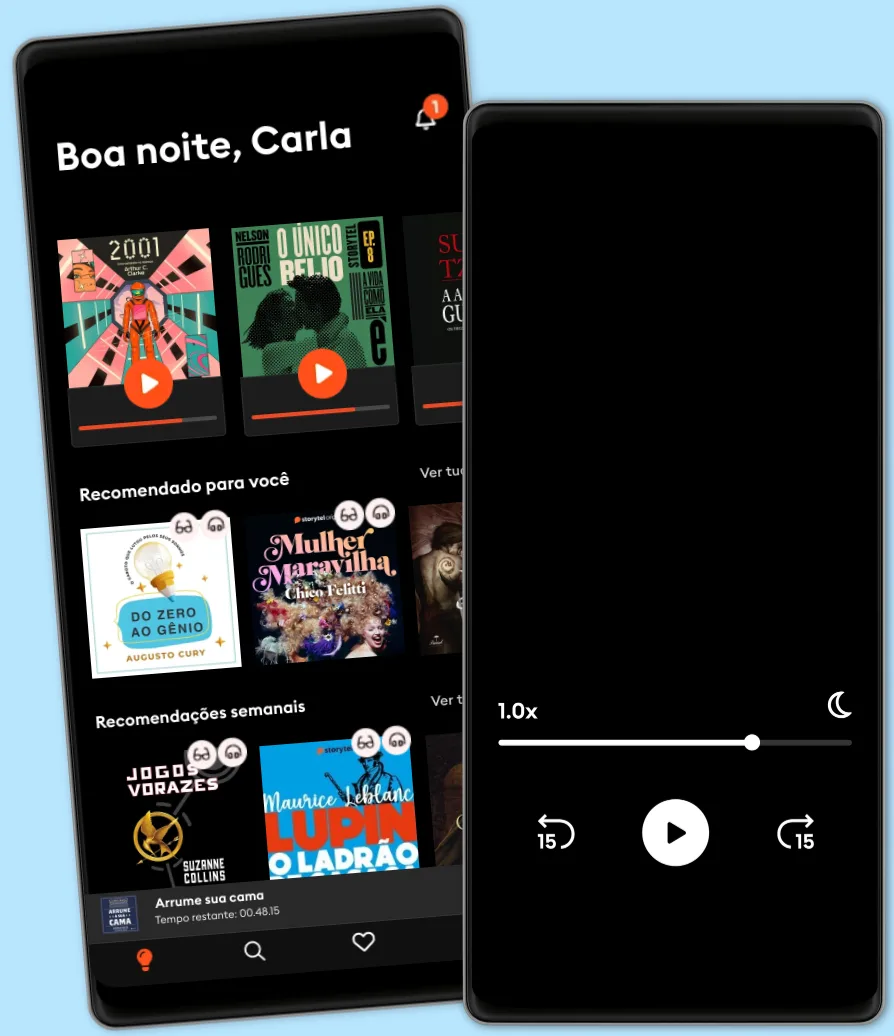

Ouça e leia

Entre em um mundo infinito de histórias

- Ler e ouvir tanto quanto você quiser

- Com mais de 500.000 títulos

- Títulos exclusivos + Storytel Originals

- 7 dias de teste gratuito, depois R$19,90/mês

- Fácil de cancelar a qualquer momento

The Economics of the Stock Market

- por

- Com:

- Editora

- 1 Avaliações

3

- Duração

- 5H 18min

- Idiomas

- Inglês

- Format

- Categoria

Economia & Negócios

The current consensus economic model, the neoclassical synthesis, depends on aprioristic assumptions that are shown to be invalid when tested against the data and fails to include finance. Economic policy based on this consensus has led to the financial crisis of 2008, the "Great Recession" that followed, and the slow subsequent rate of growth. In The Economics of the Stock Market, Andrew Smithers proposes a model that is robust when tested, and by including the impact of the stock market on the economy, overcomes both these defects. The faults of the current consensus model are shown to result typically from an unscientific methodology in which assumptions are held to be valid despite their incompatibility with data evidence. Smithers demonstrates examples of these faults: the assumption that leverage does not affect the value of produced capital assets; the assumption that short-term and long-term interest rates, and the cost of equity capital, are codetermined; and the assumption that the decisions of corporate managements aim to maximize the present value of corporate assets rather than the value determined by the stock market. The Economics of the Stock Market proposes a model that includes and explains the stationarity of real returns on equity, based on the interaction of the differing utility preferences of the managers of companies and the owners of financial capital.

© 2023 Ascent Audio (Audiolivros): 9781663728708

Data de lançamento

Audiolivros: 6 de junho de 2023

Tags

Outros também usufruíram...

