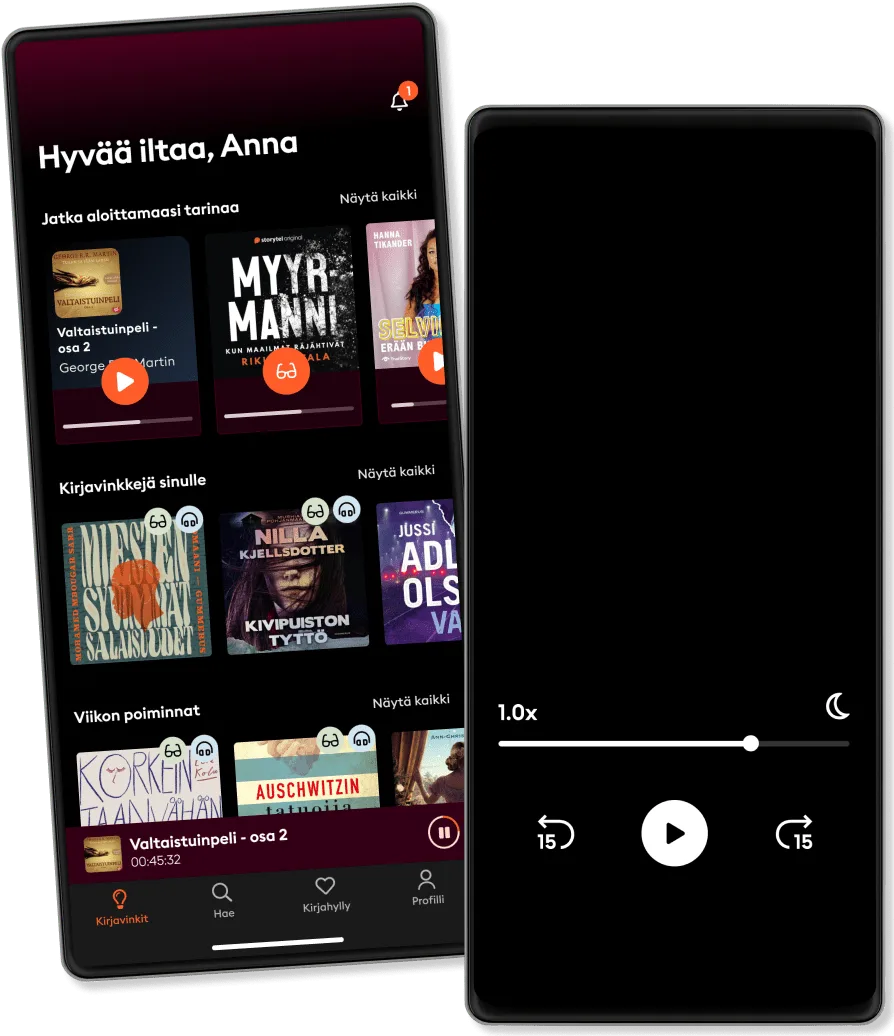

Kuuntele missä ja milloin haluat

Astu tarinoiden maailmaan

- Pohjoismaiden suosituin ääni- ja e-kirjapalvelu

- Uppoudu suureen valikoimaan äänikirjoja ja e-kirjoja

- Storytel Original -sisältöjä yksinoikeudella

- Ei sitoutumisaikaa

Rule Breaker Investing: How to Pick the Best Stocks of the Future and Build Lasting Wealth – Written By The Co-Founder Of The Motley Fool

- Kirjailija

- Lukija

- Julkaisija

- 3 Arviota

4

- Kesto

- 8T 7M

- Kielet

- Englanti

- Formaatti

- Kategoria

Hyvinvointi & elämäntaito

Read by author, David Gardner

'A delight to read, easy to understand, and packed with wisdom.' —Morgan Housel, bestselling author, The Psychology of Money

'Time-tested habits to make wise, safe investments.' —Arthur C. Brooks, #1 New York Times bestselling author

'One of the very best books on investing.' — John Mackey, Former CEO, Whole Foods Market

Want to know the real secret to investing success?

It’s not 'buy low, sell high,' picking 'undervalued' stocks, or rebalancing winners ... just as they start to win big. Those are old rules, often repeated – and often wrong.

The secret is to break those rules!

For over thirty years, David Gardner, the Motley Fool’s Co-Founder and Chief Rule Breaker, has led millions of investors worldwide to market-beating returns through unconventional choices. His greatest stock picks have helped investors make 100+ times their money on companies including Amazon.com, Starbucks, Nvidia, Netflix, Booking Holdings, MercadoLibre, and Tesla. They look like obvious winners today, but to truly win big, you have to spot them before they're obvious.

