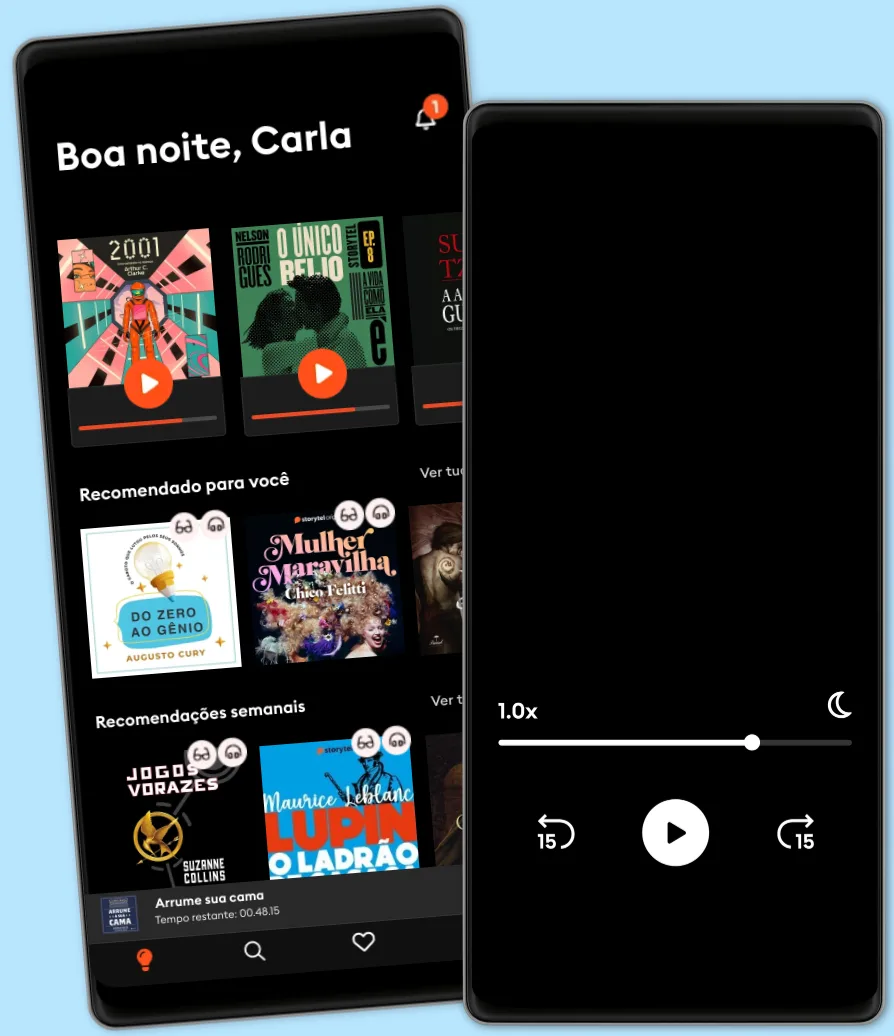

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

Dividend Investing

- por

- Com:

- Editora

- 14 Avaliações

3.6

- Duração

- 2H 46min

- Idiomas

- Inglês

- Format

- Categoria

Economia & Negócios

Dividend investing is a strategy of buying stocks that pay dividends in order to receive a regular income from your investments. This income is in addition to any growth your portfolio experiences as the stock in it gains value.

Dividends are payments a corporation makes to shareholders. When you own stocks that pay dividends, you are receiving a share of the company profits. Dividend investing allows you to create a stream of income in addition to the growth in your portfolio's market value from asset appreciation.

Experienced dividend investors like to invest significantly in stocks that pay large dividends in order to make money.

Buying stocks that pay dividends can reward you over time as long as you make intelligent buying choices.

If the company you own shares of has a dividend reinvestment plan, or DRIP, you can choose to have your dividends reinvested to buy additional shares, rather than having them paid out as a profit. This is a useful strategy when your dividends are small, either because the company is growing or because you don't own much stock.

Good dividend investors tend to focus on either a high dividend yield approach or a high dividend growth rate strategy. Both serve different roles in different portfolios.

A high dividend yield strategy focuses on slow-growing companies that have substantial cash flow. This allows them to fund large dividend payments and produces an immediate income.

A high dividend growth rate strategy focuses on buying stock in companies that currently pay lower-than-average dividends but are growing quickly. This allows investors to buy profitable stocks at a lower rate and make a large absolute dollar income over a 5- or 10-year period.

© 2021 Author's Republic (Audiolivros): 9781662183935

Data de lançamento

Audiolivros: 28 de março de 2021

Outros também usufruíram...

- Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway's Vice Chairman on Life, Business, and the Pursuit of Wealth With Commentary by David Clark David Clark

- Dividend Investing: A Simple, Concise & Complete Guide to Dividend Investing Jonathan Marlow

- 7 Secrets to Investing Like Warren Buffett Mary Buffett

- The Intelligent Investor Rev Ed. Benjamin Graham

- Mastering The Market Cycle: Getting the odds on your side Howard Marks

- The Intelligent Investor Benjamin Graham

- The Little Book of Behavioral Investing: How not to be your own worst enemy (Little Book, Big Profits) James Montier

- The Warren Buffett Stock Portfolio: Warren Buffett's Stock Picks: When and Why He Is Investing in Them Mary Buffett

- One Up On Wall Street: How To Use What You Already Know To Make Money In The Market Peter Lynch

- The Little Book That Still Beats the Market Joel Greenblatt

- A Random Walk Down Wall Street: Including a Life-Cycle Guide to Personal Investing Burton G. Malkiel

- The Case for Dividend Growth: Investing in a Post-Crisis World David L. Bahnsen

- Investing in One Lesson Mark Skousen

- Learn to Earn: A Beginner's Guide to the Basics of Investing Peter Lynch

- The Big Secret for the Small Investor: The Shortest Route to Long-Term Investment Success Joel Greenblatt

- Warren Buffett's Ground Rules: Words of Wisdom from the Partnership Letters of the World's Greatest Investor Jeremy C. Miller

- Principles: Life and Work Ray Dalio

- Common Stocks and Uncommon Profits and Other Writings (2nd Edition): 2nd Edition Philip A. Fisher

- Money Machine: The Surprisingly Simple Power of Value Investing Gary Smith

- The Little Book of Big Dividends: A Safe Formula for Guaranteed Returns Terry Savage

- Invested: How Warren Buffett and Charlie Munger Taught Me to Master My Mind, My Emotions, and My Money (with a Little Help From My Dad) Danielle Town

- Dividends Still Don't Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock Market Kelley Wright

- Beating the Street: How to Use What You Already Know to Make Money in the Market Peter Lynch

- Think and Grow Rich Napoleon Hill

- Unshakeable: Your Financial Freedom Playbook Tony Robbins

- The Little Book of Bulletproof Investing: Do's and Don'ts to Protect Your Financial Life Phil DeMuth

- Warren Buffett Speaks: Wit and Wisdom from the World's Greatest Investor Janet Lowe

- The Art of Value Investing: Essential Strategies for Market-Beating Returns John Heins

- The Triumph of Value Investing: Smart Money Tactics for the Post-Recession Era Janet Lowe

- The Book of Investing Wisdom: Classic Writings by Great Stock-Pickers and Legends of Wall Street Peter Krass

- The Dhandho Investor: The Low-Risk Value Method to High Returns Mohnish Pabrai

- The New Buffettology: How Warren Buffett Got and Stayed Rich in Markets Like This and How You Can Too! Mary Buffett

- The Little Book That Builds Wealth: Morningstar's Knock-out Formula Pat Dorsey

- Warren Buffett: Inside the Ultimate Money Mind Robert G. Hagstrom

- Dividend Investing for Beginners & Dummies Giovanni Rigters

- Richer, Wiser, Happier: How the World's Greatest Investors Win in Markets and Life William Green

- Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth T. Harv Eker

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early Retirement Joey Thompson

- Invest and Grow Rich: Achieve Financial Independence with $500 a Month Sanjay Jaybhay

- Stock Investing For Dummies: 5th Edition Paul Mladjenovic

- Value Investing Introbooks Team

- Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth T. Harv Eker

- You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market Profits Joel Greenblatt

- Common Stocks and Common Sense: The Strategies, Analyses, Decisions, and Emotions of a Particularly Successful Value Investor Edgar Wachenheim

- Choose FI: Your Blueprint for Financial Independence Jonathan Mendonsa

- The Elements of Investing: Easy Lessons for Every Investor: Easy Lessons for Every Investor, Updated Edition Charles D. Ellis

- The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit Aswath Damodaran

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- O sonho de um homem ridículo Fiódor Dostoiévski

4.8

- Pratique o poder do "Eu posso" Bruno Gimenes

4.6

- Gerencie suas emoções Augusto Cury

4.5

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- 10 Maneiras de manter o foco James Fries

3.8

- Arrume sua cama William McRaven

4.5

- Jogos vorazes Suzanne Collins

4.8

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- A metamorfose Franz Kafka

4.4

- Poder e Manipulação Jacob Petry

4.6

- A gente mira no amor e acerta na solidão Ana Suy

4.4

- Pare de Procrastinar: Supere a preguiça e conquiste seus objetivos Giovanni Rigters

4.3

- A cantiga dos pássaros e das serpentes Suzanne Collins

4.6

- A arte da guerra Sun Tzu

4.6

Português

Brasil