- Options Trading For Dummies, 4th Edition Joe Duarte, MD

- Exchange-Traded Funds For Dummies Russell Wild

- The Land of Enterprise: A Business History of the United States Benjamin C. Waterhouse

- Modern Economics Ben Bailey

- Cracking the China Conundrum: Why Conventional Economic Wisdom Is Wrong Yukon Huang

- The Fundamentals of Hedge Fund Management: How to Successfully Launch and Operate a Hedge Fund Daniel A. Strachman

- The Federal Reserve and the Financial Crisis Ben S. Bernanke

- The Money Revolution: How to Finance the Next American Century Richard Duncan

- The Global Debt Trap: How to Escape the Danger and Build a Fortune Claus Vogt

- Factor Investing For Dummies James Maendel, BFA

- Debt, Deficits, and the Demise of the American Economy Jeff Cox

- Essays on the Great Depression Ben S. Bernanke

- Life in the Financial Markets: How They Really Work And Why They Matter To You Daniel Lacalle

- JPMorgan's Fall and Revival: How the Wave of Consolidation Changed America's Premier Bank Nicholas P. Sargen

- Economic Warfare: Secrets of Wealth Creation in the Age of Welfare Politics Herman Cain

- The Making of a Democratic Economy: Building Prosperity for the Many, Not Just the Few Marjorie Kelly

- Unloved Bull Markets: Getting Rich the Easy Way by Riding Bull Markets Craig Callahan

- Rattiner’s Secrets of Financial Planning: From Running Your Practice to Optimizing Your Client's Experience Jeffrey H. Rattiner

- The Oxford Handbook of IPOs Douglas Cumming

- Anatomy of a Ponzi: Scams Past and Present Colleen Cross

- Investing in Gold & Silver For Dummies Paul Mladjenovic, CFP

- Yellen: The Trailblazing Economist Who Navigated an Era of Upheaval Jon Hilsenrath

- The Complete Guide to Investing in Commodity Trading & Futures: How to Earn High Rates of Returns Safely Mary B. Holihan

- Code Red: How to Protect Your Savings From the Coming Crisis John Mauldin

- Big Picture Economics: How to Navigate the New Global Economy Joel Naroff

- The Big Picture MBA: What Every Business School Graduate Knows Peter Navarro

- Lombard Street: A Description of the Money Market Walter Bagehot

- The Future of China Introbooks Team

- Understandable Economics: Because Understanding Our Economy Is Easier Than You Think and More Important Than You Know Howard Yaruss

- Hedging Demystified: How to Balance Risk and Protect Profit Tim Bishop

- The $10 Trillion Prize: Captivating the Newly Affluent in China and India Michael J. Silverstein

- Exile on Wall Street: One Analyst's Fight to Save the Big Banks from Themselves Mike Mayo

- Practical Portfolio Performance Measurement and Attribution Carl R. Bacon

- Behavioral Economics Introbooks Team

- The Stock Market Crash 1929 Introbooks Team

- The Number That Killed Us: A Story of Modern Banking, Flawed Mathematics, and a Big Financial Crisis Pablo Triana

- Investment Basics Explained Introbooks Team

- Divestitures: CREATING VALUE THROUGH STRATEGY, STRUCTURE, AND IMPLEMENTATION Emilie R. Feldman

- Rigged Money: Beating Wall Street at Its Own Game Lee Munson

- Advanced Investments The Great Courses

- Home Buying 101: From Mortgages and the MLS to Making the Offer and Moving In, Your Essential Guide to Buying Your First Home Jon Gorey

- Accounting: Tips about Balance Sheets, Salary, Taxes, and More Gerard Howles

- Bitcoin And Cryptocurrency Trading For Beginners: Bitcoin Options Strategies & Leveraged Trading Using Technical Indicators Carlo Barzini

- The Space Economy: Capitalize on the Greatest Business Opportunity of Our Lifetime Chad Anderson

- 18 Maneiras De Ser Uma Pessoa Mais Interessante Tom Hope

4

- Pratique o poder do "Eu posso" Bruno Gimenes

4.5

- O sonho de um homem ridículo Fiódor Dostoiévski

4.7

- Gerencie suas emoções Augusto Cury

4.5

- Harry Potter e a Pedra Filosofal J.K. Rowling

4.9

- 10 Maneiras de manter o foco James Fries

3.8

- Jogos vorazes Suzanne Collins

4.8

- A metamorfose Franz Kafka

4.4

- Mais esperto que o diabo: O mistério revelado da liberdade e do sucesso Napoleon Hill

4.7

- A gente mira no amor e acerta na solidão Ana Suy

4.5

- Poder e Manipulação Jacob Petry

4.6

- A arte da guerra Sun Tzu

4.6

- Os "nãos" que você não disse Patrícia Cândido

4.8

- Pare de Procrastinar: Supere a preguiça e conquiste seus objetivos Giovanni Rigters

4.3

- A cantiga dos pássaros e das serpentes Suzanne Collins

4.5

Português

Brasil