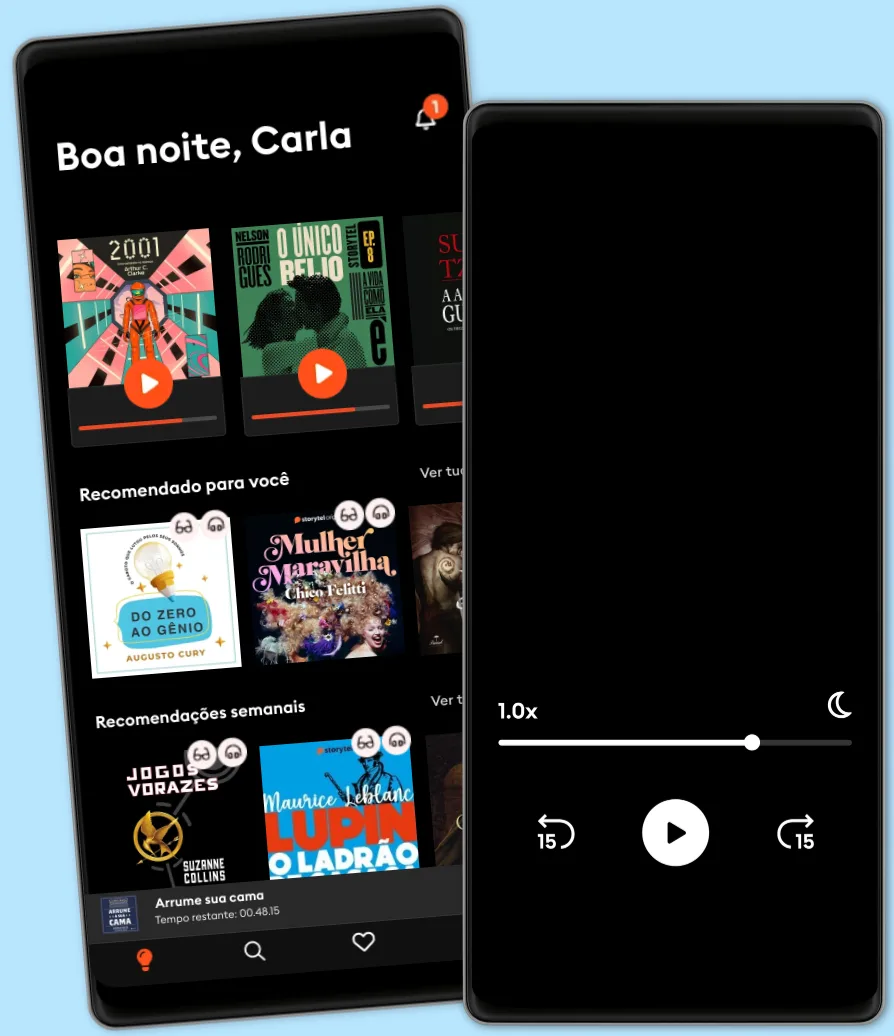

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

Mobs, Messiahs, and Markets: Surviving the Public Spectacle in Finance and Politics

- por

- Com:

- Editora

- 3 Avaliações

3.3

- Duração

- 13H 26min

- Idiomas

- Inglês

- Format

- Categoria

Crescimento pessoal

Collectively, people think and act in ways that are different from how they think and act as individuals. Understanding these differences, says William (Bill) Bonner, a longtime maverick observer of the financial world and the vagaries of the investing public, is vital to preserving your wealth and personal dignity. From the witch hunts of the early modern world to the war on terror, from the dot-com mania to the real-estate bubble, people have always been caught up in frauds, conceits, and wild guesses - often with devastating results. Now Bonner and co-author Lila Rajiva show groupthink at work in an improbable array of instances throughout history and reveal why swimming against the current pays. They explain why people so often abandon good sense and good behavior to "follow the crowd" and show you how to avoid getting caught up in the public spectacles around you. If an investor merely recognizes the way mob sentiment works, he is far ahead of others. Ordinary people turn billions of dollars worth of their hard-earned money over to brokers and fund managers daily, believing that these strangers will give them back even more. Why? This audiobook demonstrates that investors are in fact caught between a rock and a soft place - between the private world they can understand and master and the misleading public spectacle of the markets. "The farther away you get from your investments, and the less you suffer the consequences if they go bad, the worse your performance will be," say Bonner and Rajiva. "That's why 'collective' investments like index-linked funds, mutual funds, hedge funds, insurance funds, and pension funds are usually so bad. The investors are too far from the facts, and the managers are too far from the consequences."

© 2007 Ascent Audio (Audiolivros): 9781596591769

Data de lançamento

Audiolivros: 1 de novembro de 2007

Outros também usufruíram...

