3 акаунта

Неограничен достъп

Потопете се заедно в света на историите

Слушайте и четете неограничено

Прекратете по всяко време

2 профила

21.99 лв. /30 дниБългарски

България