Now, for the first time, David shares his complete playbook, giving you everything you need to apply his proven process for yourself.

Over eighteen engaging, practical chapters, you’ll discover:

• How to adopt winning investing habits and behaviours. • How to spot the best stocks of tomorrow, today. • How to build and manage a purpose-driven portfolio that reflects your best vision for our future.

David’s core message is clear: Everyone is an investor. With Rule Breaker Investing, you’ll gain the tools, insights, and confidence to invest smarter, happier, and richer.

Stop following the market. Start breaking the rules – and lead the way. Your financial future begins here.

© 2025 Harriman House (Äänikirja): 9781804093238

Julkaisupäivä

Äänikirja: 16. syyskuuta 2025

Avainsanat

Saattaisit pitää myös näistä

- 100 to 1 in the Stock Market: A Distinguished Security Analyst Tells How to Make More of Your Investment Opportunities Thomas William Phelps

- The Ultimate Dividend Playbook: Income, Insight and Independence for Today's Investor Peters

- All About Asset Allocation, Second Edition Richard A. Ferri

- The Motley Fool's Rule Makers, Rule Breakers: The Foolish Guide to Picking Stocks David Gardner

- The Most Important Thing: Uncommon Sense for The Thoughtful Investor Howard Marks

- Get Rich with Dividends: A Proven System for Earning Double-Digit Returns Marc Lichtenfeld

- The Four Pillars of Investing, Second Edition: Lessons for Building a Winning Portfolio William J. Bernstein

- Merger Masters: Tales of Arbitrage Mario Gabelli

- The Little Book of Picking Top Stocks: How to Spot Hidden Gems Martin S. Fridson

- Dual Momentum Investing: An Innovative Strategy for Higher Returns with Lower Risk Gary Antonacci

- Warren Buffett: Investor and Entrepreneur Todd A. Finkle

- Option Volatility and Pricing: Advanced Trading Strategies and Techniques Sheldon Natenberg

- Rethinking Investing: A Very Short Guide to Very Long-Term Investing Charles D. Ellis

- The Permanent Portfolio: Harry Browne's Long-Term Investment Strategy Craig Rowland

- Dumb Money: How Our Greatest Financial Minds Bankrupted the Nation Daniel Gross

- The Bogle Effect: How John Bogle and Vanguard Turned Wall Street Inside Out and Saved Investors Trillions Eric Balchunas

- Inside the Black Box : The Simple Truth About Quantitative Trading: The Simple Truth About Quantitative Trading Rishi K. Narang

- Confessions of the Pricing Man: How Price Affects Everything Hermann Simon

- Dear Mr. Buffett: What an Investor Learns 1,269 Miles from Wall Street Janet M. Tavakoli

- Summary of Charles T. Munger's Poor Charlie’s Almanack IRB Media

- Wealth, War, and Wisdom Barton Biggs

- 7 Powers: The Foundations of Business Strategy Hamilton Helmer

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and Buyouts Claudia Zeisberger

- Private Equity Laid Bare Ludovic Phalippou

- In Too Deep: BP and the Drilling Race That Took It Down Alison Fitzgerald

- The Bogleheads' Guide to Retirement Planning Taylor Larimore

- Private Debt Stephen L. Nesbitt

- Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism Jeff Gramm

- Why Does the Stock Market Go Up?: Everything You Should Have Been Taught About Investing in School, But Weren’t Brian Feroldi

- The New Gold Standard: Rediscovering the Power of Gold to Protect and Grow Wealth Paul Nathan

- Startup Life: Surviving and Thriving in a Relationship with an Entrepreneur Brad Feld

- The Deals of Warren Buffett Volume 4: Making the World's Most Respected Company Glen Arnold

- Confessions of Stock Market Wizards: Doyens of Indian Investing on Their Biggest Learnings Kalpan Mitra

- Billion Dollar Start-Up: The True Story of How a Couple of 29-Year-Olds Turned $35,000 into a $1,000,000,000 Cannabis Company Adam Miron

- Founder vs Investor: The Honest Truth About Venture Capital from Startup to IPO Elizabeth Joy Zalman

- Nothing But Net: 10 Timeless Stock-Picking Lessons from One of Wall Street’s Top Tech Analysts Mark Mahaney