- The Great Deformation: The Corruption of Capitalism in America David A. Stockman

- EconoPower: How a New Generation of Economists Is Transforming the World Mark Skousen

- Democratic Capitalism at the Crossroads: Technological Change and the Future of Politics Carles Boix

- Taxing the Rich: A Short History of Fiscal Fairness in the United States and Europe David Stasavage

- The Payoff: Why Wall Street Always Wins Jeff Connaughton

- Consent and Control in the Authoritarian Workplace: Russia and China Compared Martin Krzywdzinski

- The Federal Reserve and the Financial Crisis Ben S. Bernanke

- Last Resort: The Financial Crisis and the Future of Bailouts Eric A. Posner

- The New Empire of Debt: The Rise and Fall of an Epic Financial Bubble William Bonner

- Inside Rupert's Brain: How the World's Most Powerful Media Mogul Really Thinks Paul R. LaMonica

- The Instant Economist: You Need to Know About How the Economy Works Timothy Taylor

- Lecturing Birds on Flying: Can Mathematical Theories Destroy the Financial Markets Pablo Triana

- George Washington: The Founding Father Paul Johnson

- Central Banking in Turbulent Times Francesco Papadia

- A Crisis of Beliefs: Investor Psychology and Financial Fragility Nicola Gennaioli

- Yellen: The Trailblazing Economist Who Navigated an Era of Upheaval Jon Hilsenrath

- Free Market Revolution: How Ayn Rand’s Ideas Can End Big Government Don Watkins

- Borrowed Time: Two Centuries of Booms, Busts, and Bailouts at Citi James Freeman

- Citizen Capitalism: How a Universal Fund Can Provide Influence and Income to All Lynn A. Stout

- The Tyranny of Dead Ideas: Revolutionary Thinking for a New Age of Prosperity Matt Miller

- Billionaires in World Politics Peter Hagel

- Bailout Nation: How Greed and Easy Money Corrupted Wall Street and Shook the World Economy Barry Ritholtz

- The Next Great Bubble Boom Harry S. Dent

- Global Economic Boom & Bust Cycles: The Great Depression of the 21st Century Khafra K Om-Ra-Seti

- The Oxford Handbook of IPOs Douglas Cumming

- A Primer on the Economics of Sport Robert Butler

- Chinese Rules: Mao's Dog, Deng's Cat, and Five Timeless Lessons from the Front Lines in China Tim Clissold

- The New Financial Deal: Understanding the Dodd-Frank Act and Its (Unintended) Consequences William D. Cohan

- A Rabble of Dead Money: The Great Crash and the Global Depression: 1929–1939: The Great Crash and the Global Depression: 1929 - 1939 Charles R. Morris

- World 3.0: Global Prosperity and How to Achieve it Pankaj Ghemewat

- China's Rise and the New Age of Gold: How Investors Can Profit from a Changing World Stephen Leeb

- How Wealth Rules the World: Saving Our Communities and Freedoms from the Dictatorship of Property Ben G. Price

- Modern Economics Ben Bailey

- Chain Blame: How Wall Street Caused the Mortgage and Credit Crisis Padilla Muolo

- Advanced Investments The Great Courses

- The Code Economy: A Forty-Thousand Year History Philip E. Auerswald

- Lombard Street: A Description of the Money Market Walter Bagehot

- Silicon Gold Rush: The Next Generation of High-Tech Stars Rewrites the Rules of Business Karen Southwick

- The Making of a Democratic Economy: Building Prosperity for the Many, Not Just the Few Marjorie Kelly

- Economic Warfare: Secrets of Wealth Creation in the Age of Welfare Politics Herman Cain

- The $10 Trillion Prize: Captivating the Newly Affluent in China and India Michael J. Silverstein

- The Number That Killed Us: A Story of Modern Banking, Flawed Mathematics, and a Big Financial Crisis Pablo Triana

- The Last Gold Rush…Ever!: 7 Reasons for the Runaway Gold Market and How You Can Profit from It Charles Goyette

- JPMorgan's Fall and Revival: How the Wave of Consolidation Changed America's Premier Bank Nicholas P. Sargen

- Weaving the Web Tim Berners-Lee

- Good for the Money: My Fight to Pay Back America Bob Benmosche

- Spiderweb Capitalism: How Global Elites Exploit Frontier Markets Kimberly Kay Hoang

- The Evolution a Corporate Idealist: Girl Meets Oil Christine Bader

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- Pratique o poder do "Eu posso" Bruno Gimenes

4.6

- O sonho de um homem ridículo Fiódor Dostoiévski

4.7

- Gerencie suas emoções Augusto Cury

4.5

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- 10 Maneiras de manter o foco James Fries

3.8

- Jogos vorazes Suzanne Collins

4.8

- A metamorfose Franz Kafka

4.4

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- Poder e Manipulação Jacob Petry

4.6

- A gente mira no amor e acerta na solidão Ana Suy

4.5

- A arte da guerra Sun Tzu

4.6

- Os "nãos" que você não disse Patrícia Cândido

4.8

- Pare de Procrastinar: Supere a preguiça e conquiste seus objetivos Giovanni Rigters

4.3

- A cantiga dos pássaros e das serpentes Suzanne Collins

4.5

Português

Brasil