- What It Takes: Seven Secrets of Success from the World's Greatest Professional Firms Charles D. Ellis

- Financial Statements, Third Edition: A Step-by-Step Guide to Understanding and Creating Financial Reports Thomas Ittelson

- How to Smell a Rat: The Five Signs of Financial Fraud Ken Fisher

- Long-Term Secrets to Short-Term Trading Larry Williams

- My Life as a Quant: Reflections on Physics and Finance Emanuel Derman

- The Black Swan Problem: Risk Management Strategies for a World of Wild Uncertainty Hakan Jankensgård

- Running with Purpose: How Brooks Outpaced Goliath Competitors to Lead the Pack Jim Weber

- The Women of Berkshire Hathaway: Lessons from Warren Buffett's Female CEOs and Directors Karen Linder

- Beat the Crowd: How You Can Out-Invest the Herd by Thinking Differently Elisabeth Dellinger

- The Bogleheads' Guide to the Three-Fund Portfolio: How a Simple Portfolio of Three Total Market Index Funds Outperforms Most Investors with Less Risk Taylor Larimore

- Better than Alpha: Three Steps to Capturing Excess Returns in a Changing World Christopher M. Schelling

- Monetizing Innovation: How Smart Companies Design the Product Around the Price Georg Tacke

- Even the Odds: Sensible Risk-Taking in Business, Investing, and Life Karen Firestone

- Selling Your Startup: Crafting the Perfect Exit, Selling Your Business, and Everything Else Entrepreneurs Need to Know Alejandro Cremades

- Barefoot to Billionaire: Reflections on a Life's Work and a Promise to Cure Cancer Jon Huntsman

- HBR Guide to Delivering Effective Feedback Harvard Business Review

- Diary of a Hedgehog: Biggs' Final Words on the Markets Barton Biggs

- Summary of Gregory Zuckerman's The Man Who Solved the Market IRB Media

- The AIG Story Lawrence A. Cunningham

- Why Moats Matter: The Morningstar Approach to Stock Investing Heather Brilliant

- Finish Big: How Great Entrepreneurs Exit Their Companies on Top Bo Burlingham

- Stop. Think. Invest.: A Behavioral Finance Framework for Optimizing Investment Portfolios Michael Bailey

- The Deal: Secrets for Mastering the Art of Negotiation Josh Flagg

- The Wisdom of Finance: Discovering Humanity in the World of Risk and Return Mihir Desai

- Erikoisjoukoissa – Janne Lehtosen tarina Kati Pukki

4.6

- Niko: Kaikki mitä en ole kertonut Mari Koppinen

4.2

- Kuka pimeässä kulkee Elina Backman

4

- JHT – Missio vai mielenrauha Oskari Saari

4.3

- Ei sinun lapsesi Nilla Kjellsdotter

4

- Lääkärin vaimo Daniel Hurst

3.6

- Koti kadulla Laura Juntunen

4

- Remonttitaitoisen unelma Solja Krapu-Kallio

3.5

- Myrskynsilmä: Empyreum 3 Rebecca Yarros

4.2

- Hupparizombi Eve Hietamies

4.3

- Pilven varjot vaeltavat Marika Tudeer

4.2

- Tänään me kuolemme – Kouluampuja, joka muutti mielensä Janne Huuskonen

3.7

- Bodominjärven mysteeri Pauli Jokinen

3.9

- Henna Björk: Hydra Christian Rönnbacka

4.2

- Määränpäänä Medellinin kartelli Jani Perkonmäki

3.5

Valitse tilausmalli

Yli miljoona tarinaa

Suosituksia juuri sinulle

Uusia Storytel Originals + eksklusiivisia sisältöjä kuukausittain

Turvallinen Kids Mode

Ei sitoutumisaikaa

Standard

Sinulle joka kuuntelet säännöllisesti.

16.99 € /kuukausi

Ei sitoutumisaikaa

Premium

Sinulle joka kuuntelet ja luet usein.

19.99 € /kuukausi

Ei sitoutumisaikaa

Flex

Sinulle joka kuuntelet vähemmän.

9.99 € /kuukausi

Säästä käyttämättömät tunnit, max 20h

Ei sitoutumisaikaa

Unlimited

Sinulle joka haluat rajattomasti tarinoita.

29.99 € /kuukausi

Ei sitoutumisaikaa

Family

Kun haluat jakaa tarinoita perheen kanssa.

Alkaen 26.99 € /kuukausi

Ei sitoutumisaikaa

26.99 € /kuukausi

Suomi

Suomi